Target 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

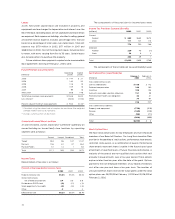

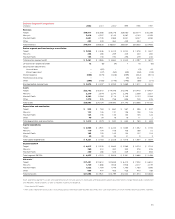

27

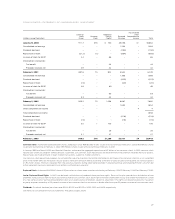

Accumulated

Common Additional Other

Stock Common Paid-in Retained

Comprehensive

(millions, except footnotes) Shares Stock Capital Earnings Income Total

January 29, 2000 911.7 $76 $ 730 $5,056 $ – $5,862

Consolidated net earnings – – – 1,264 – 1,264

Dividends declared – – – (194) – (194)

Repurchase of stock (21.2) (1) – (584) – (585)

Issuance of stock for ESOP 2.4 – 86 – – 86

Stock options and awards:

Tax benefit – – 44 – – 44

Proceeds received, net 4.9 – 42 – – 42

February 3, 2001 897.8 75 902 5,542 – 6,519

Consolidated net earnings – – – 1,368 – 1,368

Dividends declared – – – (203) – (203)

Repurchase of stock (.5) – – (20) – (20)

Issuance of stock for ESOP 2.6 – 89 – – 89

Stock options and awards:

Tax benefit – – 63 – – 63

Proceeds received, net 5.3 – 44 – – 44

February 2, 2002 905.2 75 1,098 6,687 – 7,860

Consolidated net earnings – – – 1,654 – 1,654

Other comprehensive income – – – – 4 4

Total comprehensive income 1,658

Dividends declared – – – (218) – (218)

Repurchase of stock (.5) – – (16) – (16)

Issuance of stock for ESOP 3.0 1 105 – – 106

Stock options and awards:

Tax benefit – – 26 – – 26

Proceeds received, net 2.1 – 27 – – 27

February 1, 2003 909.8 $76 $1,256 $8,107 $4 $9,443

Common Stock Authorized 6,000,000,000 shares, $.0833 par value; 909,801,560 shares issued and outstanding at February 1, 2003; 905,164,702 shares

issued and outstanding at February 2, 2002; 897,763,244 shares issued and outstanding at February 3, 2001.

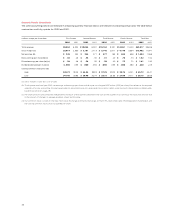

In January 1999 and March 2000, our Board of Directors authorized the aggregate repurchase of $2 billion of our common stock. In 2001, common stock

repurchases under our program were essentially suspended. Our common stock repurchases are recorded net of the premium received from put options.

Repurchases are made primarily in open market transactions, subject to market conditions.

Our common stock repurchase program has included the sale of put options that entitle the holder to sell shares of our common stock to us, at a specified

price, if the holder exercises the option. No put options were sold during or were outstanding at the end of 2002 or 2001. During 2000, we sold put options

on 9.5 million shares. Premiums received from the sale of put options during 2000 were recorded in retained earnings and totaled $29 million, of which $12

million represent premiums received on put options outstanding at year-end.

Preferred Stock Authorized 5,000,000 shares, $.01 par value; no shares were issued or outstanding at February 1, 2003, February 2, 2002 or February 3, 2001.

Junior Preferred Stock Rights In 2001, we declared a distribution of preferred share purchase rights. Terms of the plan provide for a distribution of one

preferred share purchase right for each outstanding share of our common stock. Each right will entitle shareholders to buy one twelve-hundredth of a share

of a new series of junior participating preferred stock at an exercise price of $125.00, subject to adjustment. The rights will be exercisable only if a person

or group acquires ownership of 20 percent or more of our common stock or announces a tender offer to acquire 30 percent or more of our common stock.

Dividends Dividends declared per share were $0.24, $0.225 and $0.215 in 2002, 2001 and 2000, respectively.

See Notes to Consolidated Financial Statements throughout pages 28-36.

CO N S O L I DAT E D STAT E M E N T S O F S H A R E H O L D E R S ’ I N V E S T M E N T