America Online 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 America Online annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

AOL INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

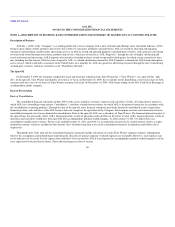

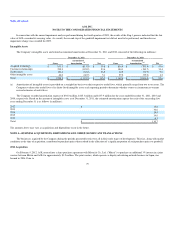

Traffic Acquisition Costs

AOL incurs costs through arrangements in which it acquires online advertising inventory from publishers for resale to advertisers and arrangements

whereby partners distribute AOL's free products or services or otherwise direct traffic to AOL Properties. AOL considers these costs to be traffic acquisition

costs (TAC). TAC arrangements have a number of different economic structures, the most common of which are: (i) payments based on a cost-per-thousand

impressions or based on a percentage of the ultimate advertising revenues generated from the advertising inventory acquired for resale, (ii) payments for direct

traffic delivered to AOL Properties priced on a per-click basis (e.g., search engine marketing fees) and (iii) payments to partners in exchange for distributing

AOL products to their users (e.g., agreements with computer manufacturers to distribute the AOL toolbar or a co-branded web portal on computers shipped to

end users). These arrangements can be on a fixed-fee basis (which often carry reciprocal performance guarantees by the counterparty), on a variable basis or,

in some cases, a combination of the two. TAC agreements with fixed payments are typically expensed ratably over the term of the agreement. TAC

agreements with variable payments are typically expensed based on the volume of the underlying activity at the specified contractual rates. TAC agreements

with a combination of a fixed fee for a minimum amount of traffic delivered or other underlying activity and variable payments for delivery or performance in

excess of the minimum are typically recognized into expense at the higher of straight-line or actual performance, taking into account counterparty

performance to date and the projected counterparty performance over the term of the agreement.

Restructuring Costs

Restructuring costs consist primarily of employee termination benefits and contract termination costs, including lease exit costs. One-time involuntary

termination benefits are recognized as a liability at estimated fair value when the plan of termination has been communicated to employees and certain other

criteria are met. With respect to certain contractual termination benefits or employee terminations in certain foreign countries operating under ongoing benefit

arrangements, a liability for termination benefits is recognized at estimated fair value when it is probable that amounts will be paid to employees and such

amounts are reasonably estimable. Contract termination costs are recognized as a liability at fair value when a contract is terminated in accordance with its

terms, or when AOL has otherwise executed a written termination of the contract. When AOL ceases using a facility but does not intend to or is unable to

terminate the operating lease, AOL records a liability for the present value of the remaining lease payments, net of estimated sublease income that could be

reasonably obtained for the property (even if the Company does not intend to sublease the facility for the remaining term of the lease). Costs associated with

exit or disposal activities are reflected as restructuring costs in the consolidated statement of operations. See "Note 9" for additional information about the

Company's restructuring activities.

Equity-Based Compensation

Prior to the spin-off from Time Warner, AOL participated in Time Warner's equity-based compensation plans and recorded compensation expense

based on the equity awards granted to AOL employees. Subsequent to the spin-off, AOL has established an equity-based compensation incentive plan and

AOL employees are no longer eligible to participate in Time Warner's equity-based compensation plans. AOL records compensation expense under the AOL

plans based on the equity awards granted to employees.

In accounting for equity-based compensation awards, the Company follows the accounting guidance for equity-based compensation, which requires that

a company measure the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award.

The cost associated with stock options is estimated using the Black-Scholes option-pricing model. The cost of equity instruments granted to employees is

recognized in the consolidated statement of operations on a straight-line basis (net of estimated forfeitures) over the period during which an employee is

required to provide service in exchange for

69