Windstream 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-23

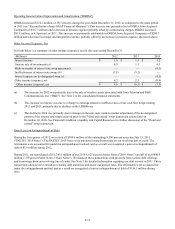

Our senior secured credit facility and Windstream indentures include maintenance covenants derived from certain financial

measures that are not calculated in accordance with accounting principles generally accepted in the United States ("non-GAAP

financial measures"). These non-GAAP financial measures are presented below for the sole purpose of demonstrating our

compliance with our debt covenants and were calculated as follows:

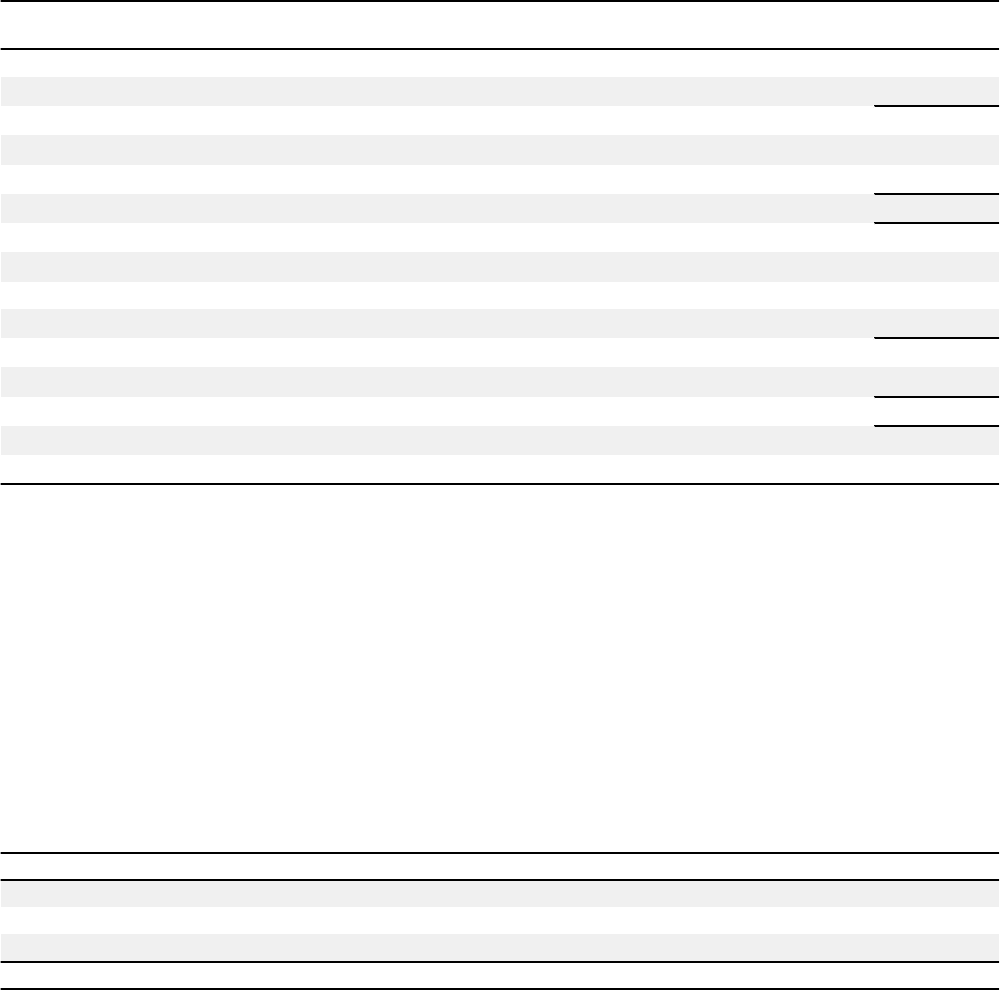

(Millions, except ratios)

December 31,

2012

Gross leverage ratio:

Total debt $ 8,996.5

Operating income, last twelve months $ 887.5

Depreciation and amortization, last twelve months 1,297.6

Other non-cash and non-recurring expense adjustments required by the credit facilities and indentures (a) 214.7

Adjusted earnings before interest, taxes, depreciation and amortization ("Adjusted EBITDA") $ 2,399.8

Leverage ratio (b) 3.75

Maximum gross leverage ratio allowed 4.50

Interest coverage ratio:

Adjusted EBITDA $ 2,399.8

Interest expense, last twelve months $ 625.1

Adjustments required by the credit facilities and indentures (c) 24.2

Adjusted interest expense $ 649.3

Interest coverage ratio (d) 3.70

Minimum interest coverage ratio allowed 2.75

(a) Adjustments required by the credit facility and indentures primarily consist of the inclusion of pension and share-

based compensation expense, non-recurring merger, integration and restructuring charges.

(b) The gross leverage ratio is computed by dividing total debt by adjusted EBITDA.

(c) Adjustments required by the credit facility and indentures primarily consist of the inclusion of capitalized interest and

amortization of the discount on long-term debt, net of premiums.

(d) The interest coverage ratio is computed by dividing adjusted EBITDA by adjusted interest expense.

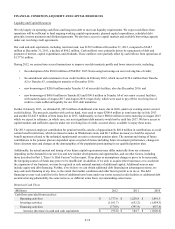

Credit Ratings

As of February 11, 2013, Moody’s Investors Service, Standard & Poor’s Corporation ("S&P") and Fitch Ratings had granted us

the following senior secured, senior unsecured and corporate credit ratings:

Description Moody’s S&P Fitch

Senior secured credit rating Baa3 BB+ BBB-

Senior unsecured credit rating Ba3 B BB+

Corporate credit rating Ba2 BB- BB+

Outlook Negative Stable Stable

Factors that could affect our short and long-term credit ratings would include, but are not limited to, a material decline in our

operating results, increased debt levels relative to operating cash flows resulting from future acquisitions, increased capital

expenditure requirements, or changes to our dividend policy. If our credit ratings were to be downgraded, we might incur

higher interest costs on future borrowings, and our access to the public capital markets could be adversely affected. Our

exposure to interest risk is further discussed in the Market Risk section below. A downgrade in our current short or long-term

credit ratings would not accelerate scheduled principal payments of our existing long-term debt, as discussed further in Note 5.

Our next significant scheduled debt maturity is in 2017.