Windstream 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-10

(e) The decrease in 2012 was primarily due to our pension plan assets performing better than expected, partially offset by

a decrease in the discount rate from 4.64 percent to 3.85 percent. The increase in pension expense in 2011 was

primarily due to a decline in the discount rate from 5.31 percent to 4.64 percent. Lower returns on pension plan assets

also contributed to the increase in pension expense in 2011.

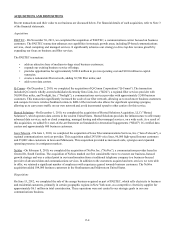

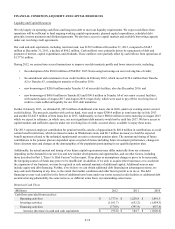

Cost of Products Sold

Cost of products sold represents the cost of equipment sales to customers.

The following table reflects the primary drivers of year-over-year changes in cost of products sold:

Twelve Months Ended

December 31, 2012

Twelve Months Ended

December 31, 2011

(Millions)

Increase

(Decrease) %

Increase

(Decrease) %

Due to acquired companies $ 93.1 $ 16.3

Due to increases in costs of contractor sales (a) 17.4 14.1

Due to decreases in consumer costs of products sold (1.1)(3.5)

Due to changes in equipment sales to business customers

(4.7) 3.5

Total increases in cost of products sold $ 104.7 99% $ 30.4 41%

(a) Increases in contractor cost of products sold for both periods were consistent with the changes in contractor sales in

2012 and 2011.

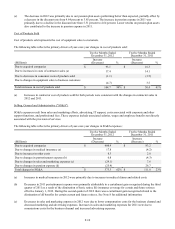

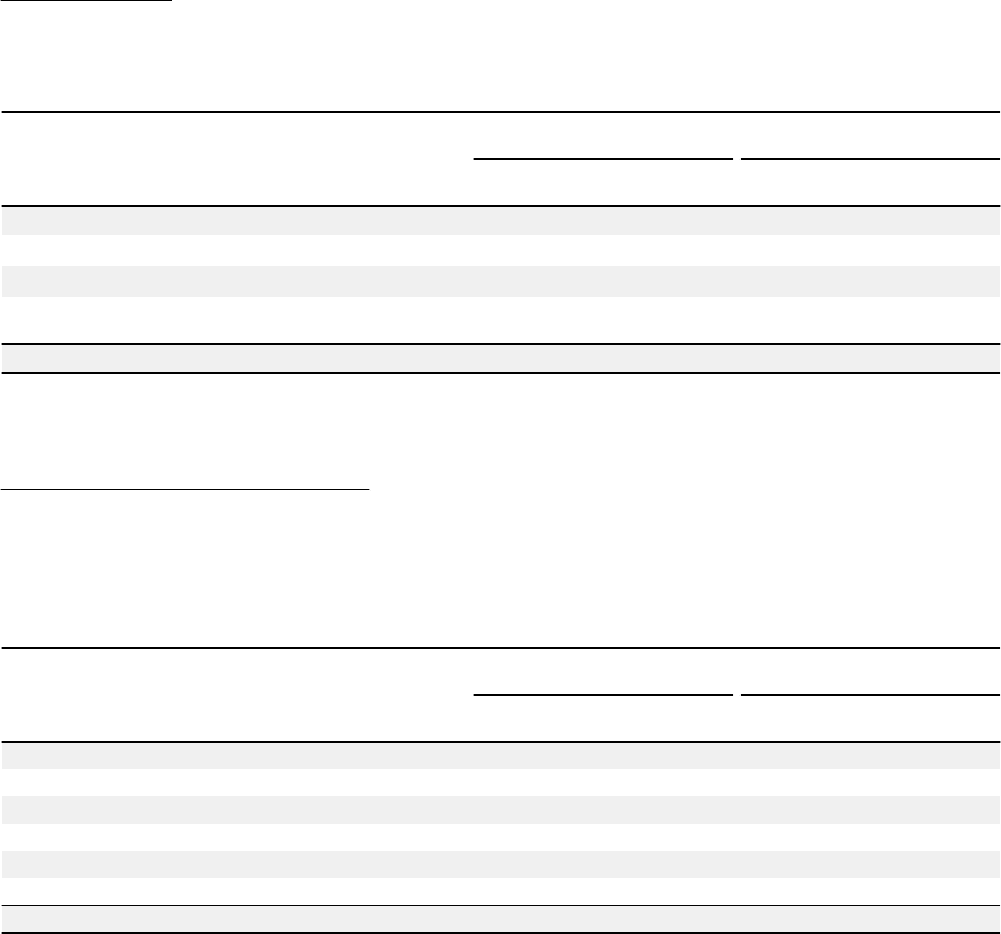

Selling, General and Administrative ("SG&A")

SG&A expenses result from sales and marketing efforts, advertising, IT support, costs associated with corporate and other

support functions, and professional fees. These expenses include associated salaries, wages and employee benefits not directly

associated with the provision of services.

The following table reflects the primary drivers of year-over-year changes in SG&A expenses:

Twelve Months Ended

December 31, 2012

Twelve Months Ended

December 31, 2011

(Millions)

Increase

(Decrease) %

Increase

(Decrease) %

Due to acquired companies $ 400.9 $ 83.2

Due to changes in medical insurance (a) 17.8 (4.2)

Due to increases in other costs 8.3 2.0

Due to changes in postretirement expense (b) 0.8 (4.3)

Due to changes in sales and marketing expenses (c) (29.1) 7.6

Due to changes in pension expense (d) (25.4) 26.7

Total changes in SG&A $ 373.3 62% $ 111.0 23%

(a) Increases in medical insurance in 2012 were primarily due to increases in medical claims and related costs.

(b) Decreases in 2011 postretirement expense were primarily attributable to a curtailment gain recognized during the third

quarter of 2011 as a result of the elimination of basic retiree life insurance coverage for certain and future retirees

effective January 1, 2012. During the second quarter of 2012 there was a curtailment gain recognized related to the

elimination of all benefits for certain current and future retirees. See Note 8 for additional information.

(c) Decreases in sales and marketing expenses in 2012 were due to lower compensation costs for the business channel and

decreased marketing and advertising expenses. Increases in sales and marketing expenses for 2011 were due to

commissions costs for the business channel and increased advertising expenses.