American Airlines 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

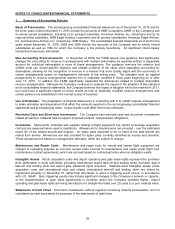

58

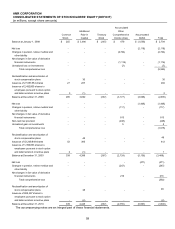

AMR CORPORATION

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT)

(in millions, except share amounts)

Common

Stock

Additional

Paid-

in

Capital

Treasury

Stock

Accumulated

Other

Comprehensive

Income (loss)

Accumulated

Deficit

Total

Balance at January 1, 2008

$ 255

$ 3,696

$ (367)

$ 670

$ (1,550)

$ 2,704

Net loss

-

-

-

-

(2,118)

(2,118)

Changes in pension, retiree medical and

other liability

-

-

-

(2,724)

-

(2,724)

Net changes in fair value of derivative

financial instruments

-

-

-

(1,116)

-

(1,116)

Unrealized loss on investments

-

-

-

(7)

-

(7)

Total comprehensive loss

(5,965)

Reclassification and amortization of

stock compensation plans

-

30

-

-

-

30

Issuance of 27,057,554 shares

27

267

-

-

-

294

Issuance of 2,492,860 shares to

employees pursuant to stock option

and deferred stock incentive plans

3

(1)

-

-

-

2

Balance at December 31, 2008

285

3,992

(367)

(3,177)

(3,668)

(2,935)

Net loss

-

-

-

-

(1,468)

(1,468)

Changes in pension, retiree medical and

other liability

-

-

-

(117)

-

(117)

Net changes in fair value of derivative

financial instruments

-

-

-

813

-

813

Non-cash tax provision

-

-

-

(248)

-

(248)

Unrealized gain on investments

-

-

-

5

-

5

Total comprehensive loss

(1,015)

Reclassification and

amortization of

stock compensation plans

-

48

-

-

-

48

Issuance of 52,269,849 shares

52

360

-

-

-

412

Issuance of 1,399,833 shares to

employees pursuant to stock option

and deferred stock incentive plans

2

(1)

-

-

-

1

Balance at December 31, 2009

339

4,399

(367)

(2,724)

(5,136)

(3,489)

Net loss

-

-

-

-

(471)

(471)

Changes in pension, retiree medical and

other liability

-

-

-

(247)

-

(2

47)

Net changes in fair value of derivative

financial instruments

-

-

-

216

-

216

Total comprehensive loss

(502)

Reclassification and amortization of

stock compensation plans

-

48

-

-

-

48

Issuance

of 825,397 shares to

employees

pursuant to stock option

and deferred stock incentive plans

-

(2)

-

-

-

(2)

Balance at December 31, 2010

339

4,445

(367)

(2,755)

(5,607)

(3,945)

The accompanying notes are an integral part of these financial statements.