Proctor and Gamble 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial StatementsThe Procter & Gamble Company 57

Amounts in millions of dollars except per share amounts or as otherwise specified.

Cash Flow Presentation

The Consolidated Statements of Cash Flows are prepared using the

indirect method, which reconciles net earnings to cash flow from

operating activities. The reconciliation adjustments include the removal

of timing differences between the occurrence of operating receipts

and payments and their recognition in net earnings. The adjustments

also remove cash flows arising from investing and financing activities,

which are presented separately from operating activities. Cash flows

from foreign currency transactions and operations are translated at an

average exchange rate for the period. Cash flows from hedging activities

are included in the same category as the items being hedged. Cash

flows from derivative instruments designated as net investment hedges

are classified as financing activities. Realized gains and losses from

non-qualifying derivative instruments used to hedge currency exposures

resulting from intercompany financing transactions are also classified

as financing activities. Cash flows from other derivative instruments

used to manage interest, commodity or other currency exposures are

classified as operating activities. Cash payments related to income taxes

are classified as operating activities.

Cash Equivalents

Highly liquid investments with remaining stated maturities of three

months or less when purchased are considered cash equivalents and

recorded at cost.

Investments

Investment securities consist of readily marketable debt and equity

securities. Unrealized gains or losses are charged to earnings for

investments classified as trading. Unrealized gains or losses on securities

classified as available-for-sale are generally recorded in shareholders’

equity. If an available-for-sale security is other than temporarily

impaired, the loss is charged to either earnings or shareholders’

equity depending on our intent and ability to retain the security until

we recover the full cost basis and the extent of the loss attributable to

the creditworthiness of the issuer. Investments in certain companies

over which we exert significant influence, but do not control the

financial and operating decisions, are accounted for as equity method

investments. Other investments that are not controlled, and over

which we do not have the ability to exercise significant influence,

areaccounted for under the cost method. Both equity and cost

method investments are included as other noncurrent assets in the

Consolidated Balance Sheets.

Inventory Valuation

Inventories are valued at the lower of cost or market value. Product-

related inventories are primarily maintained on the first-in, first-out

method. Minor amounts of product inventories, including certain

cosmetics and commodities, are maintained on the last-in, first-out

method. The cost of spare part inventories is maintained using the

average cost method.

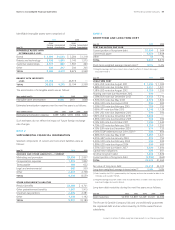

Property, Plant and Equipment

Property, plant and equipment is recorded at cost reduced by accu-

mulated depreciation. Depreciation expense is recognized over the

assets’ estimated useful lives using the straight-line method. Machinery

and equipment includes office furniture and fixtures (15-year life),

computer equipment and capitalized software (3- to 5-year lives) and

manufacturing equipment (3- to 20-year lives). Buildings are depreci-

ated over an estimated useful life of 40 years. Estimated useful lives

are periodically reviewed and, when appropriate, changes are made

prospectively. When certain events or changes in operating conditions

occur, asset lives may be adjusted and an impairment assessment

may be performed on the recoverability of the carrying amounts.

Goodwill and Other Intangible Assets

Goodwill and indefinite-lived brands are not amortized, but are

evaluated for impairment annually or when indicators of a potential

impairment are present. Our impairment testing of goodwill is per-

formed separately from our impairment testing of indefinite-lived

intangibles. The annual evaluation for impairment of goodwill and

indefinite-lived intangibles is based on valuation models that incorporate

assumptions and internal projections of expected future cash flows and

operating plans. We believe such assumptions are also comparable

to those that would be used by other marketplace participants.

We have acquired brands that have been determined to have indefi-

nite lives due to the nature of our business. We evaluate a number of

factors to determine whether an indefinite life is appropriate, including

the competitive environment, market share, brand history, product life

cycles, operating plans and the macroeconomic environment of the

countries in which the brands are sold. When certain events or changes

in operating conditions occur, an impairment assessment is performed

and indefinite-lived brands may be adjusted to a determinable life.

The cost of intangible assets with determinable useful lives is amortized

to reflect the pattern of economic benefits consumed, either on a

straight-line or accelerated basis over the estimated periods benefited.

Patents, technology and other intangibles with contractual terms are

generally amortized over their respective legal or contractual lives.

Customer relationships, brands and other non-contractual intangible

assets with determinable lives are amortized over periods generally

ranging from 5to 30 years. When certain events or changes in oper-

ating conditions occur, an impairment assessment is performed and

lives of intangible assets with determinable lives may be adjusted.

Fair Values of Financial Instruments

Certain financial instruments are required to be recorded at fair value.

Changes in assumptions or estimation methods could affect the fair

value estimates; however, we do not believe any such changes would

have a material impact on our financial condition, results of operations

or cash flows. Other financial instruments, including cash equivalents,

other investments and short-term debt, are recorded at cost, which

approximates fair value. The fair values of long-term debt and financial

instruments are disclosed in Note 4and Note 5, respectively.