Charter 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 Charter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

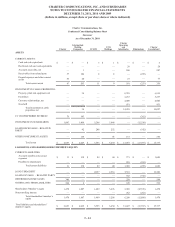

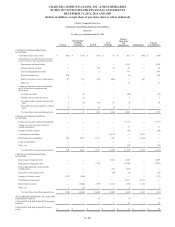

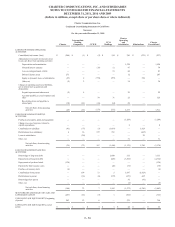

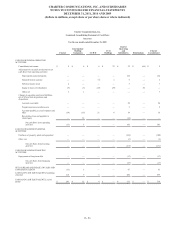

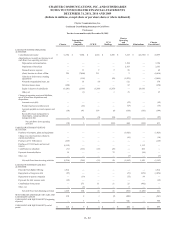

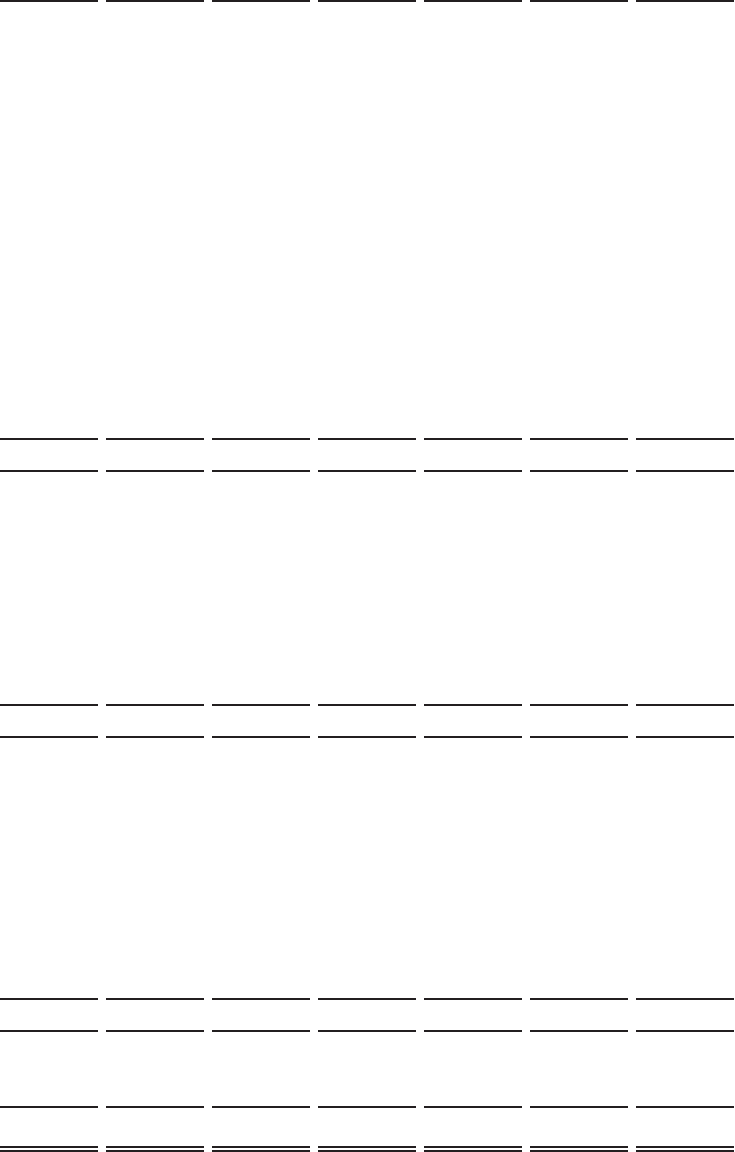

CHARTER COMMUNICATIONS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2011, 2010 AND 2009

(dollars in millions, except share or per share data or where indicated)

F- 49

Charter Communications, Inc.

Condensed Consolidating Statement of Cash Flows

Successor

For the year ended December 31, 2011

CASH FLOWS FROM OPERATING

ACTIVITIES:

Consolidated net income (loss)

Adjustments to reconcile net income (loss)

to net cash flows from operating activities:

Depreciation and amortization

Noncash interest expense

Loss on extinguishment of debt

Deferred income taxes

Equity in (income) losses of subsidiaries

Other, net

Changes in operating assets and liabilities,

net of effects from acquisitions and

dispositions:

Accounts receivable

Prepaid expenses and other assets

Accounts payable, accrued expenses and

other

Receivables from and payables to related

party

Net cash flows from operating activities

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchases of property, plant and equipment

Change in accrued expenses related to

capital expenditures

Purchase of cable systems

Contribution to subsidiary

Distributions from subsidiary

Loans to subsidiaries

Other, net

Net cash flows from investing activities

CASH FLOWS FROM FINANCING

ACTIVITIES:

Borrowings of long-term debt

Repayments of long-term debt

Borrowings (payments) loans payable -

related parties

Payment for debt issuance costs

Purchase of treasury stock

Contributions from parent

Distributions to parent

Other, net

Net cash flows from financing activities

NET INCREASE (DECREASE) IN CASH AND

CASH EQUIVALENTS

CASH AND CASH EQUIVALENTS, beginning

of period

CASH AND CASH EQUIVALENTS, end of

period

Charter

$ (382)

—

—

—

294

87

—

—

1

1

(1)

—

—

—

—

—

528

—

—

528

—

—

—

—

(533)

—

—

5

(528)

—

—

$ —

Intermediate

Holding

Companies

$ (116)

—

—

—

—

116

—

(5)

(1)

(2)

9

1

—

—

—

—

3,645

—

—

3,645

—

—

—

—

(200)

—

(3,444)

(2)

(3,646)

—

—

$ —

CCH II

$(116)

—

(38)

6

—

(82)

—

—

—

(14)

(9)

(253)

—

—

—

—

1,311

—

—

1,311

—

(332)

—

—

—

—

(729)

—

(1,061)

(3)

3

$ —

CCO

Holdings

$ 82

—

20

—

—

(463)

—

—

—

58

(7)

(310)

—

—

—

(2,837)

650

—

—

(2,187)

3,640

—

223

(54)

—

—

(1,311)

—

2,498

1

1

$ 2

Charter

Operating

and

Subsidiaries

$ 505

1,592

52

137

(4)

—

33

(20)

1

(5)

8

2,299

(1,311)

57

(89)

—

—

—

(24)

(1,367)

1,849

(4,740)

(223)

(8)

—

2,837

(650)

2

(933)

(1)

28

$ 27

Eliminations

$(342)

—

—

—

—

342

—

—

—

—

—

—

—

—

—

2,837

(6,134)

—

—

(3,297)

—

—

—

—

—

(2,837)

6,134

—

3,297

—

—

$ —

Charter

Consolidated

$(369)

1,592

34

143

290

—

33

(25)

1

38

—

1,737

(1,311)

57

(89)

—

—

—

(24)

(1,367)

5,489

(5,072)

—

(62)

(733)

—

—

5

(373)

(3)

32

$ 29