Coca Cola 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Coca Cola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20FEB200406462039

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

፤ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2004

OR

អTRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File No. 1-2217

(Exact name of Registrant as specified in its charter)

DELAWARE 58-0628465

(State or other jurisdiction of (IRS Employer

incorporation or organization) Identification No.)

One Coca-Cola Plaza

Atlanta, Georgia 30313

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (404) 676-2121

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

COMMON STOCK, $0.25 PAR VALUE NEW YORK STOCK EXCHANGE

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of

the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements

for the past 90 days. Yes ፤No អ

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained

herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. អ

Indicate by check mark whether the Registrant is an accelerated filer (as defined in Rule 12b-2 of the Act).

Yes ፤No អ

The aggregate market value of the common equity held by non-affiliates of the Registrant (assuming for these

purposes, but without conceding, that all executive officers and Directors are ‘‘affiliates’’ of the Registrant) as of June 30,

2004, was $105,498,951,553 (based on the closing sale price of the Registrant’s Common Stock on that date as reported on

the New York Stock Exchange).

The number of shares outstanding of the Registrant’s Common Stock as of February 28, 2005 was 2,410,089,440.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s Proxy Statement for the Annual Meeting of Shareowners to be held on April 19, 2005, are

incorporated by reference in Part III.

Table of contents

-

Page 1

..., that all executive officers and Directors are ''affiliates'' of the Registrant) as of June 30, 2004, was $105,498,951,553 (based on the closing sale price of the Registrant's Common Stock on that date as reported on the New York Stock Exchange). The number of shares outstanding of the Registrant... -

Page 2

...Executive Officers of the Company ...Security Holders ...1 13 13 17 17 Part II Item 5. Item Item Item Item Item Item Item 6. 7. 7A. 8. 9. 9A. 9B. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities ...Selected Financial Data ...Management... -

Page 3

... to as strategic business units: • North America • Africa • Asia • Europe, Eurasia and Middle East • Latin America • Corporate. This structure is the basis for our Company's internal financial reporting. The North America operating segment includes the United States, Canada and Puerto... -

Page 4

... Corporate operating segment. At the date of this report, the heads of the strategic business units are as follows: Donald R. Knauss (North America), Alexander B. Cummings, Jr. (Africa), Mary E. Minnick (Asia), A.R.C. ''Sandy'' Allan (Europe, ´ Octavio Reyes (Latin America). See ''Item X.-Executive... -

Page 5

... Diet Coke (sold under the trademark Coca-Cola Light in many countries other than the United States), caffeine free Diet Coke, Diet Coke with Lemon, Coca-Cola with Lime, Diet Coke with Lime, Vanilla Coke, Diet Vanilla Coke, Cherry Coke, Diet Cherry Coke, Coca-Cola C2, Fanta brand soft drinks, Sprite... -

Page 6

... and products in 2004. Among numerous examples, we introduced Diet Coke with Lime in Australia, New Zealand and North America and Coca-Cola C2 in Japan and North America. In China, we launched Sprite Icy Mint. In Germany, we launched Fanta Citrell, the first mid-calorie soft drink available... -

Page 7

...the terms of the bottling or distribution agreements between our Company and the bottlers. Also, on a discretionary basis in most cases, the Company may develop and introduce new products, packages and equipment to assist its bottlers. Likewise, in many instances we provide promotional and marketing... -

Page 8

... United States, the form of Bottler's Agreement for cola-flavored soft drinks that covers the largest amount of U.S. volume (the ''1987 Contract'') gives us complete flexibility to determine the price and other terms of sale of soft drink concentrates and syrups for cola-flavored Company Trademark... -

Page 9

... sales for our Company's concentrate business. When this occurs, both we and our bottling partners benefit from long-term growth in volume, improved cash flows and increased shareowner value. The level of our investment generally depends on the bottler's capital structure and its available resources... -

Page 10

...programs and assist in the development of the bottler's business and information systems and the establishment of appropriate capital structures. In line with our long-term bottling strategy, we may periodically consider options for reducing our ownership interest in a bottler. One such option is to... -

Page 11

...Club trademarks. ready-to-drink coffee products primarily under the Nescafe In July 2002, our Company and Danone Waters of North America, Inc. (''DWNA'') formed a new company, CCDA, for the production, marketing and distribution of DWNA's bottled spring and source water business in the United States... -

Page 12

...to fluctuations in its market price. Our Company generally has not experienced any difficulties in obtaining its requirements for sweeteners. In the United States we purchase our requirements of high-fructose corn syrup with the assistance of Coca-Cola Bottlers' Sales & Services Company LLC (''CCBSS... -

Page 13

... report as ''technology.'' This technology generally relates to our Company's products and the processes for their production; the packages used for our products; the design and operation of various processes and equipment used in our business; and certain quality assurance and financial software... -

