Sprint - Nextel 2005 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2005 Sprint - Nextel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SPRINT NEXTEL CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

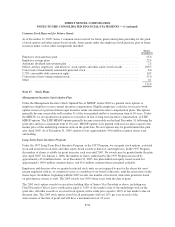

The following table shows the changes in the accumulated postretirement benefit obligation:

Year Ended December 31,

2005 2004

(in millions)

Beginning balance ........................................................ $ 967 $ 1,116

Service cost ............................................................. 13 13

Interest cost ............................................................. 48 56

Plan amendments ......................................................... (250) (35)

Actuarial losses (gains) .................................................... 3 (125)

Benefits paid ............................................................ (62) (58)

Ending balance .......................................................... $ 719 $ 967

Amounts included on the accompanying consolidated balance sheets were as follows:

As of December 31,

2005 2004

(in millions)

Accumulated postretirement benefit obligation .................................... $ 719 $ 967

Plan assets ................................................................. (42) (43)

Unrecognized transition obligation .............................................. 7 8

Unrecognized prior service benefit .............................................. 397 204

Unrecognized net loss ........................................................ (243) (264)

Accrued postretirement benefits cost ............................................ $ 838 $ 872

Discount rate ............................................................... 5.75% 6.0%

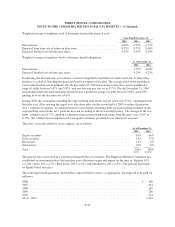

The net postretirement benefits cost consisted of the following:

Year Ended December 31,

2005 2004 2003

(in millions)

Service cost—benefits earned during the year ............................. $ 13 $ 13 $ 14

Interest on accumulated postretirement benefit obligation .................... 48 56 62

Expected return on assets ............................................. (3) (3) (3)

Recognition of transition obligation ..................................... (1) (1) (1)

Recognition of prior service cost ....................................... (57) (49) (45)

Recognition of actuarial losses ......................................... 28 28 27

Net periodic postretirement benefits cost ................................. $ 28 $ 44 $ 54

Weighted-average assumptions used to determine net periodic postretirement benefit costs:

Year Ended December 31,

2005 2004 2003

Discount rate ....................................................... 6.00% 6.25% 6.75%

Assumed return on assets ............................................. 8.75% 8.75% 9.00%

F-58