Nike 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17NIKE,INC.-Form10-K

PARTII

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

ITEM7 Management’s Discussion and Analysis of

Financial Condition and Results of Operations

NIKE designs, develops, markets and sells high quality footwear, apparel,

equipment and accessory products worldwide. We are the largest seller

of athletic footwear and apparel in the world. We sell our products to retail

accounts, through NIKE-owned retail stores and internet sales, which we refer

to as our “Direct to Consumer” operations, and through a mix of independent

distributors and licensees, worldwide. Our goal is to deliver value to our

shareholders by building a profi table global portfolio of branded footwear,

apparel, equipment and accessories businesses. Our strategy is to achieve

long-term revenue growth by creating innovative, “must have” products,

building deep personal consumer connections with our brands, and delivering

compelling retail presentation and experiences.

In addition to achieving long-term revenue growth, we continue to strive to

deliver shareholder value by driving operational excellence in several key areas:

•

Making our supply chain a competitive advantage through operational discipline,

• Reducing product costs through a continued focus on lean manufacturing

and product design that strives to eliminate waste,

•

Improving selling and administrative expense productivity by focusing on

investments that drive economic returns in the form of incremental revenue

and gross margin, and leveraging existing infrastructure across our portfolio

of brands to eliminate duplicative costs,

• Improving working capital effi ciency, and

• Deploying capital effectively to create value for our shareholders.

Through execution of this strategy, our long-term fi nancial goals continue to be:

• High single-digit revenue growth,

• Mid-teens earnings per share growth,

• Increased return on invested capital and accelerated cash fl ows, and

•

Consistent results through effective management of our diversifi ed portfolio

of businesses.

Over the past tenyears, we have achieved or exceeded all of these fi nancial

goals. During this time, NIKE,Inc’s revenues and earnings per share have

grown 8% and 15%, respectively, on an annual compounded basis. Our return

on invested capital has increased from 14% to 22% and we expanded gross

margins by more than 5 percentage points.

Our fi scal2011 results demonstrated our continued focus toward meeting

our fi nancial goals, while positioning ourselves for sustainable, profi table

long-term growth. Despite the uncertain macroeconomic environment in

fi scal2011, wedelivered record high revenues and diluted earnings per

share. Our revenues grew 10% to $20.9billion, net income increased 12%

to $2.1billion, and we delivered diluted earnings per share of $4.39, a 14%

increase from fi scal2010.

Income before income taxes increased 13% for fi scal2011 primarily as a

result of the increase in revenues and leverage on selling and administrative

expense, which more than offset a decrease in gross margin percentage.

The increase in revenues is refl ective of increased demand for NIKE Brand

footwear and apparel products across most businesses, particularly in the

North America, Emerging Markets and Greater China geographies. Demand for

our NIKE Brand footwear and apparel was fueled by our innovative products

as well as strong category focused retail presentations. The decrease in

gross margin percentage was primarily driven by higher product input costs,

increased transportation expenses and a lower mix of licensee revenue as

certain markets within our Other Businesses transitioned to NIKE,Inc. owned

markets. These factors more than offset the positive impact from the growth

and expanding profi tability of our NIKE Brand Direct to Consumer business

and our ongoing product cost reduction initiatives.

Net income for fi scal2011 was negatively impacted by ayear-over-year

increase of 80 basis points in our effective tax rate, driven primarily by an

increase in the percentage of total pre-tax income earned from operations

in the UnitedStates. The UnitedStates statutory tax rate is generally higher

than the tax rate on operations outside the UnitedStates.

For theyear, diluted earnings per share grew at a higher rate than net income

due to a 2% decrease in the weighted average number of diluted common

shares outstanding driven by our share repurchases during fi scal2011. Whilewe

increased the use of working capital in fi scal2011 to support the growth of our

businesses, we returned larger amounts of cash to our shareholders through

higher dividends and increased share repurchases compared to fi scal2010.

While we continue to believe that the Company is well positioned from a

business and fi nancial perspective, our future performance is subject to the

inherent uncertainty presented by volatile macroeconomic conditions that may

have an impact on our operations around the world. Our future performance

is subject to our continued ability to take appropriate actions to respond to

these conditions.

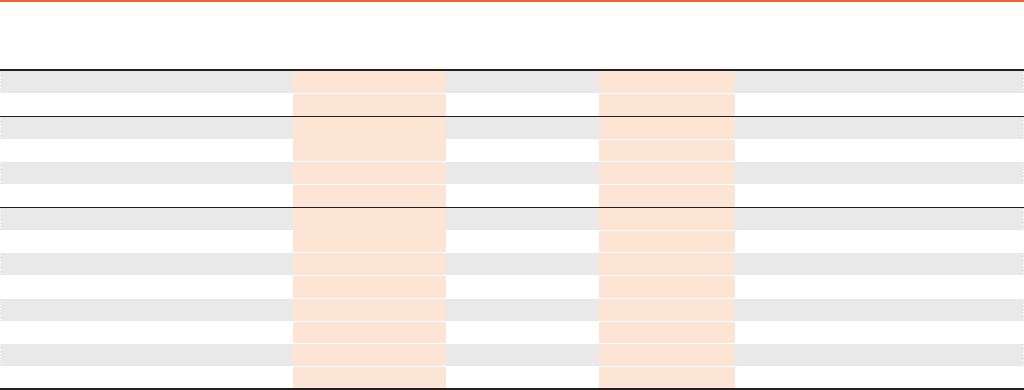

Results of Operations

(Inmillions, except per share data)

Fiscal2011 Fiscal2010

FY11vs. FY10

%Change Fiscal2009

FY10vs. FY09

%Change

Revenues $ 20,862 $ 19,014 10 % $ 19,176 -1 %

Cost of sales 11,354 10,214 11 % 10,572 -3 %

Gross margin 9,508 8,800 8 % 8,604 2 %

Gross margin % 45.6 % 46.3 % 44.9 %

Demand creation expense 2,448 2,356 4 % 2,352 0 %

Operating overhead expense 4,245 3,970 7 % 3,798 5 %

Total selling and administrative expense 6,693 6,326 6 %

6,150 3 %

% of Revenues 32.1 % 33.3 % 32.1 %

Restructuring charges — — — 195 —

Goodwill impairment — — — 199 —

Intangible and other asset impairment — — — 202 —

Income before income taxes 2,844 2,517 13 % 1,957 29 %

Net income 2,133 1,907 12 % 1,487 28 %

Diluted earnings per share 4.39 3.86 14 % 3.03 27 %