Lowe's 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Lowe's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

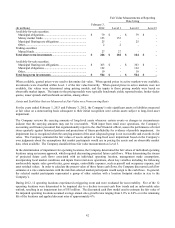

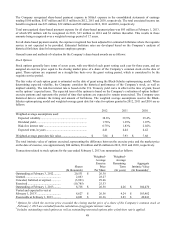

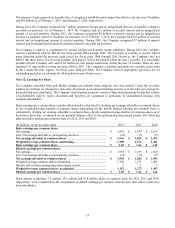

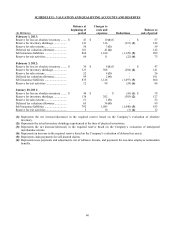

The components of the income tax provision are as follows:

(In millions) 2012 2011 2010

Current:

Federal .............................................................................................. $ 1,162 $ 891 $ 1,171

State .................................................................................................. 155 124 188

Total current ...................................................................................... 1,317 1,015 1,359

Deferred:

Federal .............................................................................................. (133) 50 (117)

State .................................................................................................. (6) 2 (24)

Total deferred..................................................................................... (139) 52 (141)

Total income tax provision ................................................................ $ 1,178 $ 1,067 $ 1,218

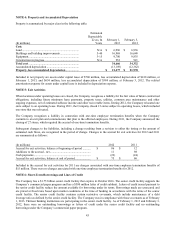

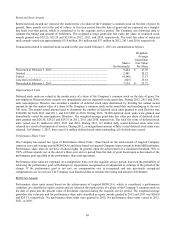

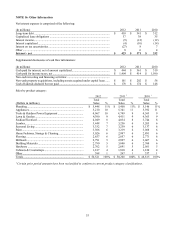

The tax effects of cumulative temporary differences that gave rise to the deferred tax assets and liabilities were as follows:

February 1,

2013

February 3,

2012

(In millions)

Deferred tax assets:

Self-insurance ................................................................................................. $ 375 $ 316

Share-based payment expense ........................................................................ 73 105

Deferred rent .................................................................................................. 80 80

Net operating losses ....................................................................................... 131 100

Other, net ........................................................................................................ 113 121

Total deferred tax assets .................................................................................. 772 722

Valuation allowance .......................................................................................... (142) (101)

Net deferred tax assets ..................................................................................... 630 621

Deferred tax liabilities:

Property .......................................................................................................... (783) (903)

Other, net ........................................................................................................ (85) (66)

Total deferred tax liabilities ............................................................................ (868) (969)

Net deferred tax liability ................................................................................. $ (238) $ (348)

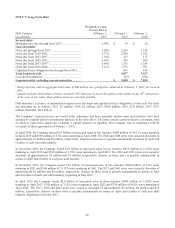

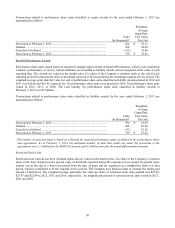

The Company operates as a branch in various foreign jurisdictions and cumulatively has incurred net operating losses of

$474 million and $379 million as of February 1, 2013, and February 3, 2012, respectively. The net operating losses are

subject to expiration in 2017 through 2032. Deferred tax assets have been established for these foreign net operating losses

in the accompanying consolidated balance sheets. Given the uncertainty regarding the realization of foreign net deferred

tax assets, the Company recorded cumulative valuation allowances of $142 million and $101 million at February 1, 2013,

and February 3, 2012, respectively.

The Company has not provided for deferred income taxes on approximately $36 million of undistributed earnings of

international subsidiaries because of its intention to indefinitely reinvest these earnings outside the U.S. It is not practicable

to determine the income tax liability that would be payable on these earnings.

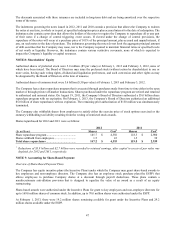

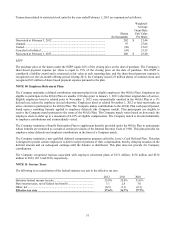

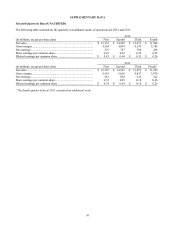

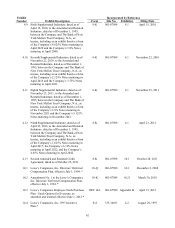

A reconciliation of the beginning and ending balances of unrecognized tax benefits is as follows:

(In millions) 2012 2011 2010

Unrecognized tax benefits, beginning of year .....................................

$

146

$

165

$

154

Additions for tax positions of prior years ............................................ 20 11 22

Reductions for tax positions of prior years .......................................... (3) (19) (19)

Additions based on tax positions related to the current year ................ - 19 9

Settlements ........................................................................................... (100) (30) (1)

Unrecognized tax benefits, end of year ................................................

$

63

$

146

$

165