Microsoft 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.products where customers have the right to receive unspecified upgrades/enhancements on a when-and-if-available basis

and for which vendor-specific objective evidence of fair value does not exist for the upgrades/enhancements is recognized

on a straight-line basis over the estimated life of the software.

Revenue related to our Xbox 360 gaming and entertainment console, Kinect for Xbox 360, games published by us, and

other hardware components is generally recognized when ownership is transferred to the resellers. Revenue related to

games published by third parties for use on the Xbox 360 platform is recognized when games are manufactured by the

game publishers.

Display advertising revenue is recognized as advertisements are displayed. Search advertising revenue is recognized

when the ad appears in the search results or when the action necessary to earn the revenue has been completed.

Consulting services revenue is recognized as services are rendered, generally based on the negotiated hourly rate in the

consulting arrangement and the number of hours worked during the period. Consulting revenue for fixed-price services

arrangements is recognized as services are provided. Revenue from prepaid points redeemable for the purchase of

software or services is recognized upon redemption of the points and delivery of the software or services.

Cost of Revenue

Cost of revenue includes; manufacturing and distribution costs for products sold and programs licensed; operating costs

related to product support service centers and product distribution centers; costs incurred to include software on PCs sold

by OEMs, to drive traffic to our websites, and to acquire online advertising space (“traffic acquisition costs”); costs

incurred to support and maintain Internet-based products and services, including royalties; warranty costs; inventory

valuation adjustments; costs associated with the delivery of consulting services; and the amortization of capitalized

research and development costs. Capitalized research and development costs are amortized over the estimated lives of

the products.

Product Warranty

We provide for the estimated costs of fulfilling our obligations under hardware and software warranties at the time the

related revenue is recognized. For hardware warranties, we estimate the costs based on historical and projected product

failure rates, historical and projected repair costs, and knowledge of specific product failures (if any). The specific

hardware warranty terms and conditions vary depending upon the product sold and the country in which we do business,

but generally include parts and labor over a period generally ranging from 90 days to three years. For software warranties,

we estimate the costs to provide bug fixes, such as security patches, over the estimated life of the software. We regularly

reevaluate our estimates to assess the adequacy of the recorded warranty liabilities and adjust the amounts as

necessary.

Research and Development

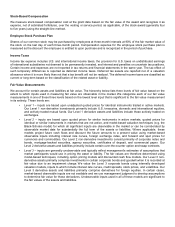

Research and development expenses include payroll, employee benefits, stock-based compensation expense, and other

headcount-related expenses associated with product development. Research and development expenses also include

third-party development and programming costs, localization costs incurred to translate software for international markets,

and the amortization of purchased software code and services content. Such costs related to software development are

included in research and development expense until the point that technological feasibility is reached, which for our

software products, is generally shortly before the products are released to manufacturing. Once technological feasibility is

reached, such costs are capitalized and amortized to cost of revenue over the estimated lives of the products.

Sales and Marketing

Sales and marketing expenses include payroll, employee benefits, stock-based compensation expense, and other

headcount-related expenses associated with sales and marketing personnel, and the costs of advertising, promotions,

trade shows, seminars, and other programs. Advertising costs are expensed as incurred. Advertising expense was $1.6

billion, $1.9 billion, and $1.6 billion in fiscal years 2012, 2011, and 2010, respectively.