Microsoft 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

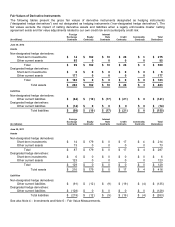

For derivative instruments designated as cash-flow hedges, the effective portion of the derivative’s gain (loss) is initially

reported as a component of OCI and is subsequently recognized in earnings when the hedged exposure is recognized in

earnings. For options designated as cash-flow hedges, changes in the time value are excluded from the assessment of

hedge effectiveness and are recognized in earnings. Gains (losses) on derivatives representing either hedge components

excluded from the assessment of effectiveness or hedge ineffectiveness are recognized in earnings.

For derivative instruments that are not designated as hedges, gains (losses) from changes in fair values are primarily

recognized in other income (expense). Other than those derivatives entered into for investment purposes, such as

commodity contracts, the gains (losses) are generally economically offset by unrealized gains (losses) in the underlying

available-for-sale securities, which are recorded as a component of OCI until the securities are sold or other-than-

temporarily impaired, at which time the amounts are moved from OCI into other income (expense).

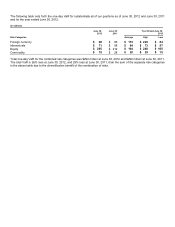

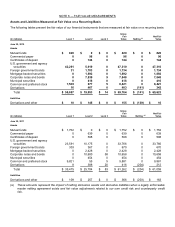

Allowance for Doubtful Accounts

The allowance for doubtful accounts reflects our best estimate of probable losses inherent in the accounts receivable

balance. We determine the allowance based on known troubled accounts, historical experience, and other currently

available evidence. Activity in the allowance for doubtful accounts was as follows:

(In millions)

Year Ended June 30,

2012

2011

2010

Balance, beginning of period

$

333

$

375

$

451

Charged to costs and other

115

14

45

Write-offs

(59

)

(56

)

(121

)

Balance, end of period

$

389

$

333

$

375

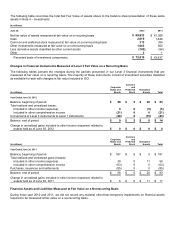

Inventories

Inventories are stated at the lower of cost or market, using the average cost method. Cost includes materials, labor, and

manufacturing overhead related to the purchase and production of inventories. We regularly review inventory quantities

on hand, future purchase commitments with our suppliers, and the estimated utility of our inventory. If our review indicates

a reduction in utility below carrying value, we reduce our inventory to a new cost basis through a charge to cost of

revenue.

Property and Equipment

Property and equipment is stated at cost and depreciated using the straight-line method over the shorter of the estimated

useful life of the asset or the lease term. The estimated useful lives of our property and equipment are generally as

follows: computer software developed or acquired for internal use, three years; computer equipment, two to three years;

buildings and improvements, five to 15 years; leasehold improvements, two to 10 years; and furniture and equipment, one

to five years. Land is not depreciated.

Goodwill

Goodwill is tested for impairment at the reporting unit level (operating segment or one level below an operating segment)

on an annual basis (May 1 for us) and between annual tests if an event occurs or circumstances change that would more

likely than not reduce the fair value of a reporting unit below its carrying value.