GE 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2012 ANNUAL REPORT 119

notes to consolidated financial statements

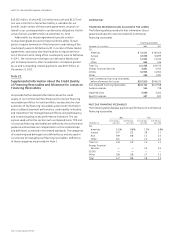

CHANGES IN LEVEL 3 INSTRUMENTS FOR THE YEAR ENDED DECEMBER 31, 2011

(In millions)

Balance at

January 1,

2011

Net realized/

unrealized

gains (losses)

included in

earnings (a)

Net realized/

unrealized

gains (losses)

included in

accumulated

other

comprehensive

income Purchases Sales Settlements

Transfers

into Level 3 (b)

Transfers

out of

Level 3 (b)

Balance at

December 31,

2011

Net change

in unrealized

gains (losses)

relating to

instruments

still held at

December 31,

2011 (c)

Investment securities

Debt

U.S. corporate $3,199 $ 78 $(157) $ 235 $(183) $(112) $182 $ (7) $ 3,235 $ —

State and municipal 225 — — 12 — (8) — (152) 77 —

Residential

mortgage-backed 66 (3) 1 2 (5) (1) 71 (90) 41 —

Commercial

mortgage-backed 49 — — 6 — (4) 3 (50) 4 —

Asset-backed 2,540 (10) 61 2,157 (185) (11) 1 (513) 4,040 —

Corporate—non-U.S. 1,486 (47) (91) 25 (55) (118) 85 (81) 1,204 —

Government—non-U.S. 156 (100) 48 41 (1) (27) 107 (140) 84 —

U.S. government and

federal agency 210 — 43 500 — — — (500) 253 —

Retained interests 39 (28) 26 8 (5) (5) — — 35 —

Equity

Available-for-sale 24 — — — — — 4 (11) 17 —

Trading — — — — — — — — — —

Derivatives (d) (e) 265 151 2 (2) — (207) 150 10 369 130

Other 906 95 (9) 152 (266) (6) — (55) 817 34

Total $9,165 $136 $ (76) $3,136 $(700) $(499) $603 $(1,589) $10,176 $164

(a) Earnings effects are primarily included in the “GECC revenues from services” and “Interest and other financial charges” captions in the Statement of Earnings.

(b) Transfers in and out of Level 3 are considered to occur at the beginning of the period. Transfers out of Level 3 were a result of increased use of quotes from independent

pricing vendors based on recent trading activity.

(c) Represented the amount of unrealized gains or losses for the period included in earnings.

(d) Represented derivative assets net of derivative liabilities and included cash accruals of $3 million not reflected in the fair value hierarchy table.

(e) Gains (losses) included in net realized/unrealized gains (losses) included in earnings were offset by the earnings effects from the underlying items that were economically

hedged. See Note 22.

Non-Recurring Fair Value Measurements

The following table represents non-recurring fair value amounts

(as measured at the time of the adjustment) for those assets

remeasured to fair value on a non-recurring basis during the

fiscal year and still held at December 31, 2012 and 2011. These

assets can include loans and long-lived assets that have been

reduced to fair value when they are held for sale, impaired loans

that have been reduced based on the fair value of the underlying

collateral, cost and equity method investments and long-lived

assets that are written down to fair value when they are impaired

and the remeasurement of retained investments in formerly

consolidated subsidiaries upon a change in control that results

in deconsolidation of a subsidiary, if we sell a controlling interest

and retain a noncontrolling stake in the entity. Assets that are

written down to fair value when impaired and retained invest-

ments are not subsequently adjusted to fair value unless further

impairment occurs.

Remeasured during the year ended December 31

2012 2011

(In millions) Level 2 Level 3 Level 2 Level 3

Financing receivables

and loans held for sale $ 366 $4,094 $ 158 $5,159

Cost and equity method

investments (a) 8 313 — 403

Long-lived assets,

including real estate 702 2,184 1,343 3,282

Total $1,076 $6,591 $1,501 $8,844

(a) Includes the fair value of private equity and real estate funds included in Level 3

of $84 million and $123 million at December 31, 2012 and 2011, respectively.

The following table represents the fair value adjustments to

assets measured at fair value on a non-recurring basis and still

held at December 31, 2012 and 2011.

Year ended December 31

(In millions) 2012 2011

Financing receivables and loans held for sale $ (595) $ (857)

Cost and equity method investments (a) (153) (274)

Long-lived assets, including real estate (b) (624) (1,424)

Total $(1,372) $(2,555)

(a) Includes fair value adjustments associated with private equity and real estate

funds of $(33) million and $(24) million during 2012 and 2011, respectively.

(b) Includes impairments related to real estate equity properties and investments

recorded in other costs and expenses of $218 million and $976 million during

2012 and 2011, respectively.