Apple 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Apple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

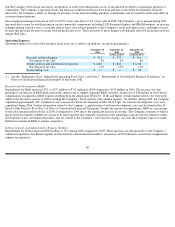

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Interest Rate and Foreign Currency Risk Management

The Company regularly reviews its foreign exchange forward and option positions and its interest rate swap and option positions, both on a

stand-alone basis and in conjunction with its underlying foreign currency and interest rate related exposures. However, given the effective

horizons of the Company’s risk management activities and the anticipatory nature of the exposures, there can be no assurance the hedges will

offset more than a portion of the financial impact resulting from movements in either foreign exchange or interest rates. In addition, the timing

of the accounting for recognition of gains and losses related to mark-to-market instruments for any given period may not coincide with the

timing of gains and losses related to the underlying economic exposures and, therefore, may adversely affect the Company’s operating results

and financial position.

Interest Rate Risk

While the Company is exposed to interest rate fluctuations in many of the world’s leading industrialized countries, the Company’s interest

income and expense is most sensitive to fluctuations in the general level of U.S. interest rates. In this regard, changes in U.S. interest rates

affect the interest earned on the Company’s cash, cash equivalents, and short-

term investments as well as costs associated with foreign currency

hedges.

The Company’s short-term investment policy and strategy is to ensure the preservation of capital, meet liquidity requirements, and optimize

return in light of the current credit and interest rate environment. A portion of the Company’s cash is managed by external managers within the

guidelines of the Company’s investment policy and to an objective market benchmark. The Company’s internal portfolio is benchmarked

against external manager performance, allowing for differences in liquidity needs.

The Company’s exposure to market risk for changes in interest rates relates primarily to the Company’s investment portfolio. The Company

places its short-term investments in highly liquid securities issued by high credit quality issuers and, by policy, limits the amount of credit

exposure to any one issuer. The Company’s general policy is to limit the risk of principal loss and ensure the safety of invested funds by

limiting market and credit risk. All highly liquid investments with initial maturities of three months or less are classified as cash equivalents;

highly liquid investments with initial maturities greater than three months are classified as short-term investments. As of September 30, 2006,

approximately $921 million of the Company’s short-term investments had underlying maturities ranging from 1 to 5 years. As of

September 24, 2005, $287 million of the Company’s short-term investments had underlying maturities ranging from 1 to 5 years. The

remainder all had underlying maturities of less than 12 months. The Company may sell its investments prior to their stated maturities for

strategic purposes, in anticipation of credit deterioration or for duration management. The Company recognized net losses before taxes of

$434,000 and $137,000 in 2006 and 2005, respectively, and a net gain before taxes of $1 million in 2004 as a result of such sales.

To provide a meaningful assessment of the interest rate risk associated with the Company’s investment portfolio, the Company performed a

sensitivity analysis to determine the impact a change in interest rates would have on the value of the investment portfolio assuming a 100 basis

point parallel shift in the yield curve. Based on investment positions as of September 30, 2006, a hypothetical 100 basis point increase in

interest rates across all maturities would result in a $15.2 million decline in the fair market value of the portfolio. As of September 24, 2005, a

similar 100 basis point shift in the yield curve would have resulted in a $19.9 million decline in fair value. Such losses would only be realized

if the Company sold the investments prior to maturity.

70