Target 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART III

Certain information required by Part III is incorporated by reference from Target’s definitive Proxy

Statement to be filed on or about April 9, 2007. Except for those portions specifically incorporated in this

Form 10-K by reference to Target’s Proxy Statement, no other portions of the Proxy Statement are deemed to

be filed as part of this Form 10-K.

Item 10. Directors, Executive Officers and Corporate Governance.

Election of Directors, Section 16(a) Beneficial Ownership Reporting Compliance, Additional

Information – Business Ethics and Conduct and General Information About the Board of Directors – Board

Meetings and Committees, of Target’s Proxy Statement to be filed on or about April 9, 2007, are

incorporated herein by reference. See also Item 4A, Executive Officers of Part I hereof.

Item 11. Executive Compensation.

Executive and Director Compensation, of Target’s Proxy Statement to be filed on or about April 9,

2007, is incorporated herein by reference.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.

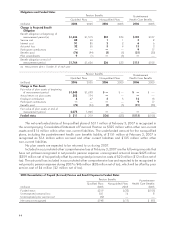

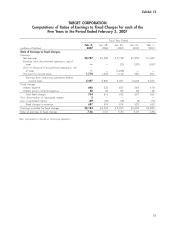

Equity Compensation Plan Information

Number of Securities Number of Securities

to be Issued Upon Weighted Average Remaining Available for

Exercise of Exercise Price of Future Issuance Under

Outstanding Options, Outstanding Equity Compensation Plans

Warrants and Rights Options, Warrants as of February 3, 2007

as of February 3, and Rights as of (Excluding Securities

2007 February 3, 2007 Reflected in Column (a))

Plan Category (a) (b) (c)

Equity compensation plans approved by

security holders 30,025,530(1) $41.95 42,974,387

Equity compensation plans not approved

by security holders — — —

Total 30,025,530 $41.95 42,974,387

(1) This amount includes 2,115,595 performance shares and RSU shares potentially issuable under our Long-Term Incentive Plan. According to

the existing plan provisions and compensation deferral elections, approximately 32 percent of these potentially issuable performance shares,

if and when earned, will be paid in cash or deferred through a credit to the deferred compensation accounts of the participants in an amount

equal to the value of any earned performance shares. The actual number of performance shares to be issued, cash to be paid, or credits to be

made to deferred compensation accounts, if any, depends on our financial performance over a period of time. Performance shares do not

have an exercise price and thus they have been excluded from the weighted average exercise price calculation in column (b).

Beneficial Ownership of Certain Shareholders, of Target’s Proxy Statement to be filed on or about

April 9, 2007, is incorporated herein by reference.

Item 13. Certain Relationships and Related Transactions, and Director Independence.

Certain Relationships and General Information About the Board of Directors – Director Independence,

of Target’s Proxy Statement to be filed on or about April 9, 2007, are incorporated herein by reference.

Item 14. Principal Accountant Fees and Services.

Audit and Non-audit Fees, of Target’s Proxy Statement to be filed on or about April 9, 2007, is

incorporated herein by reference.

49

PART III