Microsoft 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

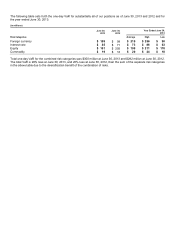

(a) See Note 12 – Debt of the Notes to Financial Statements.

(b) These amounts represent commitments for the construction of buildings, building improvements, and leasehold

improvements.

(c) These amounts represent undiscounted future minimum rental commitments under noncancellable facilities leases.

(d) These amounts represent purchase commitments, including all open purchase orders and all contracts that are take-

or-pay contracts that are not presented as construction commitments above.

(e) We have excluded long-term tax contingencies, other tax liabilities, and deferred income taxes of $11.3 billion and

other long-term contingent liabilities of $162 million (related to the antitrust and unfair competition class action

lawsuits) from the amounts presented, as the amounts that will be settled in cash are not known and the timing of

any payments is uncertain. We have also excluded unearned revenue and non-cash items.

Other Planned Uses of Capital

We will continue to invest in sales, marketing, product support infrastructure, and existing and advanced areas of

technology. Additions to property and equipment will continue, including new facilities, data centers, and computer

systems for research and development, sales and marketing, support, and administrative staff. We expect capital

expenditures to increase in coming years in support of our cloud and devices strategy. We have operating leases for most

U.S. and international sales and support offices and certain equipment. We have not engaged in any related party

transactions or arrangements with unconsolidated entities or other persons that are reasonably likely to materially affect

liquidity or the availability of capital resources.

Liquidity

We earn a significant amount of our operating income outside the U.S., which is deemed to be permanently reinvested in

foreign jurisdictions. As a result, as discussed above under Cash, Cash Equivalents, and Investments, the majority of our

cash, cash equivalents, and short-term investments are held by foreign subsidiaries. We currently do not intend nor

foresee a need to repatriate these funds. We expect existing domestic cash, cash equivalents, short-term investments,

and cash flows from operations to continue to be sufficient to fund our domestic operating activities and cash

commitments for investing and financing activities, such as regular quarterly dividends, debt repayment schedules, and

material capital expenditures, for at least the next 12 months and thereafter for the foreseeable future. In addition, we

expect existing foreign cash, cash equivalents, short-term investments, and cash flows from operations to continue to be

sufficient to fund our foreign operating activities and cash commitments for investing activities, such as material capital

expenditures, for at least the next 12 months and thereafter for the foreseeable future.

Should we require more capital in the U.S. than is generated by our operations domestically, for example to fund

significant discretionary activities, such as business acquisitions and share repurchases, we could elect to repatriate

future earnings from foreign jurisdictions or raise capital in the U.S. through debt or equity issuances. These alternatives

could result in higher effective tax rates, increased interest expense, or dilution of our earnings. We have borrowed funds

domestically and continue to believe we have the ability to do so at reasonable interest rates.

RECENT ACCOUNTING GUIDANCE

Recently Adopted Accounting Guidance

In September 2011, the Financial Accounting Standards Board (“FASB”) issued guidance on testing goodwill for

impairment. The new guidance provides an entity the option to first perform a qualitative assessment to determine

whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If an entity

determines that this is the case, it is required to perform the two-step goodwill impairment test to identify potential goodwill

impairment and measure the amount of goodwill impairment loss to be recognized for that reporting unit (if any). If an

entity determines that the fair value of a reporting unit is greater than its carrying amount, the two-step goodwill

impairment test is not required. We adopted this new guidance beginning July 1, 2012. Adoption of this new guidance did

not have a material impact on our financial statements.