Electronic Arts 2008 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2008 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial

Statements — An Amendment of ARB No. 51”, which establishes new accounting and reporting standards for

noncontrolling interest (minority interest) and for the deconsolidation of a subsidiary. SFAS No. 160 also

includes expanded disclosure requirements regarding the interests of the parent and its noncontrolling interest.

SFAS No. 160 is effective for fiscal years, and interim periods within those fiscal years, beginning on or after

December 15, 2008. We do not expect the adoption of SFAS No. 160 to have a material impact on our

Consolidated Financial Statements.

In December 2007, the FASB ratified EITF consensus conclusion on EITF 07-01, “Accounting for Collabora-

tive Arrangements”. EITF 07-01 defines collaborative arrangements and establishes reporting requirements for

transactions between participants in a collaborative arrangement and between participants in the arrangement

and third parties. Under this conclusion, a participant to a collaborative arrangement should disclose

information about the nature and purpose of its collaborative arrangements, the rights and obligations under

the collaborative arrangements, the accounting policy for collaborative arrangements, and the income statement

classification and amounts attributable to transactions arising from the collaborative arrangement between

participants for each period an income statement is presented. EITF 07-01 is effective for interim or annual

reporting periods in fiscal years beginning after December 15, 2008 and requires retrospective application to

all prior periods presented for all collaborative arrangements existing as of the effective date. While we have

not yet completed our analysis, we do not anticipate the implementation of EITF 07-01 to have a material

impact on our Consolidated Financial Statements.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging

Activities — An Amendment of SFAS No. 133”. SFAS 161 requires enhanced disclosures about an entity’s

derivative and hedging activities, including how an entity uses derivative instruments, how derivative

instruments and related hedged items are accounted for under SFAS No. 133, “Accounting for Derivative

Instruments and Hedging Activities”, and how derivative instruments and related hedged items affect an

entity’s financial position, financial performance, and cash flows. The provisions of SFAS No. 161 are

effective for financial statements issued for fiscal years beginning after November 15, 2008, and interim

periods within those fiscal years. We do not expect the adoption of SFAS No. 161 to have a material impact

on our Consolidated Financial Statements.

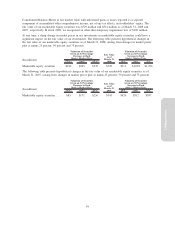

LIQUIDITY AND CAPITAL RESOURCES

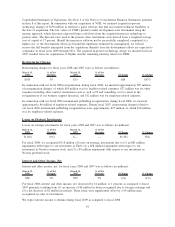

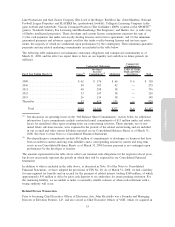

(In millions) 2008 2007

Increase /

(Decrease)

As of

March 31,

Cash and cash equivalents........................................ $1,553 $1,371 $182

Short-term investments .......................................... 734 1,264 (530)

Marketable equity securities ...................................... 729 341 388

Total ..................................................... $3,016 $2,976 $ 40

Percentage of total assets ...................................... 50% 58%

(In millions) 2008 2007

Increase /

(Decrease)

Year Ended

March 31,

Cash provided by operating activities ................................. $338 $397 $(59)

Cash used in investing activities ..................................... (429) (487) 58

Cash provided by financing activities ................................. 243 190 53

Effect of foreign exchange on cash and cash equivalents ................... 30 29 1

Net increase in cash and cash equivalents ............................ $182 $129 $53

Annual Report

49