American Airlines 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

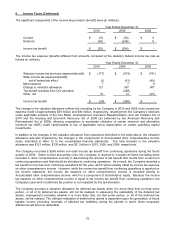

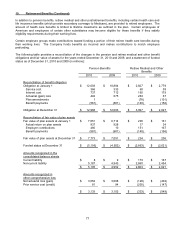

8. Income Taxes (Continued)

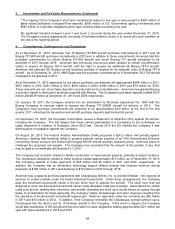

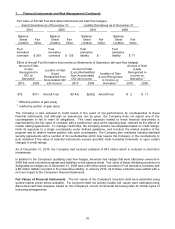

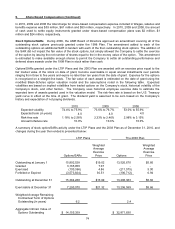

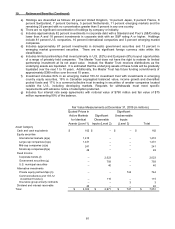

The components of AMR's deferred tax assets and liabilities were (in millions):

December 31,

2010

2009

Deferred tax assets:

Postretirement benefits other than pensions

$ 1,056

$ 971

Rent expense

333

331

Alternative minimum tax credit carryforwards

392

397

Operating loss carryforwards

2,271

2,276

Pensions

1,865

1,686

Frequent flyer obligation

630

669

Gains from lease transactions

55

90

Other

583

787

Total deferred tax assets

7,185

7,207

Valuation allowance

(2,990)

(2,869)

Net deferred tax assets

4,195

4,338

Deferred tax liabilities:

Accelerated depreciation and amortization

(3,985)

(4,152)

Other

(185)

(186)

Total deferred tax liabilities

(4,170)

(4,338)

Net deferred tax asset

$ 25

$ -

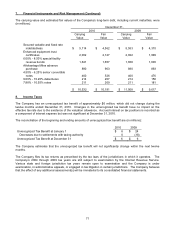

At December 31, 2010, the Company had available for federal income tax purposes an alternative minimum tax

credit carryforward of approximately $392 million, which is available for an indefinite period, and federal net

operating losses of approximately $6.7 billion for regular tax purposes, which will expire, if unused, beginning in

2022. These net operating losses include an unrealized benefit of approximately $666 million related to the

implementation of share-based compensation accounting guidance that will be recorded in equity when realized.

The Company had available for state income tax purposes net operating losses of $3.7 billion, which expire, if

unused, in years 2011 through 2027. The amount that will expire in 2011 is $25 million.

Cash payments (refunds) for income taxes were ($32) million, $6 million and $(14) million for 2010, 2009 and

2008, respectively.

Under special tax rules (the Section 382 Limitation), cumulative stock ownership changes among material

shareholders exceeding 50 percent during a 3-year period can potentially limit a company’s future use of net

operating losses and tax credits (NOLs). The Section 382 Limitation may be increased by certain “built-in gains,”

as provided by current IRS guidance. Based on available information, the Company believes it is not currently

subject to the Section 382 Limitation. If triggered under current conditions, the Section 382 Limitation is not

expected to significantly impact the recorded value of deferred taxes or timing of utilization of the Company’s

NOLs.

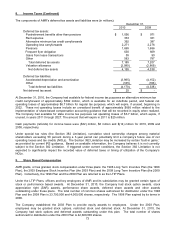

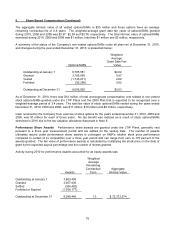

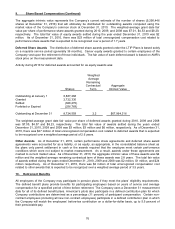

9. Share Based Compensation

AMR grants, or has granted, stock compensation under three plans: the 1998 Long Term Incentive Plan (the 1998

Plan), the 2003 Employee Stock Incentive Plan (the 2003 Plan) and the 2009 Long Term Incentive Plan (the 2009

Plan). Collectively, the 1998 Plan and the 2009 Plan are referred to as the LTIP Plans.

Under the LTIP Plans, officers and key employees of AMR and its subsidiaries may be granted certain types of

stock or performance based awards. At December 31, 2010, the Company had stock option awards, stock

appreciation right (SAR) awards, performance share awards, deferred share awards and other awards

outstanding under these plans. The total number of common shares authorized for distribution under the 1998

Plan and the 2009 Plan is 23,700,000 and 4,000,000 shares, respectively. The 1998 Plan expired by its terms in

2008.

The Company established the 2003 Plan to provide equity awards to employees. Under the 2003 Plan,

employees may be granted stock options, restricted stock and deferred stock. At December 31, 2010, the

Company had stock options and deferred awards outstanding under this plan. The total number of shares

authorized for distribution under the 2003 Plan is 42,680,000 shares.