Verizon Wireless 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Verizon Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

60

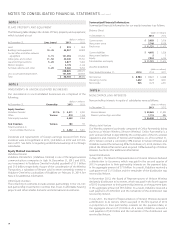

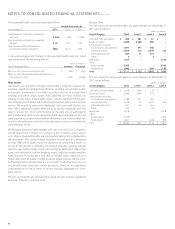

The assumed health care cost trend rates follow:

Health Care and Life

At December 31, 2013 2012 2011

Healthcare cost trend rate assumed for

next year 6.50 % 7.00 % 7.50 %

Rate to which cost trend rate gradually

declines 4.75 5.00 5.00

Year the rate reaches the level it is

assumed to remain thereafter 2020 2016 2016

A one-percentage point change in the assumed health care cost trend

rate would have the following eects:

(dollars in millions)

One-Percentage Point Increase Decrease

Eect on 2013 service and interest cost $ 184 $ (150)

Eect on postretirement benet obligation as of

December 31, 2013 2,539 (2,086)

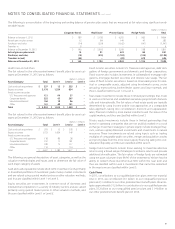

Plan Assets

Historically, our portfolio strategy emphasized a long-term equity ori-

entation, signicant global diversication, and the use of both public

and private investments. In an eort to reduce the risk of our portfolio

strategy and better align assets with liabilities, we have shifted our

strategy to one that is more liability driven, where cash ows from invest-

ments better match projected benet payments but result in lower asset

returns. We intend to reduce the likelihood that assets will decline at a

time when liabilities increase (referred to as liability hedging), with the

goal to reduce the risk of underfunding to the plan and its participants

and beneciaries. Both active and passive management approaches are

used depending on perceived market eciencies and various other fac-

tors. Our diversication and risk control processes serve to minimize the

concentration of risk.

While target allocation percentages will vary over time, the company’s

overall investment strategy is to achieve a mix of assets, which allows

us to meet projected benets payments while taking into consideration

risk and return. The current target allocation for plan assets is designed

so that 70% of the assets have the objective of achieving a return in

excess of the growth in liabilities (comprised of public equities, private

equities, real estate, hedge funds and emerging debt) and 30% of the

assets are invested as liability hedging assets (typically longer duration

xed income). This allocation will shift as funded status improves to a

higher allocation to liability hedging assets. Target policies will be revis-

ited periodically to ensure they are in line with fund objectives. Due to

our diversication and risks control processes, there are no signicant

concentrations of risk, in terms of sector, industry, geography or com-

pany names.

Pension and healthcare and life plans assets do not include signicant

amounts of Verizon common stock.

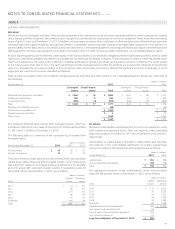

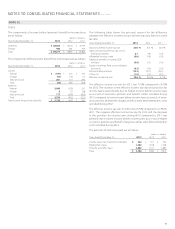

Pension Plans

The fair values for the pension plans by asset category at December 31,

2013 are as follows:

(dollars in millions)

Asset Category Total Level 1 Level 2 Level 3

Cash and cash equivalents $ 968 $ 881 $ 87 $ –

Equity securities 4,200 3,300 900 –

Fixed income securities

U.S. Treasuries and agencies 1,097 691 406 –

Corporate bonds 2,953 212 2,579 162

International bonds 364 51 313 –

Other 3 – 3 –

Real estate 1,784 – – 1,784

Other

Private equity 3,942 – – 3,942

Hedge funds 1,800 – 604 1,196

Total $ 17,111 $ 5,135 $ 4,892 $ 7,084

The fair values for the pension plans by asset category at December 31,

2012 are as follows:

(dollars in millions)

Asset Category Total Level 1 Level 2 Level 3

Cash and cash equivalents $ 1,618 $ 1,586 $ 32 $ –

Equity securities 2,944 2,469 475 –

Fixed income securities

U.S. Treasuries and agencies 1,589 1,125 464 –

Corporate bonds 2,456 35 2,225 196

International bonds 601 140 461 –

Other 210 – 210 –

Real estate 2,018 – – 2,018

Other

Private equity 5,039 – – 5,039

Hedge funds 1,807 – 1,249 558

Total $ 18,282 $ 5,355 $ 5,116 $ 7,811