Charter 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Charter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

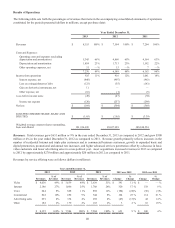

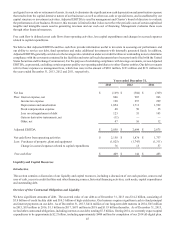

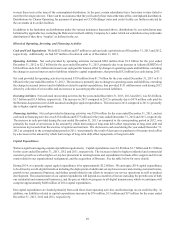

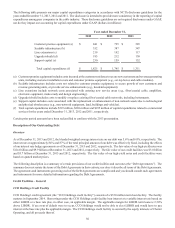

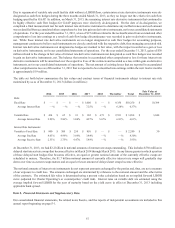

The following table presents our major capital expenditures categories in accordance with NCTA disclosure guidelines for the

years ended December 31, 2013, 2012 and 2011. The disclosure is intended to provide more consistency in the reporting of capital

expenditures among peer companies in the cable industry. These disclosure guidelines are not required disclosures under GAAP,

nor do they impact our accounting for capital expenditures under GAAP (dollars in millions):

Year ended December 31,

2013 2012 2011

Customer premise equipment (a) $ 841 $ 795 $ 585

Scalable infrastructure (b) 352 387 347

Line extensions (c) 219 192 117

Upgrade/rebuild (d) 183 212 130

Support capital (e) 230 159 132

Total capital expenditures (f) $ 1,825 $ 1,745 $ 1,311

(a) Customer premise equipment includes costs incurred at the customer residence to secure new customers and revenue generating

units, including customer installation costs and customer premise equipment (e.g., set-top boxes and cable modems).

(b) Scalable infrastructure includes costs not related to customer premise equipment, to secure growth of new customers and

revenue generating units, or provide service enhancements (e.g., headend equipment).

(c) Line extensions include network costs associated with entering new service areas (e.g., fiber/coaxial cable, amplifiers,

electronic equipment, make-ready and design engineering).

(d) Upgrade/rebuild includes costs to modify or replace existing fiber/coaxial cable networks, including betterments.

(e) Support capital includes costs associated with the replacement or enhancement of non-network assets due to technological

and physical obsolescence (e.g., non-network equipment, land, buildings and vehicles).

(f) Total capital expenditures include $319 million, $269 million and $195 million of capital expenditures related to commercial

services for the years ended December 31, 2013, 2012 and 2011, respectively.

Certain prior period amounts have been reclassified to conform with the 2013 presentation.

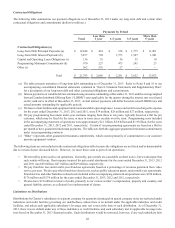

Description of Our Outstanding Debt

Overview

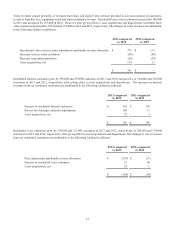

As of December 31, 2013 and 2012, the blended weighted average interest rate on our debt was 5.6% and 6.0%, respectively. The

interest rate on approximately 84% and 87% of the total principal amount of our debt was effectively fixed, including the effects

of our interest rate hedge agreements as of December 31, 2013 and 2012, respectively. The fair value of our high-yield notes was

$10.4 billion and $9.9 billion at December 31, 2013 and 2012, respectively. The fair value of our credit facilities was $3.8 billion

and $3.7 billion at December 31, 2013 and 2012, respectively. The fair value of our high-yield notes and credit facilities were

based on quoted market prices.

The following description is a summary of certain provisions of our credit facilities and our notes (the “Debt Agreements”). The

summary does not restate the terms of the Debt Agreements in their entirety, nor does it describe all terms of the Debt Agreements.

The agreements and instruments governing each of the Debt Agreements are complicated and you should consult such agreements

and instruments for more detailed information regarding the Debt Agreements.

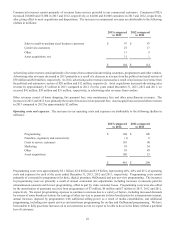

Credit Facilities – General

CCO Holdings Credit Facility

CCO Holdings' credit agreement (the “CCO Holdings credit facility”) consists of a $350 million term loan facility. The facility

matures in September 2014. Borrowings under the CCO Holdings credit facility bear interest at a variable interest rate based on

either LIBOR or a base rate plus, in either case, an applicable margin. The applicable margin for LIBOR term loans is 2.50%

above LIBOR. If an event of default were to occur, CCO Holdings would not be able to elect LIBOR and would have to pay

interest at the base rate plus the applicable margin. The CCO Holdings credit facility is secured by the equity interests of Charter

Operating, and all proceeds thereof.