Walmart 2016 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2016 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29Only Walmart

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

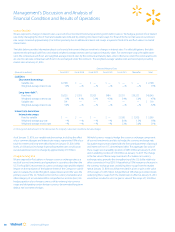

Contractual Obligations and Other Commercial Commitments

The following table sets forth certain information concerning our obligations and commitments to make contractual future payments, such as debt

and lease agreements, and certain contingent commitments:

Payments Due During Fiscal Years Ending January 31,

(Amounts in millions) Total 2017 2018-2019 2020-2021 Thereafter

Recorded contractual obligations:

Long-term debt

(1)

$ 40,959 $ 2,745 $ 5,016 $ 3,850 $29,348

Short-term borrowings 2,708 2,708 — — —

Capital lease and financing obligations

(2)

8,655 815 1,468 1,279 5,093

Unrecorded contractual obligations:

Non-cancelable operating leases 21,505 2,057 3,783 3,227 12,438

Estimated interest on long-term debt 30,391 1,806 3,445 3,129 22,011

Trade letters of credit 2,709 2,709

Stand-by letters of credit 1,813 1,813 — — —

Purchase obligations 14,099 6,830 5,527 1,549 193

Total commercial commitments $122,839 $21,483 $19,239 $13,034 $69,083

(1) “Long-term debt” includes the fair value of our derivatives classified as fair value hedges.

(2) “Capital lease and financing obligations” includes executory costs and imputed interest related to capital lease and financing obligations that are not yet recorded.

Refer to Note 11 in the “Notes to the Consolidated Financial Statements” for more information.

Additionally, the Company has $15.0 billion in undrawn committed lines

of credit which, if drawn upon, would be included in the current liabilities

section of the Company’s Consolidated Balance Sheets.

Estimated interest payments are based on our principal amounts and

expected maturities of all debt outstanding at January 31, 2016, and

management’s forecasted market rates for our variable rate debt.

Purchase obligations include legally binding contracts, such as firm

commitments for inventory and utility purchases, as well as commitments

to make capital expenditures, software acquisition and license commit-

ments and legally binding service contracts. Purchase orders for inventory

and other services are not included in the table above. Purchase orders

represent authorizations to purchase rather than binding agreements.

For the purposes of this table, contractual obligations for the purchase

of goods or services are defined as agreements that are enforceable and

legally binding and that specify all significant terms, including: fixed or

minimum quantities to be purchased; fixed, minimum or variable price

provisions; and the approximate timing of the transaction. Our purchase

orders are based on our current inventory needs and are fulfilled by our

suppliers within short time periods. We also enter into contracts for

outsourced services; however, the obligations under these contracts

are not significant and the contracts generally contain clauses allowing

for cancellation without significant penalty.

The expected timing for payment of the obligations discussed above is

estimated based on current information. Timing of payments and actual

amounts paid with respect to some unrecorded contractual commitments

may be different depending on the timing of receipt of goods or services

or changes to agreed-upon amounts for some obligations.

In addition to the amounts shown in the table above, $607 million of

unrecognized tax benefits are considered uncertain tax positions and

have been recorded as liabilities. The timing of the payment, if any,

associated with these liabilities is uncertain. Refer to Note 9 in the

“Notes to Consolidated Financial Statements” for additional discussion

of unrecognized tax benefits.

Off Balance Sheet Arrangements

In addition to the unrecorded contractual obligations presented above,

we have entered into certain arrangements, as discussed below, for which

the timing of payment, if any, is unknown.

The Company has future lease commitments for land and buildings for

approximately 215 future locations. These lease commitments have

lease terms ranging from 10 to 30 years and provide for certain mini-

mum rentals. If leases for all of those future locations had been executed

as of February 1, 2016, payments under operating leases would increase

by $34 million for fiscal 2017, based on current estimates.

In connection with certain long-term debt issuances, we could be liable

for early termination payments if certain unlikely events were to occur.

At January 31, 2016, the aggregate termination payment would have

been $44 million. The arrangement pursuant to which this payment

could be made will expire in fiscal 2019.

Market Risk

In addition to the risks inherent in our operations, we are exposed to

certain market risks, including changes in interest rates and fluctuations

in currency exchange rates.

The analysis presented below for each of our market risk sensitive

instruments is based on a hypothetical scenario used to calibrate

potential risk and does not represent our view of future market changes.

The effect of a change in a particular assumption is calculated without

adjusting any other assumption. In reality, however, a change in one

factor could cause a change in another, which may magnify or negate

other sensitivities.