DTE Energy 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 DTE Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company’s stock incentive program permits the grant of incentive stock options, non-qualifying stock options, stock awards, performance shares

and performance units to employees and members of its Board of Directors. As a result of a stock award, a settlement of an award of performance shares, or by

exercise of a participant’s stock option, the Company may deliver common stock from the Company’s authorized but unissued common stock and/or from

outstanding common stock acquired by or on behalf of the Company in the name of the participant. Key provisions of the stock incentive program are:

• Authorized limit is 14,500,000 shares of common stock;

• Prohibits the grant of a stock option with an exercise price that is less than the fair market value of the Company’s stock on the date of the

grant; and

• Imposes the following award limits to a single participant in a single calendar year, (1) options for more than 500,000 shares of common stock;

(2) stock awards for more than 150,000 shares of common stock; (3) performance share awards for more than 300,000 shares of common stock

(based on the maximum payout under the award); or (4) more than 1,000,000 performance units, which have a face amount of $1.00 each.

The Company records compensation expense at fair value over the vesting period for all awards it grants.

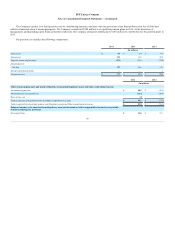

The following table summarizes the components of stock-based compensation:

Stock-based compensation expense

$ 99

$ 83

Tax benefit

38

33

Stock-based compensation cost capitalized in property, plant and equipment

15

5

Options are exercisable according to the terms of the individual stock option award agreements and expire 10 years after the date of the grant. The

option exercise price equals the fair value of the stock on the date that the option was granted. Stock options vest ratably over a 3-year period.

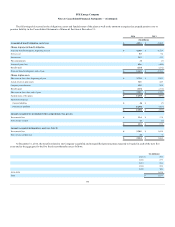

The following table summarizes our stock option activity for the year ended December 31, 2014:

Options outstanding at December 31, 2013 723,697

$ 42.60

Granted —

$ —

Exercised (268,689)

$ 41.14

Forfeited or expired (10,730)

$ 39.41

Options outstanding and exercisable at December 31, 2014 444,278

$ 43.56

$ 17

As of December 31, 2014, the weighted average remaining contractual life for the exercisable shares is 3.41 years. As of December 31, 2014, all options

were vested. No options vested during 2014.

There were no options granted during 2014, 2013 or 2012. The intrinsic value of options exercised for the years ended December 31, 2014, 2013 and

2012 was $11 million, $12 million and $25 million, respectively. Total option expense recognized was zero for 2014 and 2013 and $0.7 million for 2012.

103