Safeway 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188

|

|

Table of Contents

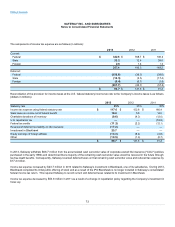

At year-end 2013, Safeway leased approximately 54% of its stores. Most leases have renewal options, typically with increased rental rates

during the option period. Certain of these leases contain options to purchase the property at amounts that approximate fair market value.

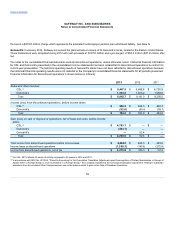

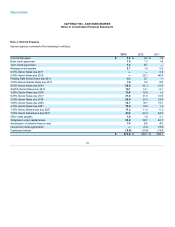

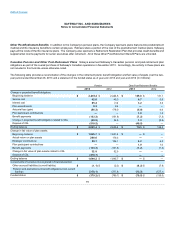

As of year-end 2013, future minimum rental payments applicable to non-cancelable capital and operating leases with remaining terms in

excess of one year were as follows (in millions):

Capital

leases

Operating

leases

2014 $83.7

$470.3

2015 80.8

430.3

2016 73.7

397.3

2017 64.3

351.1

2018 55.1

299.5

Thereafter 298.4

1,781.5

Total minimum lease payments 656.0

$3,730.0

Less amounts representing interest (231.2)

Present value of net minimum lease payments 424.8

Less current obligations (49.3)

Long-term obligations $375.5

Future minimum lease payments under non-cancelable capital and operating lease agreements have not been reduced by future minimum

sublease rental income of $173.6 million.

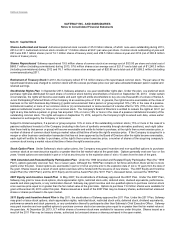

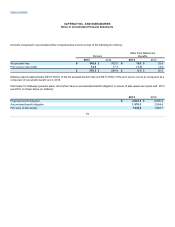

Amortization expense for property under capital leases was $46.1 million in 2013, $26.3 million in 2012 and $24.6 million in 2011.

Accumulated amortization of property under capital leases was $251.9 million at year-end 2013 and $223.1 million at year-end 2012.

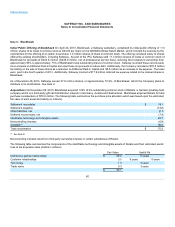

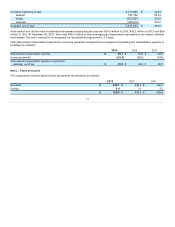

The following schedule shows the composition of total rental expense for all operating leases (in millions):

2012 2011

Property leases:

Minimum rentals $371.0 $366.6

Contingent rentals (1) 7.7 7.6

Less rentals from subleases (9.4)(8.0)

369.3 366.2

Equipment leases 20.4 20.1

$389.7 $386.3

(1) In general, contingent rentals are based on individual store sales.

69