Walmart 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 2015 Annual Report

Indefinite-lived intangible assets are included in other assets and

deferred charges in the Company’s Consolidated Balance Sheets. These

assets are evaluated for impairment based on their fair values using valu-

ation techniques which are updated annually based on the most recent

variables and assumptions. There were no impairment charges related to

indefinite-lived intangible assets recorded for fiscal 2015, 2014 and 2013.

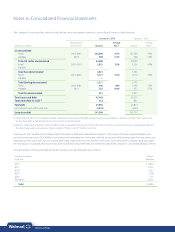

Self Insurance Reserves

The Company uses a combination of insurance and self insurance for a

number of risks, including, but not limited to, workers’ compensation,

general liability, auto liability, product liability and the Company’s obliga-

tion for employee-related health care benefits. Liabilities relating to the

claims associated with these risks are estimated by considering historical

claims experience, frequency, severity, demographic factors and other

actuarial assumptions, including incurred but not reported claims. In

estimating its liability for such claims, the Company periodically analyzes

its historical trends, including loss development, and applies appropriate

loss development factors to the incurred costs associated with the

claims. To limit exposure to certain risks, the Company maintains

stop-loss insurance coverage for workers’ compensation of $5 million

per occurrence, and in most instances, $15 million per occurrence for

general liability.

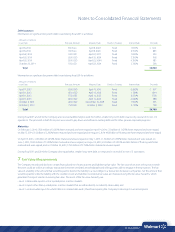

Income Taxes

Income taxes are accounted for under the balance sheet method.

Deferred tax assets and liabilities are recognized for the estimated future

tax consequences attributable to differences between the financial

statement carrying amounts of existing assets and liabilities and their

respective tax bases (“temporary differences”). Deferred tax assets and

liabilities are measured using enacted tax rates in effect for the year in

which those temporary differences are expected to be recovered or set-

tled. The effect on deferred tax assets and liabilities of a change in tax rate

is recognized in income in the period that includes the enactment date.

Deferred tax assets are evaluated for future realization and reduced by

a valuation allowance to the extent that a portion is not more likely than

not to be realized. Many factors are considered when assessing whether

it is more likely than not that the deferred tax assets will be realized,

including recent cumulative earnings, expectations of future taxable

income, carryforward periods, and other relevant quantitative and quali-

tative factors. The recoverability of the deferred tax assets is evaluated

by assessing the adequacy of future expected taxable income from all

sources, including reversal of taxable temporary differences, forecasted

operating earnings and available tax planning strategies. These sources

of income rely heavily on estimates.

In determining the provision for income taxes, an annual effective

income tax rate is used based on annual income, permanent differences

between book and tax income, and statutory income tax rates. Discrete

events such as audit settlements or changes in tax laws are recognized

in the period in which they occur.

The Company records a liability for unrecognized tax benefits resulting

from uncertain tax positions taken or expected to be taken in a tax return.

The Company records interest and penalties related to unrecognized tax

benefits in interest expense and operating, selling, general and administra-

tive expenses, respectively, in the Company’s Consolidated Statements

of Income. Refer to Note 9 for additional income tax disclosures.

Revenue Recognition

Sales

The Company recognizes sales revenue, net of sales taxes and estimated

sales returns, at the time it sells merchandise to the customer.

Membership Fee Revenue

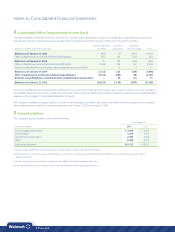

The Company recognizes membership fee revenue both in the U.S.

and internationally over the term of the membership, which is typically

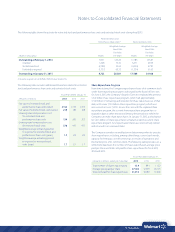

12 months. The following table summarizes membership fee activity

for fiscal 2015, 2014 and 2013:

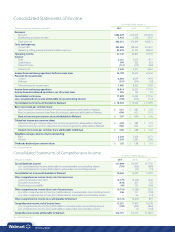

Fiscal Years Ended January 31,

(Amounts in millions) 2015 2014 2013

Deferred membership fee revenue,

beginning of year $ 641 $ 575 $ 559

Cash received from members 1,410 1,249 1,133

Membership fee revenue recognized (1,292) (1,183) (1,117)

Deferred membership fee revenue,

end of year $ 759 $ 641 $ 575

Membership fee revenue is included in membership and other income

in the Company’s Consolidated Statements of Income. The deferred

membership fee is included in accrued liabilities in the Company’s

Consolidated Balance Sheets.

Shopping Cards

Customer purchases of shopping cards are not recognized as revenue

until the card is redeemed and the customer purchases merchandise

using the shopping card. Shopping cards in the U.S. do not carry an

expiration date; therefore, customers and members can redeem their

shopping cards for merchandise indefinitely. Shopping cards in certain

foreign countries where the Company does business may have expiration

dates. A certain number of shopping cards, both with and without

expiration dates, will not be fully redeemed. Management estimates

unredeemed shopping cards and recognizes revenue for these

amounts over shopping card historical usage periods based on historical

redemption rates. Management periodically reviews and updates its

estimates of usage periods and redemption rates.

Financial and Other Services

The Company recognizes revenue from service transactions at the time

the service is performed. Generally, revenue from services is classified

as a component of net sales in the Company’s Consolidated Statements

of Income.

Cost of Sales

Cost of sales includes actual product cost, the cost of transportation to

the Company’s distribution facilities, stores and clubs from suppliers, the

cost of transportation from the Company’s distribution facilities to the

stores, clubs and customers and the cost of warehousing for the Sam’s

Club segment and import distribution centers. Cost of sales is reduced

by supplier payments that are not a reimbursement of specific,

incremental and identifiable costs.

Notes to Consolidated Financial Statements