Electronic Arts 2011 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2011 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

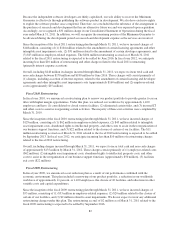

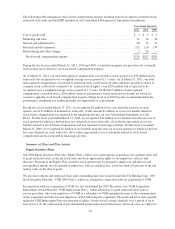

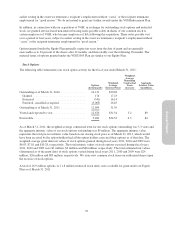

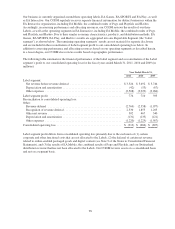

The following table summarizes stock-based compensation expense resulting from stock options, restricted stock,

restricted stock units and the ESPP included in our Consolidated Statements of Operations (in millions):

Year Ended March 31,

2011 2010 2009

Cost of goods sold ..........................................................$2$2$2

Marketing and sales ......................................................... 21 16 20

General and administrative ................................................... 40 33 47

Research and development ................................................... 111 110 134

Restructuring and other charges ............................................... 2 26 —

Stock-based compensation expense .......................................... $176 $187 $203

During the fiscal years ended March 31, 2011, 2010 and 2009, we did not recognize any provision for or benefit

from income taxes related to our stock-based compensation expense.

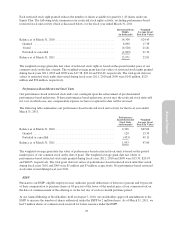

As of March 31, 2011, our total unrecognized compensation cost related to stock options was $36 million and is

expected to be recognized over a weighted-average service period of 1.5 years. As of March 31, 2011, our total

unrecognized compensation cost related to restricted stock, restricted stock units and notes payable in shares of

common stock (collectively referred to as “restricted stock rights”) was $255 million and is expected to be

recognized over a weighted-average service period of 1.9 years. Of the $255 million of unrecognized

compensation cost noted above, $24 million relates to performance-based restricted stock units for which we

ceased recognizing stock-based compensation expense during fiscal year 2010 because we determined that the

performance attainment was neither probable nor improbable of achievement.

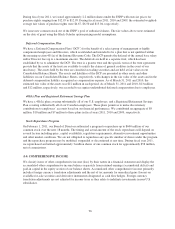

For the fiscal year ended March 31, 2011, we recognized $2 million of tax costs from the exercise of stock

options, net of $3 million of deferred tax write-offs; of this amount $1 million of excess tax benefit related to

stock-based compensation was reported in the financing activities on our Consolidated Statements of Cash

Flows. For the fiscal year ended March 31, 2010, we recognized $14 million of tax benefits from the exercise of

stock options for which we did not have any deferred tax asset write-offs; all of which represented excess tax

benefits related to stock-based compensation and was reported in financing activities. For the fiscal year ended

March 31, 2009, we recognized $2 million of tax benefits from the exercise of stock options for which we did not

have any deferred tax asset write-offs; all of which represented excess tax benefits related to stock-based

compensation and was reported in financing activities.

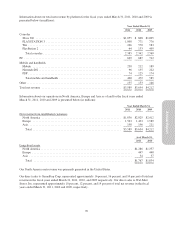

Summary of Plans and Plan Activity

Equity Incentive Plans

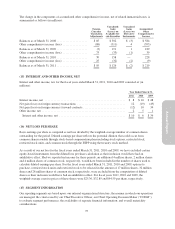

Our 2000 Equity Incentive Plan (the “Equity Plan”) allows us to grant options to purchase our common stock and

to grant restricted stock, restricted stock units and stock appreciation rights to our employees, officers and

directors. Pursuant to the Equity Plan, incentive stock options may be granted to employees and officers and

non-qualified options may be granted to employees, officers and directors, at not less than 100 percent of the fair

market value on the date of grant.

We also have options and restricted stock units outstanding that were granted under the VG Holding Corp. 2005

Stock Incentive Plan (the “VGH 2005 Plan”), which we assumed in connection with our acquisition of VGH.

In connection with our acquisition of VGH, we also established the 2007 Electronic Arts VGH Acquisition

Inducement Award Plan (the “VGH Inducement Plan”), which allowed us to grant restricted stock units to

service providers, who were employees of VGH or a subsidiary of VGH immediately prior to the consummation

of the acquisition and who became employees of EA following the acquisition. The restricted stock units granted

under the VGH Inducement Plan vest pursuant to either (1) time-based vesting schedules over a period of up to

four years or (2) the achievement of pre-determined performance-based milestones, and in all cases are subject to

92