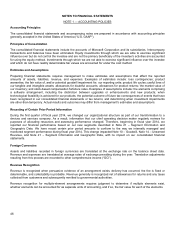

Microsoft 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

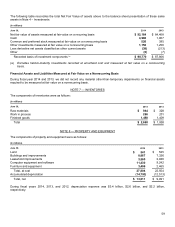

Equity and other investments classified as long-term include both debt and equity instruments. With the exception of

certain corporate notes that are classified as held-to-maturity, debt and publicly-traded equity securities are classified as

available-for-sale and realized gains and losses are recorded using the specific identification method. Changes in the

market value of available-for-sale securities, excluding other-than-temporary impairments, are reflected in OCI. Held-to-

maturity investments are recorded and held at amortized cost. Common and preferred stock and other investments that

are restricted for more than one year or are not publicly traded are recorded at cost or using the equity method.

We lend certain fixed-income and equity securities to increase investment returns. The loaned securities continue to be

carried as investments on our balance sheet. Cash and/or security interests are received as collateral for the loaned

securities with the amount determined based upon the underlying security lent and the creditworthiness of the borrower.

Cash received is recorded as an asset with a corresponding liability.

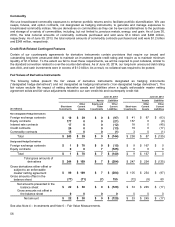

Investments are considered to be impaired when a decline in fair value is judged to be other-than-temporary. Fair value is

calculated based on publicly available market information or other estimates determined by management. We employ a

systematic methodology on a quarterly basis that considers available quantitative and qualitative evidence in evaluating

potential impairment of our investments. If the cost of an investment exceeds its fair value, we evaluate, among other

factors, general market conditions, credit quality of debt instrument issuers, the duration and extent to which the fair value

is less than cost, and for equity securities, our intent and ability to hold, or plans to sell, the investment. For fixed-income

securities, we also evaluate whether we have plans to sell the security or it is more likely than not that we will be required

to sell the security before recovery. We also consider specific adverse conditions related to the financial health of and

business outlook for the investee, including industry and sector performance, changes in technology, and operational and

financing cash flow factors. Once a decline in fair value is determined to be other-than-temporary, an impairment charge

is recorded to other income (expense) and a new cost basis in the investment is established.

Derivative instruments are recognized as either assets or liabilities and are measured at fair value. The accounting for

changes in the fair value of a derivative depends on the intended use of the derivative and the resulting designation.

For derivative instruments designated as fair value hedges, the gains (losses) are recognized in earnings in the periods of

change together with the offsetting losses (gains) on the hedged items attributed to the risk being hedged. For options

designated as fair value hedges, changes in the time value are excluded from the assessment of hedge effectiveness and

are recognized in earnings.

For derivative instruments designated as cash-flow hedges, the effective portion of the gains (losses) on the derivatives is

initially reported as a component of OCI and is subsequently recognized in earnings when the hedged exposure is

recognized in earnings. For options designated as cash-flow hedges, changes in the time value are excluded from the

assessment of hedge effectiveness and are recognized in earnings. Gains (losses) on derivatives representing either

hedge components excluded from the assessment of effectiveness or hedge ineffectiveness are recognized in earnings.

For derivative instruments that are not designated as hedges, gains (losses) from changes in fair values are primarily

recognized in other income (expense). Other than those derivatives entered into for investment purposes, such as

commodity contracts, the gains (losses) are generally economically offset by unrealized gains (losses) in the underlying

available-for-sale securities, which are recorded as a component of OCI until the securities are sold or other-than-

temporarily impaired, at which time the amounts are reclassified from accumulated other comprehensive income (“AOCI”)

into other income (expense).

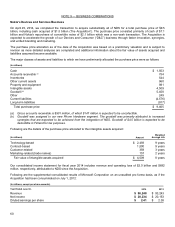

Allowance for Doubtful Accounts

The allowance for doubtful accounts reflects our best estimate of probable losses inherent in the accounts receivable

balance. We determine the allowance based on known troubled accounts, historical experience, and other currently

available evidence. Activity in the allowance for doubtful accounts was as follows:

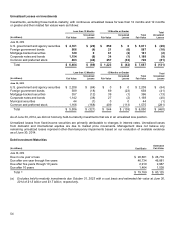

(In millions)

Y

ear Ended June 30, 2014 2013 2012

Balance, beginning of period $ 336 $ 389 $ 333

Charged to costs and other 16 4 115

Write-offs (51) (57) (59)

Balance, end of period $ 301 $ 336 $ 389