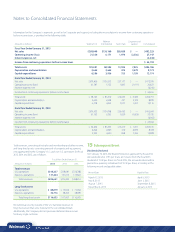

Walmart 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

2015 Annual Report

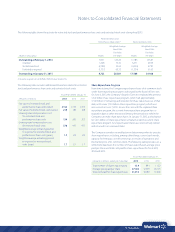

The Company uses derivative financial instruments for the purpose of

hedging its exposure to interest and currency exchange rate risks and,

accordingly, the contractual terms of a hedged instrument closely mirror

those of the hedged item, providing a high degree of risk reduction and

correlation. Contracts that are effective at meeting the risk reduction and

correlation criteria are recorded using hedge accounting. If a derivative

financial instrument is recorded using hedge accounting, depending on

the nature of the hedge, changes in the fair value of the instrument will

either be offset against the change in fair value of the hedged assets,

liabilities or firm commitments through earnings or be recognized in

accumulated other comprehensive income (loss) until the hedged item

is recognized in earnings. Any hedge ineffectiveness is immediately

recognized in earnings. The Company’s net investment and cash flow

instruments are highly effective hedges and the ineffective portion has

not been, and is not expected to be, significant. Instruments that do not

meet the criteria for hedge accounting, or contracts for which the

Company has not elected hedge accounting, are recorded at fair value

with unrealized gains or losses reported in earnings during the period

of the change.

Fair Value Instruments

The Company is a party to receive fixed-rate, pay variable-rate interest

rate swaps that the Company uses to hedge the fair value of fixed-rate

debt. The notional amounts are used to measure interest to be paid or

received and do not represent the Company’s exposure due to credit

loss. The Company’s interest rate swaps that receive fixed-interest rate

payments and pay variable-interest rate payments are designated as

fair value hedges. As the specific terms and notional amounts of the

derivative instruments match those of the fixed-rate debt being hedged,

the derivative instruments are assumed to be perfectly effective hedges.

Changes in the fair values of these derivative instruments are recorded

in earnings, but are offset by corresponding changes in the fair values

of the hedged items, also recorded in earnings, and, accordingly, do not

impact the Company’s Consolidated Statements of Income. These fair

value instruments will mature in October 2020.

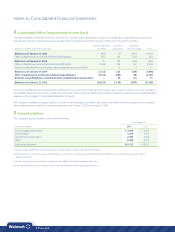

Net Investment Instruments

The Company is a party to cross-currency interest rate swaps that the

Company uses to hedge its net investments. The agreements are con-

tracts to exchange fixed-rate payments in one currency for fixed-rate

payments in another currency. All changes in the fair value of these

instruments are recorded in accumulated other comprehensive income

(loss), offsetting the currency translation adjustment of the related

investment that is also recorded in accumulated other comprehensive

income (loss). These instruments will mature on dates ranging from

October 2023 to February 2030.

The Company has issued foreign-currency-denominated long-term debt

as hedges of net investments of certain of its foreign operations. These

foreign-currency-denominated long-term debt issuances are designated

and qualify as nonderivative hedging instruments. Accordingly, the

foreign currency translation of these debt instruments is recorded in

accumulated other comprehensive income (loss), offsetting the foreign

currency translation adjustment of the related net investments that is

also recorded in accumulated other comprehensive income (loss).

At January 31, 2015 and January 31, 2014, the Company had ¥100 billion

and ¥200 billion, respectively, of outstanding long-term debt designated

as a hedge of its net investment in Japan, as well as outstanding long-term

debt of £2.5 billion at January 31, 2015 and 2014 that was designated as a

hedge of its net investment in the United Kingdom. These nonderivative

net investment hedges will mature on dates ranging from July 2015 to

January 2039.

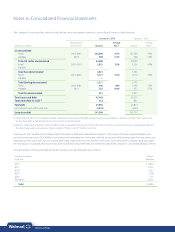

Cash Flow Instruments

The Company is a party to receive variable-rate, pay fixed-rate interest

rate swaps that the Company uses to hedge the interest rate risk of certain

non-U.S. denominated debt. The swaps are designated as cash flow

hedges of interest expense risk. Amounts reported in accumulated other

comprehensive income (loss) related to these derivatives are reclassified

from accumulated other comprehensive income (loss) to earnings as

interest is expensed for the Company’s variable-rate debt, converting

the variable-rate interest expense into fixed-rate interest expense.

These cash flow instruments will mature in July 2015.

The Company is also a party to receive fixed-rate, pay fixed-rate

cross-currency interest rate swaps to hedge the currency exposure

associated with the forecasted payments of principal and interest of

certain non-U.S. denominated debt. The swaps are designated as cash

flow hedges of the currency risk related to payments on the non-U.S.

denominated debt. The effective portion of changes in the fair value of

derivatives designated as cash flow hedges of foreign exchange risk is

recorded in accumulated other comprehensive income (loss) and is

subsequently reclassified into earnings in the period that the hedged

forecasted transaction affects earnings. The hedged items are recog-

nized foreign currency-denominated liabilities that are remeasured at

spot exchange rates each period, and the assessment of effectiveness

(and measurement of any ineffectiveness) is based on total changes in

the related derivative’s cash flows. As a result, the amount reclassified

into earnings each period includes an amount that offsets the related

transaction gain or loss arising from that remeasurement and the

adjustment to earnings for the period’s allocable portion of the initial

spot-forward difference associated with the hedging instrument. These

cash flow instruments will mature on dates ranging from April 2022

to March 2034.

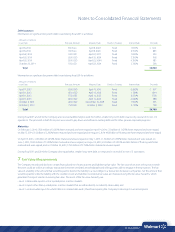

The Company used forward starting receive variable-rate, pay fixed-rate

swaps (“forward starting swaps”) to hedge its exposure to the variability

in future cash flows due to changes in the LIBOR swap rate for debt

issuances forecasted to occur in the future. These forward starting swaps

were terminated in October 2014, April 2014 and April 2013 concurrently

with the issuance of the hedged debt. Upon termination of the forward

starting swaps, the Company received net cash payments from the

related counterparties of $96 million in fiscal 2015 and made net cash

payments to the related counterparties of $74 million in fiscal 2014. The

payments were recorded in accumulated other comprehensive income

(loss) and will be reclassified to earnings over the life of the related debt

through May 2044, effectively adjusting interest expense to reflect the

fixed interest rates entered into by the forward starting swaps.

Notes to Consolidated Financial Statements