Starbucks 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Starbucks Corporation 2014 Form 10-K 75

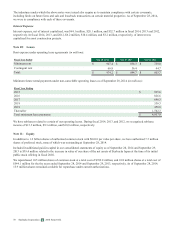

Reconciliation of the statutory US federal income tax rate with our effective income tax rate:

Fiscal Year Ended Sep 28, 2014 Sep 29, 2013 Sep 30, 2012

Total Litigation

charge All Other

Statutory rate 35.0% 35.0% 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefit 2.6 15.8 3.5 2.4 2.5

Benefits and taxes related to foreign operations (1.9) 37.5 — (3.4)(3.3)

Domestic production activity deduction (0.7) 8.1 — (0.7)(0.7)

Domestic tax credits (0.2) 2.8 — (0.3)(0.3)

Charitable contributions (0.4) 3.9 — (0.3)(0.5)

Other, net 0.2 0.7 — (0.1) 0.1

Effective tax rate 34.6% 103.8% 38.5% 32.6% 32.8%

Our effective tax rate in fiscal 2013 was significantly affected by the litigation charge we recorded as a result of the conclusion

of our arbitration with Kraft. In order to provide a more meaningful analysis of tax expense and the effective tax rate, the tables

above present separate reconciliations of the effect of the litigation charge. The deferred tax asset related to the litigation charge

is estimated to be recovered over a period of 15 years; the deferred tax asset has been classified between current and non-

current consistent with the expected recovery period for income tax reporting purposes.

US income and foreign withholding taxes have not been provided on approximately $2.2 billion of cumulative undistributed

earnings of foreign subsidiaries and equity investees. We intend to reinvest these earnings for the foreseeable future. If these

amounts were distributed to the US, in the form of dividends or otherwise, we would be subject to additional US income taxes,

which could be material. Determination of the amount of unrecognized deferred income tax liabilities on these earnings is not

practicable because of the complexities with its hypothetical calculation, and the amount of liability, if any, is dependent on

circumstances existing if and when remittance occurs.