Safeway 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188

|

|

Table of Contents

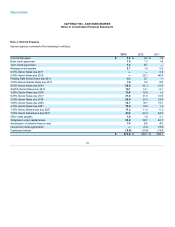

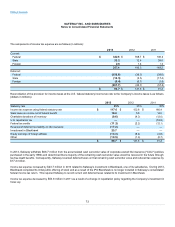

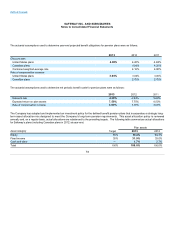

Significant components of the Company’s net deferred tax liability at year end are as follows (in millions):

2012

Deferred tax assets:

Pension liability $293.3

Workers’ compensation and other claims 189.7

Employee benefits 202.8

Accrued claims and other liabilities 95.3

Reserves not currently deductible 37.4

Federal deduction of state taxes 7.7

Foreign tax credit carryforwards 37.9

State tax credit carryforwards 27.7

Operating loss carryforwards 1.9

Other assets 3.1

896.8

Valuation Allowance (27.1)

$869.7

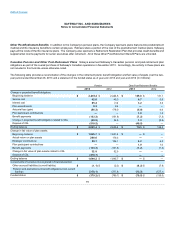

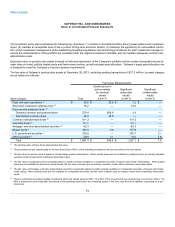

2012

Deferred tax liabilities:

Property $(662.4)

Inventory (314.5)

Investment in Blackhawk —

Investments in foreign operations (19.4)

(996.3)

Net deferred tax asset (liability) $(126.6)

Deferred tax assets and liabilities are reported in the balance sheet as follows (in millions):

2012

Current deferred tax assets (1) $1.1

Noncurrent deferred tax assets (2) 81.2

Current deferred tax liability (30.4)

Noncurrent deferred tax liability (178.5)

Net deferred tax asset (liability) $(126.6)

(1) Included in Prepaid Expenses and Other Current Assets.

(2) Included in Other Assets.

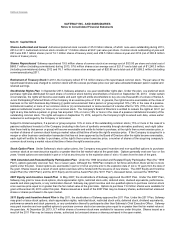

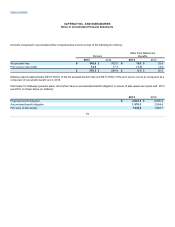

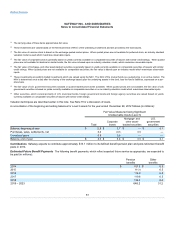

At December 28, 2013, the Company had net operating loss carryforwards for federal income tax purposes of approximately $4.5 million

which expire at various dates from 2023 to 2024. The Company also had foreign net operating loss carryforwards of $ 20.2 million which do

not expire. In addition, the Company had state tax credit carryforwards of $32.5 million which expire in 2023.

73