Electronic Arts 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy Statement

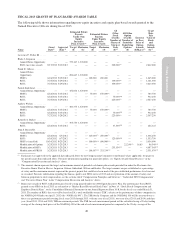

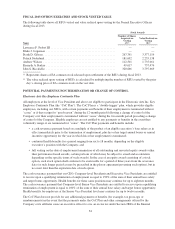

FISCAL 2013 GRANTS OF PLAN-BASED AWARDS TABLE

The following table shows information regarding non-equity incentive and equity plan-based awards granted to the

Named Executive Officers during fiscal 2013.

Name

Grant

Date(1)

Approval

Date(1)

Estimated Future

Payouts

Under Non-

Equity

Incentive

Plan Awards(2)

Estimated Future

Payouts

Under Equity

Incentive

Plan Awards

All

Other

Stock

Awards:

Number of

Shares of

Stock or

Units

(#)(4)

All Other

Option

Awards:

Number of

Securities

Underlying

Options

(#)

Exercise

or Base

Price of

Option

Awards

($/Share)(5)

Grant

Date

Fair

Value of

Stock

and

Option

Awards

($)(6)

Target

($)

Maximum

($)

Target

(#)

Maximum

(#)

Lawrence F. Probst III ..... — — — — — — — — — —

Blake J. Jorgensen ........

Annual Bonus Opportunity — — 379,167 1,320,000 — — — — — —

RSUs (new-hire award) 9/17/2012 9/13/2012 — — — — 200,000(7) 2,842,000

Frank D. Gibeau ..........

Annual Bonus

Opportunity — — 696,667 1,320,000 — — — — — —

PRSUs 6/18/2012 5/15/2012 — — 100,000 200,000 — — — 1,045,000

RSUs 7/27/2012 5/29/2012 — — — — 100,000(8) — — 1,141,000

RSUs 7/27/2012 5/29/2012 — — — — 300,000(9) — — 3,423,000

Patrick Söderlund .........

Annual Bonus Opportunity — — 456,064 1,320,000 — — — — — —

PRSUs 6/18/2012 5/15/2012 — — 75,000 150,000(3) — — — 783,750

RSUs 6/18/2012 5/15/2012 — — — — 75,000(10) — — 932,250

RSUs 7/27/2012 5/29/2012 — — — — 225,000(9) — — 2,567,250

Andrew Wilson ..........

Annual Bonus Opportunity — — 384,375 1,320,000 — — — — — —

PRSUs 6/18/2012 5/15/2012 — — 75,000 150,000(3) — — — 783,750

RSUs 6/18/2012 5/15/2012 — — — — 75,000(10) — — 932,250

RSUs 7/27/2012 5/29/2012 — — — — 225,000(9) — — 2,567,250

Kenneth A. Barker ........

Annual Bonus Opportunity — — 305,750 1,320,000 — — — — — —

RSUs 6/18/2012 5/15/2012 — — — — 37,500(10) — — 466,125

John S. Riccitiello .........

Annual Bonus Opportunity — — — — — — — — — —

PRSUs 6/18/2012 6/7/2012 — — 125,000(3) 250,000(3) — — — 1,306,250

RSUs 6/18/2012 6/7/2012 — — — — 125,000(10) — — 1,553,750

PRSUs (cancelled) 10/16/2012 9/25/2012 — — 300,000(11) 600,000(11) — — — 5,034,000

Modification of Options 3/25/2013 3/25/2013 — — — — — 22,240(12) 18.85 98,340(13)

Modification of RSUs 3/25/2013 3/25/2013 — — — — 233,334(14) — — 4,097,345(15)

Modification of PRSUs 3/25/2013 3/25/2013 — — 166,667(16) 333,334(16) — — — 2,531,670(17)

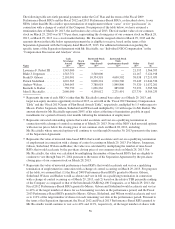

(1) Each grant was approved on the approval date indicated above by our Compensation Committee or the Board, where applicable, for grant on

the specific grant date indicated above. For more information regarding our grant date policy, see “Equity Awards Grant Practices” in the

“Compensation Discussion and Analysis” above.

(2) The amounts shown represent the target and maximum amount of potential cash bonus plan awards provided for under the Electronic Arts

Executive Bonus Plan for Messrs. Jorgensen, Gibeau, Söderlund, Wilson and Barker. The target amounts are pre-established as a percentage

of salary and the maximum amounts represent the greatest payout that could have been made if the pre-established performance level was met

or exceeded. For more information regarding the bonuses paid to our NEOs in fiscal 2013 and an explanation of the amount of salary and

bonus in proportion to total compensation, see the sections titled “Compensation Principles and Structure”, “Individual NEO Compensation”,

and “Executive Bonus Plan” in the “Compensation Discussion and Analysis” above.

(3) Represents awards of RSUs with performance-based vesting granted under our 2000 Equity Incentive Plan. The performance-based RSUs

granted to our NEOs in fiscal 2013 are referred to as “Market-Based Restricted Stock Units” in Note 14, “Stock-Based Compensation and

Employee Benefit Plans”, to the Consolidated Financial Statements in our Annual Report on Form 10-K for the fiscal year ended March 31,

2013. The number of RSUs that vest will be based on EA’s total stockholder return (“TSR”) relative to the performance of those companies in

the NASDAQ-100 Index on April 1, 2012 (the “NASDAQ-100”). The TSR for the Company and the NASDAQ 100 will be measured over a

three year performance period covering fiscal years 2013 through 2015, with one year (fiscal 2013), two year (fiscal 2013 and 2014) and three

year (fiscal 2013, 2014 and 2015) TSR measurement periods. The TSR for each measurement period will be calculated using a 90-day trailing

average of the closing stock prices of the NASDAQ-100 at the end of each measurement period as compared to the 90-day average of the

49