Windstream 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

• Require us to dedicate a substantial portion of cash flows from operations to interest and principal payments on

outstanding debt, thereby limiting the availability of cash flow to fund future capital expenditures, working capital and

other general corporate requirements;

• Limit our flexibility in planning for, or reacting to, changes in our business and the telecommunications industry;

• Place us at a competitive disadvantage compared with competitors that have less debt; and

• Limit our ability to borrow additional funds, even when necessary to maintain adequate liquidity.

In addition, our ability to borrow funds in the future will depend in part on the satisfaction of the covenants in our credit

facilities and its other debt agreements. If we are unable to satisfy the financial covenants contained in those agreements, or are

unable to generate cash sufficient to make required debt payments, the lenders and other parties to those arrangements could

accelerate the maturity of some or all of our outstanding indebtedness.

We may not generate sufficient cash flows from operations, or have future borrowings available under our credit facilities or

from other sources sufficient to enable us to make our debt payments or to fund dividends and other liquidity needs. We may

not be able to refinance any of our debt, including our credit facilities, on commercially reasonable terms or at all. If we are

unable to make payments or refinance our debt, or obtain new financing under these circumstances, we would have to consider

other options, such as selling assets, issuing additional equity or debt, or negotiating with our lenders to restructure the

applicable debt. Our credit agreement and the indentures governing our senior notes may restrict, or market or business

conditions may limit, our ability to do some of these things on favorable terms or at all.

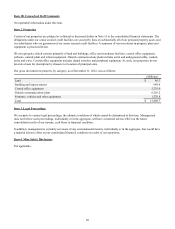

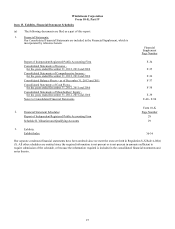

As of February 11, 2013, Moody's Investors Service ("Moody's"), S&P and Fitch Ratings ("Fitch") had granted Windstream the

following senior secured, senior unsecured and corporate credit ratings:

Description Moody’s S&P Fitch

Senior secured credit rating Baa3 BB+ BBB-

Senior unsecured credit rating Ba3 B BB+

Corporate credit rating Ba2 BB- BB+

Outlook Negative Stable Stable

Factors that could affect our short and long-term credit ratings include, but are not limited to, a material decline in our

operating results, increased debt levels relative to operating cash flows resulting from future acquisitions, increased capital

expenditure requirements, or changes to our dividend policy. In addition, we are not currently paying down a significant

amount of debt. If our credit ratings were to be downgraded from current levels, we might incur higher interest costs on future

borrowings, and our access to the public capital markets could be adversely affected.

We may be unable to fully realize expected benefits from our recent acquisitions.

We expect to achieve substantial synergies, cost savings and growth opportunities as a result of our recent acquisitions. If we

are unable to successfully integrate acquired businesses, or integrate them in a timely fashion, we may face material adverse

affects including, but not limited to:

• diversion of management's attention to and potential disruption of our ongoing businesses;

• customer losses;

• the loss of quality employees from the acquired companies;

• adverse developments in vendor relationships;

• declines in our results of operations and financial condition; and

• a decline in the market price of our common stock.