Page 14

... material adverse effect on our Company's capital expenditures, net income or competitive position. Employees As of December 31, 2004, our Company employed approximately 50,000 persons, compared to approximately 49,000 at the end of 2003. The increase in the number of employees was primarily due to... -

Page 15

... Our worldwide headquarters is located on a 35-acre office complex in Atlanta, Georgia. The complex includes the approximately 621,000 square foot headquarters building, the approximately 870,000 square foot Coca-Cola North America building and the approximately 264,000 square foot Coca-Cola Plaza... -

Page 16

...costs, expenses and settlements incurred by Aqua-Chem to date in connection with such claims. The Company owned Aqua-Chem from 1970 to 1981. During that time, the Company purchased over $400 million of insurance coverage of which $350 million is still available to cover Aqua-Chem for certain product... -

Page 17

... legal and factual arguments supporting the position that the insurance policies at issue provide coverage for the asbestos-related claims against Aqua-Chem, and both the Company and Aqua-Chem have asserted these arguments in response to the complaint. Since 1999, the Competition Directorate... -

Page 18

... for frozen Coke products conducted by one of the Company's customers, improper accounting treatment in connection with the purchase of certain fountain dispensing equipment and marketing allowances, and false or misleading statements or omissions in connection with the reporting of sales volume. On... -

Page 19

... President of the North American Division within the North America strategic business unit. Mr. Douglas was elected to his current position in February 2003. Gary P. Fayard, 52, is Executive Vice President and Chief Financial Officer of the Company. Mr. Fayard joined the Company in April 1994... -

Page 20

...of Directors and Chief Executive Officer of the Company. Mr. Isdell joined the Coca-Cola system in 1966 with the local bottling company in Zambia. In 1972, he became General Manager of Coca-Cola Bottling of Johannesburg, the largest Coca-Cola bottler in South Africa at the time. Mr. Isdell was named... -

Page 21

...Chief Operating ´xico as Officer, Latin America. He began his career with The Coca-Cola Company in 1980 at Coca-Cola de Me Manager of Strategic Planning. In 1987, he was Manager of the Sprite and Diet Coke brands at Corporate Headquarters. In 1990, he was appointed Marketing Director for the Brazil... -

Page 22

PART II ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES In the United States, the Company's common stock is listed and traded on the New York Stock Exchange (the principal market for our common stock) and is traded on the ... -

Page 23

... of the Company as defined in Rule 10b-18(a)(3) under the Exchange Act. Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs2 Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs Period Total Number of Shares Purchased1 Average Price Paid Per... -

Page 24

ITEM 6. SELECTED FINANCIAL DATA The Coca-Cola Company and Subsidiaries Compound Growth Rates (In millions except per share data and growth rates) 5 Years 10 Years Year Ended December 31, 20042 20033 SUMMARY OF OPERATIONS Net operating revenues Cost of goods sold Gross profit Selling, general and ... -

Page 25

The Coca-Cola Company and Subsidiaries 20024,5 20016 19987 19977 19967 19957 19947,8 2000 1999 $ 19,...Assets.'' In 2002, we adopted the fair value method provisions of SFAS No. 123, ''Accounting for Stock-Based Compensation,'' and we adopted SFAS No. 148, ''Accounting for Stock-Based Compensation... -

Page 26

...Cola, which is recognized as the world's most valuable brand, we market four of the world's top five soft-drink brands, including Diet Coke, Fanta and Sprite. We provide a wide variety of nonalcoholic beverages, including carbonated soft drinks, juices and juice drinks, sports drinks, water products... -

Page 27

... the purchase of cold-drink equipment; and our consumers with coupons, discounts and promotional incentives. These marketing expenditures help to enhance awareness of and increase consumer preference for our brands. We believe that greater awareness and preference promotes long-term growth in unit... -

Page 28

... ensure that our family of brands is selectively and profitably expanded to address these changing preferences. In every market we must focus on the financial health of the entire Coca-Cola system. We must look for new opportunities with each customer and allocate resources to maximize the impact on... -

Page 29

...chain management companies to help increase procurement efficiencies and centralize production and logistics operations in North America, Japan and China. In 2004, the Coca-Cola system began to realize some of the benefits from these initiatives. Lowering supply chain costs improves system economics... -

Page 30

... in diets and health in both developed and developing countries around the world. This effort may lead to the creation of new beverage products by the Company in addition to providing health and nutrition education. Water Quality and Quantity. Water quality and quantity is an issue that increasingly... -

Page 31

... Company maintains debt levels we consider prudent based on our cash flow, interest coverage ratio and percentage of debt to capital. We use debt financing to lower our overall cost of capital, which increases our return on shareowners' equity. As of December 31, 2004, our long-term debt was rated... -

