American Airlines 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

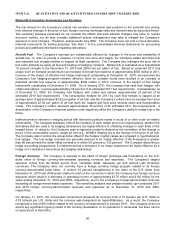

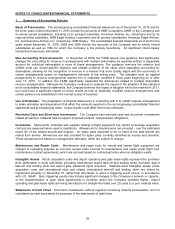

Interest The Company’s earnings are also affected by changes in interest rates due to the impact those

changes have on its interest income from cash and short-term investments, and its interest expense from

variable-rate debt instruments. The Company’s largest exposure with respect to variable rate debt comes from

changes in the London Interbank Offered Rate (LIBOR). The Company had variable rate debt instruments

representing approximately 23 percent of its total long-term debt at December 31, 2010 and 2009. If the

Company’s interest rates average 10 percent more in 2011 than they did at December 31, 2010, the Company’s

interest expense would increase by approximately $7 million and interest income from cash and short-term

investments would increase by approximately $3 million. In comparison, at December 31, 2009, the Company

estimated that if interest rates averaged 10 percent more in 2010 than they did at December 31, 2009, the

Company’s interest expense would have increased by approximately $8 million and interest income from cash

and short-term investments would have increased by approximately $1 million. These amounts are determined

by considering the impact of the hypothetical interest rates on the Company’s variable rate long-term debt and

cash and short-term investment balances at December 31, 2010 and 2009.

Market risk for fixed rate long-term debt is estimated as the potential increase in fair value resulting from a

hypothetical 10 percent decrease in interest rates and amounts to approximately $237 million and $316 million as

of December 31, 2010 and 2009, respectively. The fair values of the Company’s long-term debt were estimated

using quoted market prices or discounted future cash flows based on the Company’s incremental borrowing rates

for similar types of borrowing arrangements.