Coca Cola 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 Coca Cola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE COCA-COLA COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

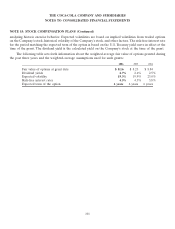

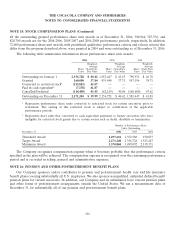

NOTE 15: STOCK COMPENSATION PLANS (Continued)

unrecognized compensation cost related to nonvested share-based compensation arrangements granted under

our plans. This cost is expected to be recognized as stock-based compensation expense over a weighted-average

period of 1.7 years. This expected cost does not include the impact of any future stock-based compensation

awards. Additionally, our equity method investees also adopted SFAS No. 123(R) effective January 1, 2006. Our

proportionate share of the stock-based compensation expense resulting from the adoption of SFAS No. 123(R)

by our equity method investees is recognized as a reduction to equity income. The adoption of SFAS No. 123(R)

by our equity method investees did not have a material impact on our consolidated financial statements.

During 2005, the Company changed its estimated service period for retirement-eligible participants in its

plans when the terms of their stock-based compensation awards provide for accelerated vesting upon early

retirement. The full-year impact of this change in our estimated service period was approximately $50 million for

2005.

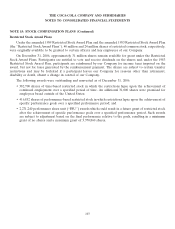

Stock Option Plans

Under our 1991 Stock Option Plan (the ‘‘1991 Option Plan’’), a maximum of 120 million shares of our

common stock was approved to be issued or transferred to certain officers and employees pursuant to stock

options granted under the 1991 Option Plan. Options to purchase common stock under the 1991 Option Plan

have been granted to Company employees at fair market value at the date of grant.

The 1999 Stock Option Plan (the ‘‘1999 Option Plan’’) was approved by shareowners in April 1999.

Following the approval of the 1999 Option Plan, no grants were made from the 1991 Option Plan, and shares

available under the 1991 Option Plan were no longer available to be granted. Under the 1999 Option Plan, a

maximum of 120 million shares of our common stock was approved to be issued or transferred to certain officers

and employees pursuant to stock options granted under the 1999 Option Plan. Options to purchase common

stock under the 1999 Option Plan have been granted to Company employees at fair market value at the date of

grant.

The 2002 Stock Option Plan (the ‘‘2002 Option Plan’’) was approved by shareowners in April 2002. An

amendment to the 2002 Option Plan which permitted the issuance of stock appreciation rights was approved by

shareowners in April 2003. Under the 2002 Option Plan, a maximum of 120 million shares of our common stock

was approved to be issued or transferred to certain officers and employees pursuant to stock options and stock

appreciation rights granted under the 2002 Option Plan. The stock appreciation rights permit the holder, upon

surrendering all or part of the related stock option, to receive common stock in an amount up to 100 percent of

the difference between the market price and the option price. No stock appreciation rights have been issued

under the 2002 Option Plan as of December 31, 2006. Options to purchase common stock under the 2002

Option Plan have been granted to Company employees at fair market value at the date of grant.

Stock options granted in December 2003 and thereafter generally become exercisable over a four-year

annual vesting period and expire 10 years from the date of grant. Stock options granted from 1999 through

July 2003 generally become exercisable over a four-year annual vesting period and expire 15 years from the date

of grant. Prior to 1999, stock options generally became exercisable over a three-year vesting period and expired

10 years from the date of grant.

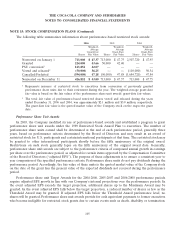

The fair value of each option award is estimated on the date of the grant using a Black-Scholes-Merton

option-pricing model that uses the assumptions noted in the following table. The expected term of the options

granted represents the period of time that options granted are expected to be outstanding and is derived by

100