Page 32

... We monitor our mix of fixed-rate and variable-rate debt, as well as our mix of term debt versus nonterm debt. This monitoring includes a review of business and other financial risks as noted above. We also enter into interest rate swap agreements to manage these risks. Value at Risk. We monitor our... -

Page 33

... of Coca-Cola Erfrischungsgetraenke AG (''CCEAG''), the largest bottler of the Company's beverage products in Germany. Under our policy, we concluded that CCEAG should be consolidated in our consolidated financial statements. Prior to February 2002, our Company accounted for CCEAG under the equity... -

Page 34

... that indicate carrying value may not be recoverable: Equity method investments Cost method investments, principally bottling companies Other assets Property, plant and equipment, net Amortized intangible assets, net (various, principally trademarks) Total Tested for impairment at least annually or... -

Page 35

...Africa where local economic and political conditions are unstable. In many of these markets, the Company has bottling assets and investments. The list below reflects the Company's carrying value of noncurrent assets which, by nature, involve inherent risks not relevant to assets located in developed... -

Page 36

... closing prices of publicly traded shares, and our Company's carrying values for significant publicly traded bottlers accounted for as equity method investees (in millions): December 31, 2004 Fair Value Carrying Value Difference Coca-Cola Enterprises Inc. Coca-Cola FEMSA, S.A. de C.V. Coca-Cola... -

Page 37

... cash flow analyses, estimates of sales proceeds and independent appraisals. Where applicable, we use an appropriate discount rate, based on the Company's cost of capital rate or location-specific economic factors. In 2004, our Company recorded impairment charges related to intangible assets... -

Page 38

... in prior carry-back years (if permitted) and the availability of tax planning strategies. A valuation allowance is required to be established unless management determines that it is more likely than not that the Company will ultimately realize the tax benefit associated with a deferred tax asset... -

Page 39

... of loss for such contingencies and accrues a liability and/or discloses the relevant circumstances, as appropriate. Management believes that any liability to the Company that may arise as a result of currently pending legal proceedings will not have a material adverse effect on the financial... -

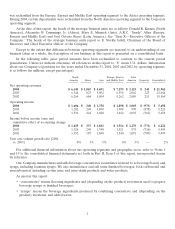

Page 40

Operations Review Analysis of Consolidated Statements of Income Percent Change Year Ended December 31, (In millions except per share data and percentages) 2004 2003 2002 04 vs. 03 03 vs. 02 NET OPERATING REVENUES Cost of goods sold GROSS PROFIT GROSS PROFIT MARGIN Selling, general and ... -

Page 41

... environment in Germany, refer to the heading ''Application of Critical Accounting Policies- Goodwill, Trademarks and Other Intangible Assets.'' Our Company is evaluating our strategies for the German operations, including addressing significant structural issues that limit the system's ability to... -

Page 42

... a long-term license agreement involving Seagram's mixers, a carbonated line of drinks. In the third quarter of 2002, our Company and DWNA formed a new joint venture company, CCDA, for the production, marketing and distribution of DWNA's bottled spring and source water business in the United States... -

Page 43

... marketing activities, such as the launch of new products in North America and Japan. Additionally, general and administrative expenses increased due to higher legal expenses, asset write-offs and structural changes. Finally, we received a $75 million insurance settlement related to the class-action... -

Page 44

... in North America and Germany. In North America, the Company integrated the operations of three separate North American business units- Coca-Cola North America, The Minute Maid Company and Coca-Cola Fountain. In Germany, CCEAG took steps to improve its efficiency in sales, distribution and... -

Page 45

... margins compared to concentrate and syrup operations. Refer to the heading ''Operations Review-Net Operating Revenues.'' • In 2004, operating income in the Corporate operating segment increased by $75 million due to the receipt of an insurance settlement related to the class-action lawsuit... -

Page 46

... exchange of similar productive assets, and no gain was recorded by our Company as a result of this merger. In connection with the merger, Coca-Cola FEMSA management initiated steps to streamline and integrate the operations. This process included the closing of various distribution centers... -

Page 47

... line item in 2003 primarily consisted of foreign exchange losses of $76 million and accretion of $51 million for the discounted value of our liability to purchase CCEAG shares. Gains on Issuances of Stock by Equity Method Investees When one of our equity method investees issues additional shares... -

Page 48

...-ounce servings). Unit case volume represents the number of unit cases of licensed beverage products directly or indirectly sold by the Coca-Cola system to customers. Unit case volume is derived based on estimates supplied by our bottling partners and distributors. Gallon sales and unit case volume... -

Page 49

...of price increases and new product introductions can create differences between gallon sales and unit case volume. Although most of our Company's revenues are not based directly on unit case volume, we believe unit case volume is one of the measures of the underlying strength of the Coca-Cola system... -

