Sprint - Nextel 2014 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2014 Sprint - Nextel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Consolidated Financial Statements

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —(CONTINUED)

F-107

Warrants

During the first quarter of 2013, we issued a warrant to purchase 2.0 million shares of Class A Common Stock

at an exercise price of $1.75 per share related to a spectrum lease agreement. The warrants expire January 29, 2019.

In connection with the Sprint Acquisition, the warrants were settled for a lump sum cash amount equal to the amount

by which the Merger Consideration exceeded the exercise price of the warrants.

In addition, prior to the closing of the merger with Sprint, we had 375,000 warrants outstanding with an

exercise price of $3.00. These warrants were settled for a lump sum cash amount equal to the amount by which the

Merger Consideration exceeded the exercise price of the warrants.

15. Related Party Transactions

We have a number of strategic and commercial relationships with third parties that have had a significant

impact on our business, operations and financial results. These relationships have been with Sprint, Intel, Comcast,

Time Warner Cable, Bright House, Google, Eagle River, and Ericsson, all of which are or have been related parties.

Some of these relationships include agreements pursuant to which we sell wireless broadband services to certain of

these related parties on a wholesale basis, which such related parties then resell to each of their respective end user

subscribers. We sell these services at terms defined in our contractual agreements.

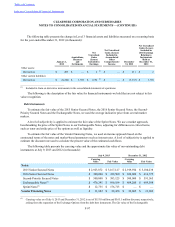

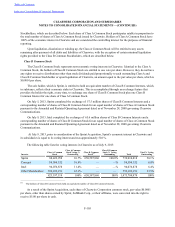

The following amounts for related party transactions are included in our consolidated financial statements (in

thousands):

July 9, December 31,

2013 2012

Accounts receivable $ 16,497 $ 17,227

Prepaid assets and other assets $ 4,235 $ 5,943

Accounts payable and accrued expenses $ 58,210 $ 8,223

Other current liabilities:

Cease-to-use $ 5,650 $ 5,497

Deferred revenue $ 200,698 $ 96,161

Other $ 5,642 $ 5,642

Other long-term liabilities:

Cease-to-use $ 37,541 $ 36,793

Deferred revenue $ 13,750 $ 83,887

Deferred rent $ 61,053 $ 32,213

Other $ 334 $ 2,821

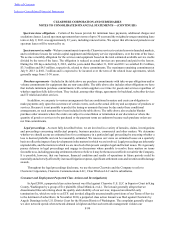

190 days Ended

July 9, Year Ended December 31,

2013 2012 2011

Revenue $ 237,111 $ 465,295 $ 493,350

Cost of goods and services and network costs (inclusive of

capitalized costs) $ 75,469 $ 152,669 $ 182,671

Selling, general and administrative (inclusive of capitalized costs) $ 26,749 $ 50,193 $ 31,453

Sprint Merger Agreement — On December 17, 2012, we entered into a Merger Agreement, pursuant to which

Sprint agreed to acquire all of the outstanding shares of Class A and Class B Common Stock not currently owned by