American Airlines 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

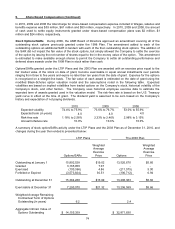

9. Share Based Compensation (Continued)

In 2010, 2009 and 2008 the total charge for share-based compensation expense included in Wages, salaries and

benefits expense was $53 million, $61 million and $53 million, respectively. In 2010, 2009 and 2008, the amount

of cash used to settle equity instruments granted under share-based compensation plans was $2 million, $1

million and $24 million, respectively.

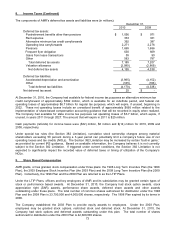

Stock Options/SARs During 2006, the AMR Board of Directors approved an amendment covering all of the

outstanding stock options previously granted under the 1998 Plan. The amendment added to each of the

outstanding options an additional SAR in tandem with each of the then outstanding stock options. The addition of

the SAR did not impact the fair value of the stock options, but simply allowed the Company to settle the exercise

of the option by issuing the net number of shares equal to the in-the-money value of the option. This amendment

is estimated to make available enough shares to permit the Company to settle all outstanding performance and

deferred share awards under the 1998 Plan in stock rather than cash.

Options/SARs granted under the LTIP Plans and the 2003 Plan are awarded with an exercise price equal to the

fair market value of the stock on date of grant, become exercisable in equal annual installments over periods

ranging from three to five years and expire no later than ten years from the date of grant. Expense for the options

is recognized on a straight-line basis. The fair value of each award is estimated on the date of grant using the

modified Black-Scholes option valuation model and the assumptions noted in the following table. Expected

volatilities are based on implied volatilities from traded options on the Company’s stock, historical volatility of the

Company’s stock, and other factors. The Company uses historical employee exercise data to estimate the

expected term of awards granted used in the valuation model. The risk-free rate is based on the U.S. Treasury

yield curve in effect at the time of grant. The dividend yield is assumed to be zero based on the Company’s

history and expectation of not paying dividends.

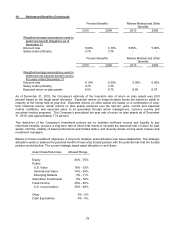

2010

2009

2008

Expected volatility

74.4% to 75.9%

73.6% to 76.7%

53.0% to 55.9%

Expected term (in years)

4.0

4.0

4.0

Risk-free rate

1.18% to 2.58%

2.33% to 2.46%

2.98% to 3.15%

Annual forfeiture rate

10.0%

10.0%

10.0%

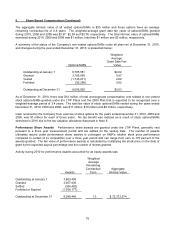

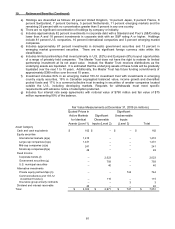

A summary of stock option/SARs activity under the LTIP Plans and the 2003 Plan as of December 31, 2010, and

changes during the year then ended is presented below:

LTIP Plans

The 2003 Plan

Options/SARs

Weighted

Average

Exercise

Price

Options

Weighted

Average

Exercise

Price

Outstanding at January 1

15,892,528

$19.02

13,526,670

$5.66

Granted

3,165,950

7.07

-

-

Exercised

(100,366)

4.86

(211,575)

5.00

Forfeited or Expired

(3,573,824)

30.51

(106,712)

6.94

Outstanding at December 31

15,384,288

$13.99

13,208,383

$5.66

Exercisable at December 31

7,290,070

$21.32

13,206,599

$5.66

Weighted Average Remaining

Contractual Term of Options

Outstanding (in years)

6.2

2.4

Aggregate

Intrinsic Value of

Options Outstanding

$ 14,155,359

$ 32,871,830