Page 50

... strong growth in South Africa. Trademark Coca-Cola increased by 11 percent during the year in South Africa as a result of continued rollout of the ''Real'' campaign, a successful summer promotion and strong marketplace execution. In the North and West Africa Division, unit case volume increased by... -

Page 51

... equipment accounted for the most significant cash outlays for investing activities in each of the three years ended December 31, 2004. Our Company currently estimates that purchases of property, plant and equipment in 2005 will be less than $1 billion. Total capital expenditures for property, plant... -

Page 52

... million of long-term debt. Our Company's total net increase in debt was primarily due to meeting our short-term cash needs in the United States, as a majority of our cash is currently being held in locations outside of the United States. Refer to the heading ''Operations Review-Interest Income and... -

Page 53

...common stock under the 1996 Plan. As strong cash flows are expected to continue in the future, the Company currently expects to increase its 2005 share repurchase levels to at least $2 billion. Refer to the heading ''Financial Strategies and Risk Management.'' Dividends have increased every year for... -

Page 54

... present value of our liability to CCEAG shareowners. We will consider several options to settle this liability including cash flows from operations, issuance of commercial paper or issuance of other long-term debt. 2 3 4 5 6 In accordance with SFAS No. 87, ''Employers' Accounting for Pensions... -

Page 55

We fund our U.S. qualified pension plans in accordance with Employee Retirement Income Security Act regulations for the minimum annual required contribution and in accordance with Internal Revenue Service regulations for the maximum annual allowable tax deduction. The minimum required contribution ... -

Page 56

...sale of production assets in Japan with a carrying value of $271 million. Refer to Note 2. • The overall increase in total assets as of December 31, 2004, compared to December 31, 2003, was primarily related to the increase in cash and cash equivalents mentioned above, which impacted the Corporate... -

Page 57

... of increasing costs and to generate sufficient cash flows to maintain our productive capability. Reconciliation of Non-GAAP Financial Measures The MD&A includes certain performance measures and ratios that may be considered ''non-GAAP financial measures'' under SEC rules and regulations. Management... -

Page 58

... cumulative effect of accounting change divided by average shareowners' equity. 2004 2003 2002 Total Debt-to-Total Capital and Net Debt-to-Net Capital Ratios December 31, (In millions except percentages) Total debt at end of period1 Less: Cash and cash equivalents Marketable securities Net debt... -

Page 59

... and obesity concerns, shifting consumer developments and needs, changes in consumer lifestyles and increased consumer information; competitive product and pricing pressures; and our ability to gain or maintain share of sales in the global market as a result of actions by competitors. Factors such... -

Page 60

... pollution and poor management. As demand for water continues to increase around the world and as the quality of the available water deteriorates, our system may incur increasing production costs, which may materially adversely affect our Company's profitability in the long run. • Our ability... -

Page 61

... DISCLOSURES ABOUT MARKET RISK The information called for by this Item is incorporated herein by reference to (i) the information in Item 7 of this report under the heading ''Financial Strategies and Risk Management'' and (ii) Note 10 to the Consolidated Financial Statements included under... -

Page 62

...' Equity ...Notes to Consolidated Financial Statements ...Report of Management on Internal Control Over Financial Reporting ...Report of Independent Registered Public Accounting Firm ...Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting ...Quarterly... -

Page 63

CONSOLIDATED STATEMENTS OF INCOME The Coca-Cola Company and Subsidiaries Year Ended December 31, (In millions except per share data) 2004 2003 2002 NET OPERATING REVENUES Cost of goods sold GROSS PROFIT Selling, general and administrative expenses Other operating charges OPERATING INCOME Interest ... -

Page 64

... cash equivalents Marketable securities Trade accounts receivable, less allowances of $69 in 2004 and $61 in 2003 Inventories Prepaid expenses and other assets TOTAL CURRENT ASSETS INVESTMENTS AND OTHER ASSETS Equity method investments: Coca-Cola Enterprises Inc. Coca-Cola Hellenic Bottling Company... -

Page 65

...TOTAL CURRENT LIABILITIES 10,971 7,886 LONG-TERM DEBT 1,157 2,517 OTHER LIABILITIES 2,814 2,512 DEFERRED INCOME TAXES 450 337 SHAREOWNERS' EQUITY Common stock, $0.25 par value Authorized: 5,600,000,000 shares; issued: 3,500,489,544 shares in 2004 and 3,494,799,258 shares in 2003 Capital... -

Page 66

CONSOLIDATED STATEMENTS OF CASH FLOWS The Coca-Cola Company and Subsidiaries Year Ended December 31, (In millions) 2004 2003 2002 OPERATING ACTIVITIES Net income Depreciation and amortization Stock-based compensation expense Deferred income taxes Equity income (loss), net of dividends Foreign ... -

