Charter 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Charter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

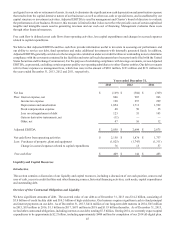

from Charter Holdco. In assessing the realizability of deferred tax assets, management considers whether it is more likely than

not that some portion or all of the deferred tax assets will be realized. Due to our history of losses and limitations imposed by

Section 382 of the Code discussed above, we were unable to assume future taxable income in our analysis and accordingly valuation

allowances have been established except for deferred benefits available to offset certain deferred tax liabilities that will reverse

over time. Accordingly, our gross deferred tax assets have been offset with a corresponding valuation allowance of $3.0 billion

and $2.9 billion at December 31, 2013 and 2012, respectively. The amount of the deferred tax assets considered realizable and,

therefore, reflected in the consolidated balance sheet, would be increased at such time that it is more-likely-than-not future taxable

income will be realized during the carryforward period. At the time this consideration is met, an adjustment to reverse some

portion of the existing valuation allowance would result.

In determining our tax provision for financial reporting purposes, Charter establishes a reserve for uncertain tax positions unless

such positions are determined to be “more likely than not” of being sustained upon examination, based on their technical merits.

In evaluating whether a tax position has met the more-likely-than-not recognition threshold, we presume the position will be

examined by the appropriate taxing authority that has full knowledge of all relevant information. A tax position that meets the

more-likely-than-not recognition threshold is measured to determine the amount of benefit to be recognized in our financial

statements. The tax position is measured as the largest amount of benefit that has a greater than 50% likelihood of being realized

when the position is ultimately resolved. There is considerable judgment involved in determining whether positions taken on the

tax return are “more likely than not” of being sustained. As of December 31, 2012, we had $202 million of liabilities for uncertain

tax positions. As of December 31, 2013, liabilities for uncertain tax positions were reduced to zero.

Charter adjusts its uncertain tax reserve estimates periodically because of ongoing examinations by, and settlements with, the

various taxing authorities, as well as changes in tax laws, regulations and interpretations.

No tax years for Charter or Charter Holdco, for income tax purposes, are currently under examination by the Internal Revenue

Service. Tax years ending 2010 through 2013 remain subject to examination and assessment. Years prior to 2010 remain open

solely for purposes of examination of Charter’s net operating loss and credit carryforwards.

Litigation

Legal contingencies have a high degree of uncertainty. When a loss from a contingency becomes estimable and probable, a reserve

is established. The reserve reflects management's best estimate of the probable cost of ultimate resolution of the matter and is

revised as facts and circumstances change. A reserve is released when a matter is ultimately brought to closure or the statute of

limitations lapses. We have established reserves for certain matters. Although certain matters are not expected individually to

have a material adverse effect on our consolidated financial condition, results of operations or liquidity, such matters could have,

in the aggregate, a material adverse effect on our consolidated financial condition, results of operations or liquidity.

Programming Agreements

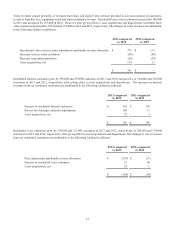

We exercise significant judgment in estimating programming expense associated with certain video programming contracts. Our

policy is to record video programming costs based on our contractual agreements with our programming vendors, which are

generally multi-year agreements that provide for us to make payments to the programming vendors at agreed upon market rates

based on the number of customers to which we provide the programming service. If a programming contract expires prior to the

parties' entry into a new agreement and we continue to distribute the service, we estimate the programming costs during the period

there is no contract in place. In doing so, we consider the previous contractual rates, inflation and the status of the negotiations in

determining our estimates. When the programming contract terms are finalized, an adjustment to programming expense is recorded,

if necessary, to reflect the terms of the new contract. We also make estimates in the recognition of programming expense related

to other items, such as the accounting for free periods, timing of rate increases and credits from service interruptions, as well as

the allocation of consideration exchanged between the parties in multiple-element transactions.

Significant judgment is also involved when we enter into agreements that result in us receiving cash consideration from the

programming vendor, usually in the form of advertising sales, channel positioning fees, launch support or marketing support. In

these situations, we must determine based upon facts and circumstances if such cash consideration should be recorded as revenue,

a reduction in programming expense or a reduction in another expense category (e.g., marketing).