Target 2015 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2015 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of pandemics, labor unrest, transport capacity and costs, port security, weather conditions, natural disasters or other

events that could slow or disrupt port activities and affect foreign trade are beyond our control and could disrupt our

supply of merchandise and/or adversely affect our results of operations. There have been periodic labor disputes

impacting the U.S. ports that have caused us to make alternative arrangements to continue the flow of inventory, and

if these types of disputes recur or worsen, it may have a material impact on our costs or inventory supply. Changes in

the costs of procuring commodities used in our merchandise or the costs related to our supply chain, including vendor

costs, labor, fuel, tariffs, currency exchange rates and supply chain transparency initiatives, could have an adverse

effect on gross margins, expenses and results of operations. Changes in our relationships with our vendors also have

the potential to increase our expenses and adversely affect results of operations.

A disruption in relationships with third parties who provide us services in connection with certain aspects of

our business could adversely affect our operations.

We rely on third parties to support a variety of business functions, including portions of our technology development

and systems, our digital platforms and distribution network operations, credit and debit card transaction processing,

extensions of credit for our 5% REDcard Rewards loyalty program, the clinics and pharmacies operated by CVS within

our stores, the infrastructure supporting our guest contact centers, and aspects of our food offerings. If we are unable

to contract with third parties having the specialized skills needed to support those strategies or integrate their products

and services with our business, or if we fail to properly manage those third parties or if they fail to meet our performance

standards and expectations, including with respect to data security, then our reputation, sales, and results of operations

could be adversely affected. In addition, we could face increased costs associated with finding replacement providers

or hiring new team members to provide these services in-house. If our guests do not react favorably to CVS’s operations

or if our relationship with CVS is ineffective, our ability to discontinue the relationship is limited and our results of

operations may be adversely affected. In addition, if we wish to have clinics and pharmacies in any new stores, those

clinics and pharmacies must be owned and operated by CVS.

Legal, Regulatory, Global and Other External Risks

Our earnings are highly susceptible to the state of macroeconomic conditions and consumer confidence in

the United States.

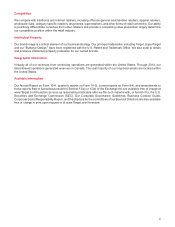

Virtually all of our sales are in the United States, making our results highly dependent on U.S. consumer confidence

and the health of the U.S. economy. In addition, a significant portion of our total sales is derived from stores located

in five states: California, Texas, Florida, Minnesota and Illinois, resulting in further dependence on local economic

conditions in these states. Deterioration in macroeconomic conditions or consumer confidence could negatively affect

our business in many ways, including slowing sales growth or reduction in overall sales, and reducing gross margins.

These same considerations impact the success of our credit card program. Even though we no longer own a consumer

credit card receivables portfolio, we share in the economic performance of the credit card program with TD. Deterioration

in macroeconomic conditions could adversely affect the volume of new credit accounts, the amount of credit card

program balances and the ability of credit card holders to pay their balances. These conditions could result in us

receiving lower profit‑sharing payments.

Weather conditions where our stores are located may impact consumer shopping patterns, which alone or

together with natural disasters, particularly in areas where our sales are concentrated, could adversely affect

our results of operations.

Uncharacteristic or significant weather conditions can affect consumer shopping patterns, particularly in apparel and

seasonal items, which could lead to lost sales or greater than expected markdowns and adversely affect our short-

term results of operations. In addition, our three largest states by total sales are California, Texas and Florida, areas

where natural disasters are more prevalent. Natural disasters in those states or in other areas where our sales are

concentrated could result in significant physical damage to or closure of one or more of our stores, distribution centers

or key vendors, and cause delays in the distribution of merchandise from our vendors to our distribution centers, stores,

and directly to guests, which could adversely affect our results of operations by increasing our costs and lowering our

sales.

8