Page 67

CONSOLIDATED STATEMENTS OF SHAREOWNERS' EQUITY The Coca-Cola Company and Subsidiaries Year Ended December 31, (In millions except per share data) 2004 2003 2002 NUMBER OF COMMON SHARES OUTSTANDING Balance at beginning of year Stock issued to employees exercising stock options Purchases of stock for... -

Page 68

... The Coca-Cola Company and all subsidiaries included in the consolidated financial statements. Operating in more than 200 countries worldwide, we primarily sell our concentrates and syrups, as well as some finished beverages, to bottling and canning operations, distributors, fountain wholesalers and... -

Page 69

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 1: ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) to the economic risks and potential rewards from the variable interest entity's assets and activities are the best evidence of control. If... -

Page 70

... FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 1: ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Revenue Recognition Our Company recognizes revenue when title to our products is transferred to our bottling partners or our customers. Advertising Costs... -

Page 71

... with our bottlers that are directed at strengthening our bottling system and increasing unit case volume. Management periodically evaluates the recoverability of these assets by preparing estimates of sales volume, the resulting gross profit, cash flows and considering other factors. Costs of these... -

Page 72

...reporting unit with its carrying value, including goodwill. Impairment assessments are performed using a variety of methodologies, including cash flow analyses, estimates of sales proceeds and independent appraisals. Where applicable, an appropriate discount rate is used, based on the Company's cost... -

Page 73

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 1: ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) negotiations between affected parties and governmental actions. Management assesses the probability of loss for such contingencies and ... -

Page 74

... FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 1: ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) During 2004, the FASB issued FASB Staff Position 106-2, ''Accounting and Disclosure Requirements Related to the Medicare Prescription Drug, Improvement... -

Page 75

... FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 1: ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) 2005. Our proportionate share of the stock-based compensation expense resulting from the adoption of SFAS No. 123(R) by our equity investees will be recognized... -

Page 76

... to major customers and purchases of bottle and can products. Payments made by us directly to CCE represent support of certain marketing activities and our participation with CCE in cooperative advertising and other marketing activities to promote the sale of Company trademark products within CCE... -

Page 77

.... These minimum average unit case sales volume levels ensure adequate gross profit from sales of concentrate to fully recover the capitalized costs plus a return on the Company's investment. Should CCE fail to purchase the specified numbers of cold-drink equipment for any calendar year through 2010... -

Page 78

... CCE $32 million for product recall costs incurred by CCE. In March 2003, our Company acquired a 100 percent ownership interest in Truesdale Packaging Company LLC (''Truesdale'') from CCE. Refer to Note 18. If valued at the December 31, 2004 quoted closing price of CCE shares, the fair value of our... -

Page 79

... for its share of a favorable tax settlement related to Coca-Cola FEMSA, S.A. de C.V. (''Coca-Cola FEMSA''). In December 2004, the Company sold certain of its production assets to an unrelated financial institution that were previously leased to the Japanese supply chain management company (refer to... -

Page 80

...this supply chain management company in Japan, a portion of our Company's business has essentially been converted from a finished product business model to a concentrate business model, thus reducing our net operating revenues and cost of goods sold. The formation of this entity included the sale of... -

Page 81

... Company sold our bottling operations in the Baltics to Coca-Cola HBC. The proceeds from the sale of the Baltic bottlers were approximately equal to the carrying value of the investment. If valued at the December 31, 2004, quoted closing prices of shares actively traded on stock markets, the value... -

Page 82

... primarily related to a $109 million impairment for certain trademarks in Latin America. In early 1999, our Company formed a strategic partnership to market and distribute such trademarked products. The macroeconomic conditions and lower pricing depressed operating margins for these trademarks. For... -

Page 83

... FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 4: GOODWILL, TRADEMARKS AND OTHER INTANGIBLE ASSETS (Continued) macroeconomic conditions and devaluation of the Argentine peso significantly impacted the valuation of bottlers' franchise rights. The following tables set forth... -

Page 84

... lack of availability for our products in the discount retail channel. The deposit laws in Germany have led to discount chains creating proprietary packages that can only be returned to their own stores. These proprietary packages are continuing to gain market share and customer acceptance. At... -

Page 85

... FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 6: SHORT-TERM BORROWINGS AND CREDIT ARRANGEMENTS (Continued) had $1,614 million in lines of credit and other short-term credit facilities available as of December 31, 2004, of which approximately $296 million was outstanding... -

Page 86

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 8: COMPREHENSIVE INCOME Accumulated other comprehensive income (loss), including our proportionate share of equity method investees' accumulated other comprehensive income (loss), consists of the following (in ... -

