Microsoft 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

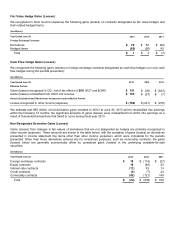

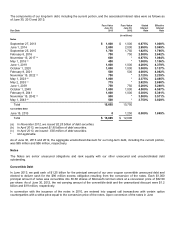

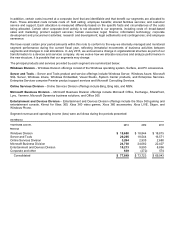

The aggregate changes in the balance of unrecognized tax benefits were as follows:

(In millions)

Year Ended June 30,

2013

2012

2011

Balance, beginning of year

$ 7,202

$ 6,935

$ 6,542

Decreases related to settlements

(30)

(16)

(632)

Increases for tax positions related to the current year

612

481

739

Increases for tax positions related to prior years

931

118

405

Decreases for tax positions related to prior years

(65)

(292)

(119)

Decreases due to lapsed statutes of limitations

(2)

(24)

0

Balance, end of year

$ 8,648

$ 7,202

$ 6,935

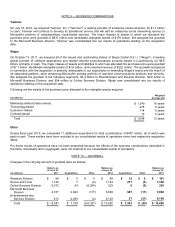

During the third quarter of fiscal year 2011, we reached a settlement of a portion of an I.R.S. audit of tax years 2004 to

2006, which reduced our income tax expense by $461 million. While we settled a portion of the I.R.S. audit, we remain

under audit for these years. In February 2012, the I.R.S. withdrew its 2011 Revenue Agents Report and reopened the

audit phase of the examination. As of June 30, 2013, the primary unresolved issue relates to transfer pricing, which could

have a significant impact on our financial statements if not resolved favorably. We believe our allowances for tax

contingencies are appropriate. We do not believe it is reasonably possible that the total amount of unrecognized tax

benefits will significantly increase or decrease within the next 12 months, because we do not believe the remaining open

issues will be resolved within the next 12 months. We also continue to be subject to examination by the I.R.S. for tax

years 2007 to 2012.

We are subject to income tax in many jurisdictions outside the U.S. Our operations in certain jurisdictions remain subject

to examination for tax years 1996 to 2012, some of which are currently under audit by local tax authorities. The

resolutions of these audits are not expected to be material to our financial statements.

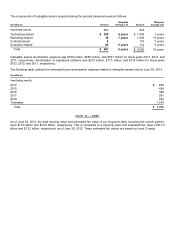

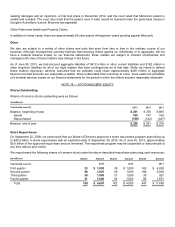

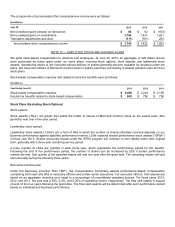

NOTE 14 — UNEARNED REVENUE

Unearned revenue comprises mainly unearned revenue from volume licensing programs, and payments for offerings for

which we have been paid in advance and we earn the revenue when we provide the service or software or otherwise

meet the revenue recognition criteria.

Volume Licensing Programs

Unearned revenue from volume licensing programs represents customer billings for multi-year licensing arrangements

paid either at inception of the agreement or annually at the beginning of each coverage period and accounted for as

subscriptions with revenue recognized ratably over the coverage period.

Other

Also included in unearned revenue are payments for post-delivery support and consulting services to be performed in the

future; Xbox LIVE subscriptions and prepaid points; OEM minimum commitments; Microsoft Dynamics business solutions

products; Skype prepaid credits and subscriptions; and other offerings for which we have been paid in advance and earn

the revenue when we provide the service or software, or otherwise meet the revenue recognition criteria.