Windstream 2012 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2012 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

____

F-91

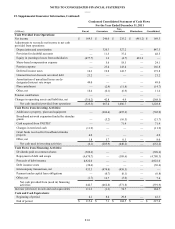

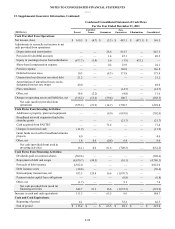

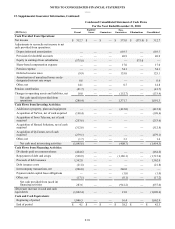

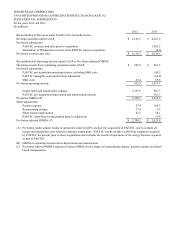

15. Supplemental Guarantor Information, Continued:

Condensed Consolidated Statement of Cash Flows

For the Year Ended December 31, 2010

(Millions) Parent

PAETEC

Issuer Guarantors

Non-

Guarantors Eliminations Consolidated

Cash Provided from Operations:

Net income $ 312.7 $ — $ — $ 575.0 $ (575.0) $ 312.7

Adjustments to reconcile net income to net

cash provided from operations:

Depreciation and amortization — — — 693.7 — 693.7

Provision for doubtful accounts — — — 48.9 — 48.9

Equity in earnings from subsidiaries (575.0) — — — 575.0 —

Share-based compensation expense — — — 17.0 — 17.0

Pension expense — — — 54.1 — 54.1

Deferred income taxes (9.9) — — 135.0 — 125.1

Amortization of unrealized losses on de-

designated interest rate swaps 0.6 — — — — 0.6

Other, net 14.1 — — 0.7 — 14.8

Pension contribution (41.7) — — — (41.7)

Changes in operating assets and liabilities, net 18.8 — — (152.7)—

(133.9)

Net cash (used in) provided from

operations (280.4) — — 1,371.7 — 1,091.3

Cash Flows from Investing Activities:

Additions to property, plant and equipment —— —

(412.0)—

(412.0)

Acquisition of NuVox, net of cash acquired (198.4) — — — — (198.4)

Acquisition of Iowa Telecom, net of cash

acquired (253.6) — — — — (253.6)

Acquisition of Hosted Solutions, net of cash

acquired (312.8) — — — — (312.8)

Acquisition of Q-Comm, net of cash

acquired (279.1) — — — — (279.1)

Other, net (1.7) — — 3.3 — 1.6

Net cash used in investing activities (1,045.6) — — (408.7)—

(1,454.3)

Cash Flows from Financing Activities:

Dividends paid on common shares (464.6) — — — — (464.6)

Repayment of debt and swaps (528.9) — — (1,186.1)—

(1,715.0)

Proceeds of debt issuance 1,562.0 — — — — 1,562.0

Debt issuance costs (21.8) — — — — (21.8)

Intercompany transactions, net (246.0) — — 246.0 — —

Payment under capital lease obligations —— —(1.0)—(1.0)

Other, net (17.1) — — (0.1)—

(17.2)

Net cash provided from (used in)

financing activities 283.6 — — (941.2)—

(657.6)

(Decrease) increase in cash and cash

equivalents (1,042.4) — — 21.8 — (1,020.6)

Cash and Cash Equivalents:

Beginning of period 1,046.5 — — 16.4 — 1,062.9

End of period $ 4.1 $ — $ — $ 38.2 $ — $ 42.3