Page 87

... FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 9: FINANCIAL INSTRUMENTS Fair Value of Financial Instruments The carrying amounts reflected in our consolidated balance sheets for cash and cash equivalents, non-marketable cost method investments, trade accounts receivable... -

Page 88

...STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 9: FINANCIAL INSTRUMENTS (Continued) On December 31, 2004 and 2003, available-for-sale and held-to-maturity securities consisted of the following (in millions): Gross Unrealized December 31, Cost Gains Losses Estimated Fair Value 2004 Available... -

Page 89

... rates and foreign exchange rates and, to a lesser extent, in commodity prices and other market risks. When entered into, the Company formally designates and documents the financial instrument as a hedge of a specific underlying exposure, as well as the risk management objectives and strategies... -

Page 90

... minimal. Interest Rate Management Our Company monitors our mix of fixed rate and variable rate debt, as well as our mix of term debt versus non-term debt. This monitoring includes a review of business and other financial risks. We also enter into interest rate swap agreements to manage these risks... -

Page 91

...Cola Company and Subsidiaries NOTE 10: HEDGING TRANSACTIONS AND DERIVATIVE FINANCIAL INSTRUMENTS (Continued) Foreign Currency Management The purpose of our foreign currency hedging activities is to reduce the risk that our eventual U.S. dollar net cash inflows resulting from sales outside the United... -

Page 92

...STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 10: HEDGING TRANSACTIONS AND DERIVATIVE FINANCIAL INSTRUMENTS (Continued) The following table summarizes activity in AOCI related to derivatives designated as cash flow hedges held by the Company during the applicable periods (in millions): Year... -

Page 93

... Coca-Cola Company and Subsidiaries NOTE 10: HEDGING TRANSACTIONS AND DERIVATIVE FINANCIAL INSTRUMENTS (Continued) The following table presents the fair values, carrying values and maturities of the Company's foreign currency derivative instruments outstanding (in millions): Carrying Values Assets... -

Page 94

... will potentially apply in 27 countries and in all channels of distribution where our carbonated soft drinks account for over 40 percent of national sales and twice the nearest competitor's share. It will take more than 12 months to fully implement the Undertaking and for the market to react to any... -

Page 95

.... The French Competition Directorate has also initiated an inquiry into commercial practices related to the soft drink sector in France. This inquiry has been conducted through visits to the offices of the Company; however, no conclusions have been communicated to the Company by the Directorate. At... -

Page 96

... to be issued or transferred to certain officers and employees pursuant to stock options granted under the 1991 Option Plan. Options to purchase common stock under the 1991 Option Plan have been granted to Company employees at fair market value at the date of grant. The 1999 Stock Option Plan (the... -

Page 97

... the market price and the option price. No stock appreciation rights have been issued under the 2002 Stock Option Plan as of December 31, 2004. Options to purchase common stock under the 2002 Option Plan have been granted to Company employees at fair market value at the date of grant. Stock options... -

Page 98

... FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 13: RESTRICTED STOCK, STOCK OPTIONS AND OTHER STOCK PLANS (Continued) The following table summarizes information about stock options at December 31, 2004 (shares in millions): Outstanding Stock Options Weighted-Average Remaining... -

Page 99

... FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 13: RESTRICTED STOCK, STOCK OPTIONS AND OTHER STOCK PLANS (Continued) Time-Based Restricted Stock Awards The following table summarizes information about time-based restricted stock awards: Number of Shares 2004 2003 2002 Outstanding... -

Page 100

... FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 13: RESTRICTED STOCK, STOCK OPTIONS AND OTHER STOCK PLANS (Continued) Performance Share Unit Awards In 2003, the Company modified its use of performance-based awards and established a program to grant performance share unit awards... -

Page 101

... TO CONSOLIDATED FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 14: PENSION AND OTHER POSTRETIREMENT BENEFIT PLANS Our Company sponsors and/or contributes to pension and postretirement health care and life insurance benefit plans covering substantially all U.S. employees. We also... -

Page 102

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 14: PENSION AND OTHER POSTRETIREMENT BENEFIT PLANS (Continued) The following table sets forth the change in the fair value of plan assets for our benefit plans (in millions): Pension Benefits December 31, 2004 1 ... -

Page 103

... The weighted-average assumptions used in computing net periodic benefit cost are as follows: Pension Benefits Year Ended December 31, 2004 2003 2002 Other Benefits 2004 2003 2002 Discount rate1 Rate of increase in compensation levels Expected long-term rate of return on plan assets 1 6% 6% 61... -

Page 104

... FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 14: PENSION AND OTHER POSTRETIREMENT BENEFIT PLANS (Continued) The assumed health care cost trend rates are as follows: December 31, 2004 2003 Health care cost trend rate assumed for next year Rate to which the cost trend rate... -

