Sprint - Nextel 2013 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2013 Sprint - Nextel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Consolidated Financial Statements

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

CONTINUED)

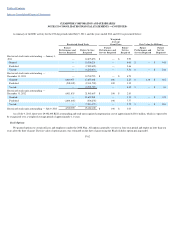

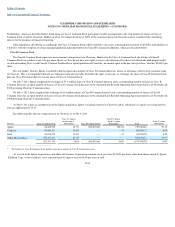

2013 and for the years ended December 31, 2012 and 2011, we paid

$43.9 million

,

$76.9 million

and

$41.1 million

, respectively, to Ericsson for network management

services.

We have evaluated subsequent events through February 24, 2014, the date in which the consolidated financial statements were issued. The following

events occurred subsequent to July 9, 2013:

Sprint Acquisition

On July 9, 2013, Sprint completed the acquisition of Clearwire Corporation and its subsidiaries. As a result of the Sprint Acquisition and the resulting

change in ownership and control, the acquisition method of accounting was applied by Sprint, pushed

-

down to us and included in our consolidated financial

statements for all periods presented subsequent to the Acquisition Date. This resulted in a new basis of presentation based on the estimated fair values of our

assets and liabilities for the successor period beginning as of the day following the consummation of the merger.

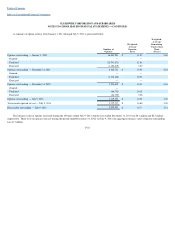

Long

-

term Debt, net

Using equity contributions from Sprint and available cash, we retired all of the 2015 Senior Secured Notes and all of the Second

-

Priority Secured Notes by

December 2013.

In September 2013, Sprint exchanged all of the outstanding Sprint Notes for 160,000,800 shares of Class B Common Stock and the same amount of Class B

Common Interests.

On October 17, 2013, the Issuers entered into a supplemental indenture related to the Exchangeable Notes that 1) permitted the periodic reports filed by

Sprint (rather than Clearwire Corporation) with the SEC to satisfy the Issuers' reporting and related obligations in the event that Sprint and Sprint

Communications unconditionally guarantee the Exchangeable Notes and 2) agreed to use commercially reasonable efforts to obtain credit ratings for the

Exchangeable Notes by two national rating agencies.

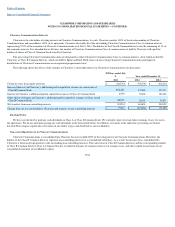

On July 19, 2013, Clearwire Communications and Clearwire Finance, Inc. entered into a $3.0 billion credit agreement, which we refer to as the Sprint Credit

Agreement, with Sprint Communications, Inc. where Sprint agrees to make revolving credit loans to us subject to the terms and conditions set forth in the

agreement. The interest rate on outstanding loans is the LIBOR Rate as of the preceding interest payment date plus applicable margin of 4.00% to 4.75%, which

is based on Moody's and S&P ratings. The interest payment date is the last business day of each fiscal quarter. The maturity date of the Sprint Credit

Agreement is July 1, 2017. Under the Sprint Credit Agreement, we are not permitted to incur indebtedness unless agreed to by Sprint through written consent.

As of December 31, 2013, the Sprint Credit Agreement had an outstanding balance of $315.5 million.

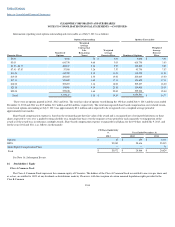

Share

-

Based Payments

In connection with the Sprint Acquisition, each outstanding and unexercised option to purchase shares of our Common Stock, whether or not then

vested, was canceled in exchange for a lump sum cash amount equal to the amount, if any, by which the Merger Consideration exceeded the exercise price of

such option, less applicable withholding taxes. In connection with the Sprint Acquisition, each RSU granted to a non

-

employee member of our board of

directors, which we refer to as a Director RSU, was canceled in exchange for a lump sum cash payment equal to the product of the Merger Consideration,

without interest, and the number of shares of Class A Common Stock subject to such Director RSU. In addition, each outstanding RSU granted prior to

December 17, 2012 was converted into a right to receive a cash payment equal to the product of the Merger Consideration and the number of shares of Class A

Common Stock subject to such unvested RSU, which we refer to as a Restricted Cash Account. On July 19, 2013, each holder of a Restricted Cash Account

received a lump sum cash payment equal to 50% of the Restricted Cash Account balance, less applicable tax withholdings. The remaining balance of the

Restricted Cash

F

-

90

16.

Subsequent Events