Sprint - Nextel 2015 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2015 Sprint - Nextel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406

|

|

Table of Contents

Index to Consolidated Financial Statements

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —(CONTINUED)

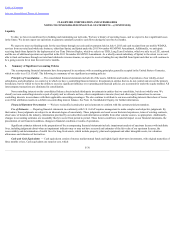

Revenue arrangements with multiple deliverables are divided into separate units and, where available, revenue is allocated using vendor-specific objective

evidence or third-party evidence of the selling prices; otherwise estimated selling prices are utilized. Any revenue attributable to the delivered elements is

recognized currently in revenue and any revenue attributable to the undelivered elements is deferred and will be recognized as the undelivered elements are

expected to be delivered over the remaining term of the agreements.

With the exception of the Universal Service Fee, which we refer to as USF, a regulatory surcharge, taxes and other fees collected from customers are

excluded from revenues. USF is recorded on a gross basis and included in revenues when billed to customers. USF included in revenue for the 190 days ended July

9, 2013 and the years ended December 31, 2012 and 2011 were $0.9 million, $2.8 million and $3.9 million, respectively.

For the 190 days ended July 9, 2013 and the years ended December 31, 2012 and 2011, substantially all of our wholesale revenues were derived from our

agreements with Sprint. In November 2011, we entered into the November 2011 4G MVNO Amendment. As a result, the minimum payments under the previous

amendment to the 4G MVNO agreement entered into with Sprint in April 2011 were replaced with the provisions of the November 2011 4G MVNO Amendment.

Under the November 2011 4G MVNO Amendment, Sprint is paying us $925.9 million for unlimited 4G mobile WiMAX services for resale to its retail subscribers

in 2012 and 2013, approximately two-thirds of which was paid for service provided in 2012, and the remainder paid for service provided in 2013. As part of the

November 2011 4G MVNO Amendment, we also agreed to usage based pricing for WiMAX services after 2013 and for LTE service beginning in 2012.

In 2011, revenues from wholesale subscribers were billed one month in arrears and were generally recognized as they are earned, based on terms defined in

our commercial agreements with our wholesale partners. For 2011, substantially all of our wholesale revenues were derived from our agreement with Sprint.

Under that agreement, revenues were earned as Sprint utilized our network, with usage-based pricing that included volume discounts.

Advertising Costs — Advertising costs are expensed as incurred or the first time the advertising occurs. Advertising expense was $22.6 million, $69.7

million and $76.4 million for the 190 days ended July 9, 2013 and the years ended December 31, 2012 and 2011 , respectively.

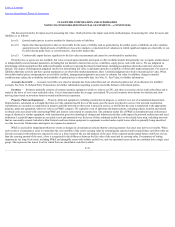

Operating Leases — We have operating leases for spectrum licenses, towers and certain facilities, and equipment for use in our operations. Certain of our

spectrum licenses are leased from third-party holders of Educational Broadband Service, which we refer to as EBS, spectrum licenses granted by the FCC. EBS

licenses authorize the provision of certain communications services on the EBS channels in certain markets throughout the United States. We account for these

spectrum leases as executory contracts which are similar to operating leases. Signed leases which have unmet conditions required to become effective are not

amortized until such conditions are met and are included in spectrum licenses in the accompanying consolidated balance sheets, if such leases require upfront

payments. For leases containing scheduled rent escalation clauses, we record minimum rental payments on a straight-line basis over the term of the lease, including

the expected renewal periods as appropriate. For leases containing tenant improvement allowances and rent incentives, we record deferred rent, which is classified

as a liability, and that deferred rent is amortized over the term of the lease, including the expected renewal periods as appropriate, as a reduction to rent expense.

We periodically terminate unutilized tower leases, or when early termination is not available under the terms of the lease, we advise our landlords of our

intention not to renew. At the time we notify our landlords of our intention not to renew, we recognize a cease-to-use tower lease liability based on the remaining

lease rentals adjusted for any prepaid or deferred rent recognized under the lease, reduced by estimated sublease rentals, if any, that could be reasonably obtained

for the property.

Discontinued Operations — As a result of a strategic decision to focus investment in the United States market, during the second quarter of 2011, we

committed to sell our operations in Belgium, Germany and Spain. These businesses comprised substantially all of the remaining operations previously reported in

our International segment. During the year ended December 31, 2012, we completed the sale of operations in Germany, Belgium and

F-81