Page 105

...FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 14: PENSION AND OTHER POSTRETIREMENT BENEFIT PLANS (Continued) Asset allocation targets promote optimal expected return and volatility characteristics given the long-term time horizon for fulfilling the obligations of the pension plans... -

Page 106

... TO CONSOLIDATED FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 14: PENSION AND OTHER POSTRETIREMENT BENEFIT PLANS (Continued) Defined Contribution Plans Our Company sponsors a qualified defined contribution plan covering substantially all U.S. employees. Under this plan, we match... -

Page 107

...initiatives recorded in locations with tax rates higher than our effective tax rate. In 2003, management concluded that it was more likely than not that tax benefits would not be realized on Coca-Cola FEMSA's write-down of intangible assets in Latin America in connection with its merger with Panamco... -

Page 108

... available to reduce a portion of the U.S. liability. As discussed in Note 1, the Jobs Creation Act was enacted in October 2004. One of the provisions provides a one time benefit related to foreign tax credits generated by equity investments in prior years. The Company recorded an income tax benefit... -

Page 109

... 2003 Deferred tax assets: Property, plant and equipment Trademarks and other intangible assets Equity method investments (including translation adjustment) Other liabilities Benefit plans Net operating/capital loss carryforwards Other Gross deferred tax assets Valuation allowance Total deferred... -

Page 110

... in North America and Germany. In North America, the Company integrated the operations of three formerly separate North American business units-Coca-Cola North America, The Minute Maid Company and Coca-Cola Fountain. In Germany, CCEAG took steps to improve its efficiency in sales, distribution and... -

Page 111

... balance sheet line item other liabilities. As of December 31, 2004, this amount was reclassified to the pension and postretirement benefit accounts as such amounts will be paid out in accordance with the Company's defined benefit and postretirement benefit plans over a number of years. 109 -

Page 112

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 17: STREAMLINING COSTS (Continued) The total streamlining initiative costs incurred for the year ended December 31, 2003 by operating segment were as follows (in millions): North America Africa Asia Europe, ... -

Page 113

... publicly traded Philippine beverage company. CBC is an established carbonated soft-drink business in the Philippines and is included in our Asia operating segment. The original sale and purchase agreement with RFM was entered into in November 2001. As of the date of this sale and purchase agreement... -

Page 114

... America; Africa; Asia; Europe, Eurasia and Middle East; Latin America; and Corporate. North America includes the United States, Canada and Puerto Rico. Prior-period amounts have been reclassified to conform to the currentperiod presentation. Segment Products and Services The business of our Company... -

Page 115

...75 million insurance settlement related to the class-action lawsuit settled in 2000. The Company subsequently donated $75 million to the Coca-Cola Foundation. Equity income (loss)-net and income (loss) before income taxes and cumulative effect of accounting change for Latin America were increased by... -

Page 116

... FINANCIAL STATEMENTS The Coca-Cola Company and Subsidiaries NOTE 19: OPERATING SEGMENTS (Continued) Compound Growth Rate Ended December 31, 2004 North America Africa Asia Europe, Eurasia and Middle East Latin America Corporate Consolidated Net operating revenues 5 years 10 years... -

Page 117

...Financial Statements. Our internal control over financial reporting is supported by a program of internal audits and appropriate reviews by management, written policies and guidelines, careful selection and training of qualified personnel and a written Code of Business Conduct adopted by our Company... -

Page 118

... standards of the Public Company Accounting Oversight Board (United States), the effectiveness of The Coca-Cola Company and subsidiaries' internal control over financial reporting as of December 31, 2004, based on criteria established in Internal Control-Integrated Framework issued by the Committee... -

Page 119

... standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of The Coca-Cola Company and subsidiaries as of December 31, 2004 and 2003, and the related consolidated statements of income, shareowners' equity, and cash flows for each of the three years... -

Page 120

... days. The increase in shipping days in the first quarter were largely offset in the fourth quarter of 2004. In the second quarter of 2004, our Company's equity income benefited by approximately $37 million for our proportionate share of a favorable tax settlement related to Coca-Cola FEMSA. Refer... -

Page 121

... ingredients and sold to bottlers to prepare finished beverages through the addition of water and, depending on the product, sweeteners and/or carbonated water marketed under trademarks of the Company. Consumer: person who drinks Company products. Cost of Capital: after-tax blended cost of equity... -

Page 122

...water, sold to bottlers and customers who add carbonated water to produce finished carbonated soft drinks. Total Capital: shareowners' equity plus total debt. Total Debt: loans and notes payable, current maturities of long-term debt and long-term debt. Total Market Value of Common Stock: stock price... -

Page 123

... consolidated subsidiaries required to be disclosed in the Company's reports filed or submitted under the Exchange Act. The report called for by Item 308(a) of Regulation S-K is incorporated herein by reference to Report of Management on Internal Control Over Financial Reporting, included in Part II... -

