Coca Cola 2004 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2004 Coca Cola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140

|

|

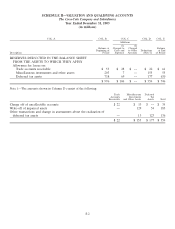

SCHEDULE II—VALUATION AND QUALIFYING ACCOUNTS

The Coca-Cola Company and Subsidiaries

Year Ended December 31, 2004

(in millions)

COL. A COL. B COL. C COL. D COL. E

Additions

(1) (2)

Balance at Charged to Charged Balance

Beginning of Costs and to Other Deductions at End

Description Period Expenses Accounts (Note 1) of Period

RESERVES DEDUCTED IN THE BALANCE SHEET

FROM THE ASSETS TO WHICH THEY APPLY

Allowance for losses on:

Trade accounts receivable $61 $28 $4 $24 $ 69

Miscellaneous investments and other assets 55 21 17 14 79

Deferred tax assets 630 291 — 67 854

$ 746 $ 340 $ 21 $ 105 $ 1,002

Note 1—The amounts shown in Column D consist of the following:

Trade Miscellaneous Deferred

Accounts Investments Tax

Receivable and Other Assets Assets Total

Charge off of uncollectible accounts $19 $ 6 $— $ 25

Write-off of impaired assets — 4 40 44

Other transactions and change in assessments about the realization of

deferred tax assets 5 4 27 36

$ 24 $ 14 $ 67 $ 105

S-1