Coca Cola 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Coca Cola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE COCA-COLA COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

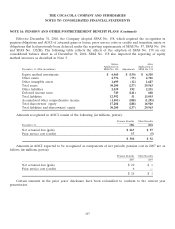

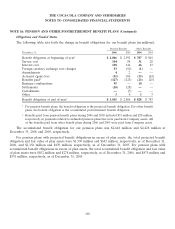

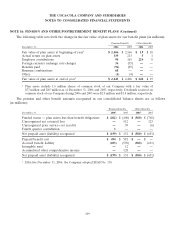

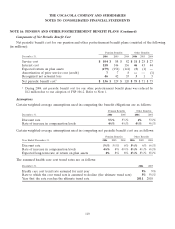

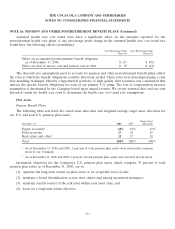

NOTE 16: PENSION AND OTHER POSTRETIREMENT BENEFIT PLANS (Continued)

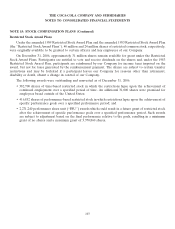

Asset allocation targets promote optimal expected return and volatility characteristics given the long-term

time horizon for fulfilling the obligations of the pension plans. Selection of the targeted asset allocation for U.S.

plan assets was based upon a review of the expected return and risk characteristics of each asset class, as well as

the correlation of returns among asset classes.

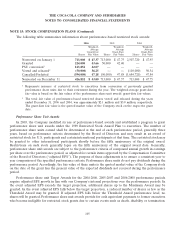

Investment guidelines are established with each investment manager. These guidelines provide the

parameters within which the investment managers agree to operate, including criteria that determine eligible

and ineligible securities, diversification requirements and credit quality standards, where applicable. Unless

exceptions have been approved, investment managers are prohibited from buying or selling commodities, futures

or option contracts, as well as from short selling of securities. Furthermore, investment managers agree to obtain

written approval for deviations from stated investment style or guidelines.

As of December 31, 2006, no investment manager was responsible for more than 10 percent of total U.S.

plan assets. In addition, diversification requirements for each investment manager prevent a single security or

other investment from exceeding 10 percent, at historical cost, of the individual manager’s portfolio.

The expected long-term rate of return assumption for U.S. plan assets is based upon the target asset

allocation and is determined using forward-looking assumptions in the context of historical returns and

volatilities for each asset class, as well as correlations among asset classes. We evaluate the rate of return

assumption on an annual basis. The expected long-term rate of return assumption used in computing 2006 net

periodic pension cost for the U.S. plans was 8.5 percent. As of December 31, 2006, the 10-year annualized return

on U.S. plan assets was 9.0 percent, the 15-year annualized return was 11.0 percent, and the annualized return

since inception was 12.8 percent.

Plan assets for our pension plans outside the United States are insignificant on an individual plan basis.

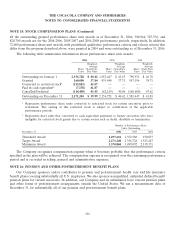

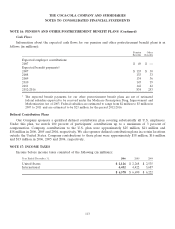

Other Benefit Plans

Plan assets associated with other benefits represent funding of the primary U.S. postretirement benefit

plans. In late 2006, we established and contributed $216 million to a U.S. Voluntary Employee Beneficiary

Association, a tax-qualified trust. As of December 31, 2006, the majority of these funds were held in short-term

investments pending the implementation of long-term asset allocation strategies. While these assets will remain

segregated from the primary U.S. pension master trust, the investment objectives, asset allocation targets and

investment guidelines will be determined in a methodology similar to that applied to the U.S. pension plans

described above.

112