Page 124

... Board of Directors and Corporate Governance-The Board and Board Committees'' in the Company's 2005 Proxy Statement is incorporated herein by reference. See Item X in Part I of this report for information regarding executive officers of the Company. The Company has adopted a code of business conduct... -

Page 125

... consolidated subsidiaries and unconsolidated subsidiaries for which financial statements are required to be filed with the SEC. The Key Executive Retirement Plan of the Company, as amended-incorporated herein by reference to Exhibit 10.2 of the Company's Form 10-K Annual Report for the year ended... -

Page 126

... to the Key Executive Retirement Plan of the Company, dated as of January 25, 2000- incorporated herein by reference to Exhibit 10.1.4 of the Company's Form 10-K Annual Report for the year ended December 31, 1999.* Amendment Number Six to the Key Executive Retirement Plan of the Company, dated as of... -

Page 127

..., dated December 15, 2004, effective January 1, 2005.* Retirement Plan for the Board of Directors of the Company, as amended-incorporated herein by reference to Exhibit 10.22 of the Company's Form 10-K Annual Report for the year ended December 31, 1991.* Deferred Compensation Plan for Non-Employee... -

Page 128

... Deferred Compensation Plan Delegation of Authority from the Compensation Committee to the Management Committee, adopted as of December 17, 2003-incorporated herein by reference to Exhibit 10.26.2 of the Company's Form 10-K Annual Report for the year ended December 31, 2003.* Letter Agreement, dated... -

Page 129

...between the Company and Chatham International Corporation, regarding consulting services to be provided by Brian G. Dyson- incorporated herein by reference to Exhibit 10.32 of the Company's Form 10-K Annual Report for the year ended December 31, 2003.* The Coca-Cola Company Benefits Plan for Members... -

Page 130

... B. Cummings, Jr.* Employment Agreement, dated as of July 18, 2002, between The Coca-Cola Export Corporation and Alexander B. Cummings, Jr.* Computation of Ratios of Earnings to Fixed Charges for the years ended December 31, 2004, 2003, 2002, 2001 and 2000. List of subsidiaries of the Company as of... -

Page 131

.... THE COCA-COLA COMPANY (Registrant) By: /s/ E. NEVILLE ISDELL E. NEVILLE ISDELL Chairman, Board of Directors, Chief Executive Officer Date: March 4, 2005 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 132

... March 4, 2005 J. PEDRO REINHARD Director March 4, 2005 * * DONALD F. MCHENRY Director March 4, 2005 JAMES D. ROBINSON III Director March 4, 2005 * * ROBERT L. NARDELLI Director March 4, 2005 PETER V. UEBERROTH Director March 4, 2005 * * JAMES B. WILLIAMS Director March 4, 2005 By: /s/ CAROL... -

Page 133

... II-VALUATION AND QUALIFYING ACCOUNTS The Coca-Cola Company and Subsidiaries Year Ended December 31, 2004 (in millions) COL. A COL. B Description Balance at Beginning of Period COL. C Additions (1) (2) Charged to Charged Costs and to Other Expenses Accounts COL. D COL. E Deductions (Note... -

Page 134

... II-VALUATION AND QUALIFYING ACCOUNTS The Coca-Cola Company and Subsidiaries Year Ended December 31, 2003 (in millions) COL. A COL. B Description Balance at Beginning of Period COL. C Additions (1) (2) Charged to Charged Costs and to Other Expenses Accounts COL. D COL. E Deductions (Note... -

Page 135

... II-VALUATION AND QUALIFYING ACCOUNTS The Coca-Cola Company and Subsidiaries Year Ended December 31, 2002 (in millions) COL. A COL. B Description Balance at Beginning of Period COL. C Additions (1) (2) Charged to Charged Costs and to Other Expenses Accounts COL. D COL. E Deductions (Note... -

Page 136

...(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: March 4, 2005 /s/ E. NEVILLE ISDELL E. Neville Isdell Chairman, Board of Directors, and Chief Executive Officer 3. 4. -

Page 137

... CERTIFICATIONS I, Gary P. Fayard, Executive Vice President and Chief Financial Officer of The Coca-Cola Company, certify that: 1. 2. I have reviewed this annual report on Form 10-K of The Coca-Cola Company; Based on my knowledge, this report does not contain any untrue statement of a material fact... -

Page 138

... annual report of The Coca-Cola Company (the ''Company'') on Form 10-K for the period ended December 31, 2004 (the ''Report''), I, E. Neville Isdell, Chairman, Board of Directors, and Chief Executive Officer of the Company and I, Gary P. Fayard, Executive Vice President and Chief Financial Officer... -

Page 139

-

Page 140

Printed on Recycled Paper L