Electronic Arts 2011 Annual Report Download - page 158

Download and view the complete annual report

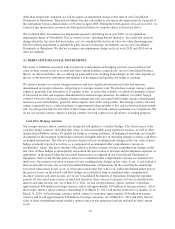

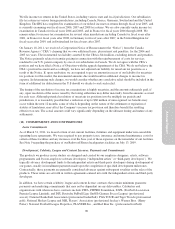

Please find page 158 of the 2011 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Because the independent software developers are thinly capitalized, our sole ability to recover the Minimum

Guarantee is effectively through publishing the software product in development. We also have exclusive rights

to exploit the software product once completed. Therefore, we concluded that the substance of the arrangement is

the purchase of research and development that has no alternative future use and was expensed upon acquisition.

Accordingly, we recognized a $31 million charge in our Consolidated Statement of Operations during the fiscal

year ended March 31, 2011. In addition, we will recognize the remaining portion of the Minimum Guarantee to

be advanced during the development period as research and development expense as the services are incurred.

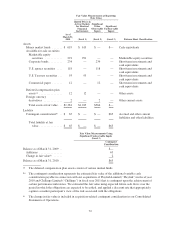

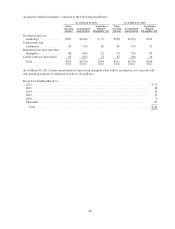

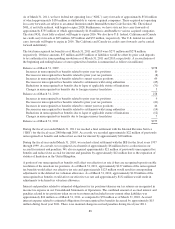

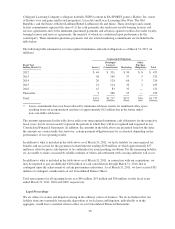

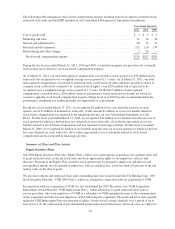

Since the inception of the fiscal 2011 restructuring plan through March 31, 2011, we have incurred charges of

$148 million, consisting of (1) $104 million related to the amendment of certain licensing agreements and other

intangible asset impairment costs, (2) $31 million related to the amendment of certain developer agreements, and

(3) $13 million in employee-related expenses. The $104 million restructuring accrual as of March 31, 2011

related to the fiscal 2011 restructuring is expected to be settled by June 2016. In fiscal year 2012, we anticipate

incurring less than $10 million of restructuring and other charges related to the fiscal 2011 restructuring

(primarily interest expense accretion).

Overall, including $148 million in charges incurred through March 31, 2011, we expect to incur total cash and

non-cash charges between $170 million and $180 million by June 2016. These charges will consist primarily of

(1) charges, including accretion of interest expense, related to the amendment of certain licensing and developer

agreements and other intangible asset impairment costs (approximately $160 million) and (2) employee-related

costs (approximately $15 million).

Fiscal 2010 Restructuring

In fiscal year 2010, we announced a restructuring plan to narrow our product portfolio to provide greater focus on

titles with higher margin opportunities. Under this plan, we reduced our workforce by approximately 1,100

employees and have (1) consolidated or closed various facilities, (2) eliminated certain titles, and (3) incurred IT

and other costs to assist in reorganizing certain activities. The majority of these exit activities were completed by

March 31, 2010.

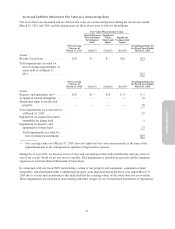

Since the inception of the fiscal 2010 restructuring plan through March 31, 2011, we have incurred charges of

$129 million, consisting of (1) $62 million in employee-related expenses, (2) $45 million related to intangible

asset impairment costs, abandoned rights to intellectual property, and other costs to assist in the reorganization of

our business support functions, and (3) $22 million related to the closure of certain of our facilities. The $11

million restructuring accrual as of March 31, 2011 related to the fiscal 2010 restructuring is expected to be settled

by September 2013. In fiscal year 2012, we anticipate incurring less than $10 million of restructuring charges

related to the fiscal 2010 restructuring.

Overall, including charges incurred through March 31, 2011, we expect to incur total cash and non-cash charges

of approximately $135 million by March 31, 2012. These charges consist primarily of (1) employee-related costs

($62 million), (2) intangible asset impairment costs, abandoned rights to intellectual property costs, and other

costs to assist in the reorganization of our business support functions (approximately $50 million), (3) facilities

exit costs ($22 million).

Fiscal 2009 Restructuring

In fiscal year 2009, we announced a cost reduction plan as a result of our performance combined with the

economic environment. This plan included a narrowing of our product portfolio, a reduction in our worldwide

workforce of approximately 11 percent, or 1,100 employees, the closure of 10 facilities, and reductions in other

variable costs and capital expenditures.

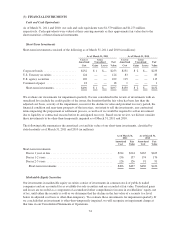

Since the inception of the fiscal 2009 restructuring plan through March 31, 2011, we have incurred charges of

$55 million, consisting of (1) $33 million in employee-related expenses, (2) $20 million related to the closure of

certain of our facilities, and (3) $2 million related to asset impairments. We do not expect to incur any additional

restructuring charges under this plan. The restructuring accrual of $2 million as of March 31, 2011 related to the

fiscal 2009 restructuring is expected to be settled by September 2016.

82