Electronic Arts 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

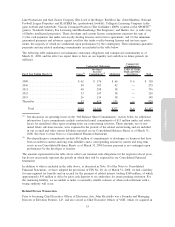

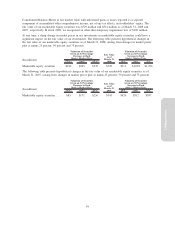

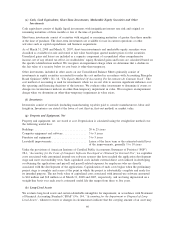

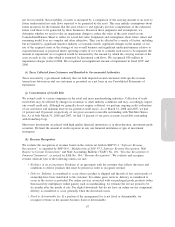

stockholders’ equity. Our portfolio of short-term investments consisted of the following investment categories,

summarized by fair value as of March 31, 2008 and 2007 (in millions):

2008 2007

As of March 31,

U.S. agency securities ..................................................... $266 $ 264

Corporate bonds ......................................................... 231 226

U.S. Treasury securities .................................................... 161 92

Asset-backed securities .................................................... 64 108

Commercial paper ........................................................ 12 574

Total short-term investments ............................................... $734 $1,264

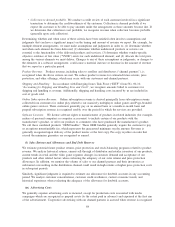

Notwithstanding our efforts to manage interest rate risks, there can be no assurance that we will be adequately

protected against risks associated with interest rate fluctuations. At any time, a sharp change in interest rates

could have a significant impact on the fair value of our investment portfolio. The following table presents the

hypothetical changes in fair value in our short-term investment portfolio as of March 31, 2008, arising from

potential changes in interest rates. The modeling technique estimates the change in fair value from immediate

hypothetical parallel shifts in the yield curve of plus or minus 50 basis points (“BPS”), 100 BPS, and 150

BPS.

(In millions) (150 BPS) (100 BPS) (50 BPS)

Fair Value

as of

March 31,

2008 50 BPS 100 BPS 150 BPS

Valuation of Securities

Given an Interest Rate

Decrease of X Basis Points

Valuation of Securities

Given an Interest Rate

Increase of X Basis Points

U.S. agency securities ........ $273 $270 $268 $266 $263 $261 $258

Corporate bonds . . .......... 235 234 233 231 230 229 227

U.S. Treasury securities ....... 166 164 163 161 160 158 156

Asset-backed securities ....... 64 64 64 64 64 63 63

Commercial paper . .......... 12 12 12 12 12 12 12

Total short-term

investments . . .......... $750 $744 $740 $734 $729 $723 $716

The following table presents the hypothetical changes in fair value in our short-term investment portfolio as of

March 31, 2007, arising from selected potential changes in interest rates.

(In millions) (150 BPS) (100 BPS) (50 BPS)

Fair Value

as of

March 31,

2007 50 BPS 100 BPS 150 BPS

Valuation of Securities

Given an Interest Rate

Decrease of X Basis Points

Valuation of Securities

Given an Interest Rate

Increase of X Basis Points

Commercial paper ........... $ 575 $ 575 $ 574 $ 574 $ 573 $ 573 $ 572

U.S. agency securities ........ 271 269 267 264 262 259 257

Corporate bonds ............ 231 230 228 226 225 223 222

Asset-backed securities . . . .... 110 109 108 108 107 106 105

U.S. Treasury securities . . . .... 95 94 94 92 92 91 90

Total short-term

investments ............ $1,282 $1,277 $1,271 $1,264 $1,259 $1,252 $1,246

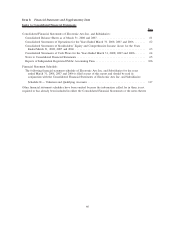

Market Price Risk

The value of our equity investments in publicly traded companies is subject to market price volatility and

foreign currency risk for investments denominated in foreign currencies. As of March 31, 2008 and 2007, our

marketable equity securities were classified as available-for-sale and, consequently, were recorded in our

58