Microsoft 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

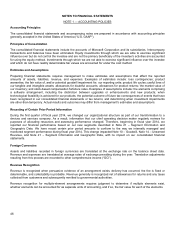

Income Taxes

Income tax expense includes U.S. and international income taxes, the provision for U.S. taxes on undistributed earnings

of international subsidiaries not deemed to be permanently invested, and interest and penalties on uncertain tax positions.

Certain income and expenses are not reported in tax returns and financial statements in the same year. The tax effect of

such temporary differences is reported as deferred income taxes. Deferred tax assets are reported net of a valuation

allowance when it is more likely than not that a tax benefit will not be realized. The deferred income taxes are classified as

current or long-term based on the classification of the related asset or liability.

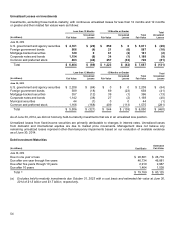

Fair Value Measurements

We account for certain assets and liabilities at fair value. The hierarchy below lists three levels of fair value based on the

extent to which inputs used in measuring fair value are observable in the market. We categorize each of our fair value

measurements in one of these three levels based on the lowest level input that is significant to the fair value measurement

in its entirety. These levels are:

• Level 1 – inputs are based upon unadjusted quoted prices for identical instruments traded in active markets.

Our Level 1 non-derivative investments primarily include U.S. government securities, domestic and

international equities, and actively traded mutual funds. Our Level 1 derivative assets and liabilities include

those actively traded on exchanges.

• Level 2 – inputs are based upon quoted prices for similar instruments in active markets, quoted prices for

identical or similar instruments in markets that are not active, and model-based valuation techniques

(e.g. the Black-Scholes model) for which all significant inputs are observable in the market or can be

corroborated by observable market data for substantially the full term of the assets or liabilities. Where

applicable, these models project future cash flows and discount the future amounts to a present value using

market-based observable inputs including interest rate curves, credit spreads, foreign exchange rates, and

forward and spot prices for currencies and commodities. Our Level 2 non-derivative investments consist

primarily of corporate notes and bonds, common and preferred stock, mortgage-backed securities, certificates

of deposit, and foreign government bonds. Our Level 2 derivative assets and liabilities primarily include certain

over-the-counter option and swap contracts.

• Level 3 – inputs are generally unobservable and typically reflect management’s estimates of assumptions that

market participants would use in pricing the asset or liability. The fair values are therefore determined using

model-based techniques, including option pricing models and discounted cash flow models. Our Level 3 non-

derivative assets primarily comprise investments in common and preferred stock and goodwill when it is

recorded at fair value due to an impairment charge. Unobservable inputs used in the models are significant to

the fair values of the assets and liabilities.

We measure certain assets, including our cost and equity method investments, at fair value on a nonrecurring basis when

they are deemed to be other-than-temporarily impaired. The fair values of these investments are determined based on

valuation techniques using the best information available, and may include quoted market prices, market comparables,

and discounted cash flow projections. An impairment charge is recorded when the cost of the investment exceeds its fair

value and this condition is determined to be other-than-temporary.

Our other current financial assets and our current financial liabilities have fair values that approximate their carrying

values.

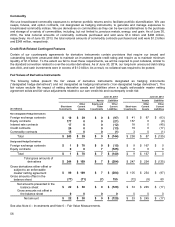

Financial Instruments

We consider all highly liquid interest-earning investments with a maturity of three months or less at the date of purchase to

be cash equivalents. The fair values of these investments approximate their carrying values. In general, investments with

original maturities of greater than three months and remaining maturities of less than one year are classified as short-term

investments. Investments with maturities beyond one year may be classified as short-term based on their highly liquid

nature and because such marketable securities represent the investment of cash that is available for current operations.

All cash equivalents and short-term investments are classified as available-for-sale and realized gains and losses are

recorded using the specific identification method. Changes in market value, excluding other-than-temporary impairments,

are reflected in OCI.