Sprint - Nextel 2013 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2013 Sprint - Nextel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Consolidated Financial Statements

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

CONTINUED)

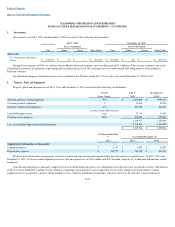

Liquidity

To date, we have invested heavily in building and maintaining our networks. We have a history of operating losses, and we expect to have significant

losses in the future. We do not expect our operations to generate cumulative positive cash flows during the next twelve months.

We expect to meet our funding needs for the near future through our cash and investments held at July 9, 2013 and cash receipts from our mobile WiMAX,

services from our retail and wholesale business, other than Sprint, and Sprint under the 2011 November 4G MVNO Amendment. Additionally, we anticipate

receiving funds from Sprint for the deployment of our Time Division Duplex, which we refer to as TDD, Long Term Evolution, which we refer to as LTE, network

and the use of additional spectrum not specified in the 2011 November 4G MVNO Amendment. As a wholly

-

owned subsidiary of Sprint, to the extent we are not

able to fund our business through our retail and wholesale revenue streams, we expect to receive funding for any shortfall from Sprint such that we will continue

to be a going concern for at least the next twelve months.

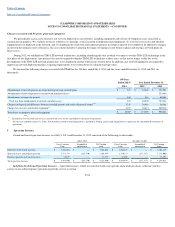

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America,

which we refer to as U.S. GAAP. The following is a summary of our significant accounting policies:

Principles of Consolidation

— The consolidated financial statements include all of the assets, liabilities and results of operations of our wholly

-

owned

subsidiaries, and subsidiaries we control or in which we have a controlling financial interest. Investments in entities that we do not control and are not the

primary beneficiary, but for which we have the ability to exercise significant influence over operating and financial policies, are accounted for under the equity

method. All intercompany transactions are eliminated in consolidation.

Non

-

controlling interests on the consolidated balance sheets include third

-

party investments in entities that we consolidate, but do not wholly own. We

classify our non

-

controlling interests as part of equity and we allocate net loss, other comprehensive income (loss) and other equity transactions to our non

-

controlling interests in accordance with their applicable ownership percentages. We also continue to attribute to our non

-

controlling interests their share of

losses even if that attribution results in a deficit non

-

controlling interest balance. See Note 14, Stockholders' Equity, for further information.

Financial Statement Presentation

— We have reclassified certain prior period amounts to conform with the current period presentation.

Use of Estimates

— Preparing financial statements in conformity with U.S. GAAP requires management to make complex and subjective judgments. By

their nature, these judgments are subject to an inherent degree of uncertainty. These judgments are based on our historical experience, terms of existing

contracts, observance of trends in the industry, information provided by our subscribers and information available from other outside sources, as appropriate.

Additionally, changes in accounting estimates are reasonably likely to occur from period to period. These factors could have a material impact on our financial

statements, the presentation of our financial condition, changes in financial condition or results of operations.

Significant estimates inherent in the preparation of the accompanying financial statements include: impairment analysis of spectrum licenses with

indefinite lives, including judgments about when an impairment indicator may or may not have occurred and estimates of the fair value of our spectrum licenses,

the recoverability and determination of useful lives for long

-

lived assets, which include property, plant and equipment and other intangible assets, tax valuation

allowances and valuation of derivatives.

Cash and Cash Equivalents

— Cash equivalents consist of money market mutual funds and highly liquid short

-

term investments, with original maturities

of three months or less. Cash equivalents are stated at cost, which

F

-

56

2.

Summary of Significant Accounting Policies