Sprint - Nextel 2013 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2013 Sprint - Nextel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Consolidated Financial Statements

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

CONTINUED)

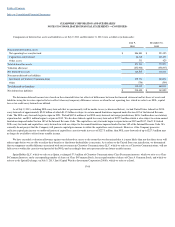

date of each draw of the Sprint Notes, the BCF will be calculated based on the closing price on settlement date less the exchange price of $1.50 per share

multiplied by the number of shares of Clearwire Class A common stock issued. The amount of the BCF for each draw is limited to the proceeds received for that

draw. The BCF is recognized as a discount to the debt and an increase to Additional paid

-

in capital on the consolidated balance sheets. The debt discount will

be accreted from the date of issuance through the stated maturity into Interest expense on the consolidated statements of operations on a straight

-

line basis.

See Note 16, Subsequent Events.

At July 9, 2013, we were in compliance with our debt covenants.

Vendor Financing Notes

We have a vendor financing facility, which we refer to as the Vendor Financing Facility, which allows us to obtain financing by entering into notes, which

we refer to as Vendor Financing Notes. The Vendor Financing Notes mature during 2014 and 2015 and the coupon rates are based on 3

-

month LIBOR plus a

spread of 5.50% and 7.00% for secured and unsecured notes, respectively.

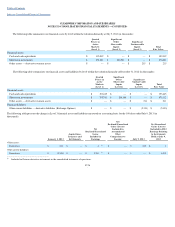

Capital Lease Obligations

Certain of our network equipment have been acquired under capital lease facilities. At the inception of the capital lease, the lower of either the present

value of the minimum lease payments required by the lease or the fair value of the equipment, is recorded as a capital lease obligation. The initial non

-

cancelable

term of these capital leases are three to twelve years and may include one or more renewal options at the end of the initial lease term that may be exercised at our

discretion. Lease payments for the initial lease term and any fixed renewal periods are established at the inception of the lease and interest expense is recognized

using the effective interest rate method based on the rate imputed using the contractual terms of the lease.

Our lease agreements may contain change of control provisions. In certain agreements, a change of control may exclude a change of control by permitted

holders including, but not limited to, Sprint, any of its successors and its respective affiliates. Other agreements may reference circumstances involving a

change of control resulting in Clearwire's credit rating falling below “

Caa1

” as rated by Moody's Investors Service. Upon the occurrence of a change of control,

the lessor may require payment of a predetermined casualty value of the leased equipment

Future Payments —

For future payments on our long

-

term debt see Note 12, Commitments and Contingencies.

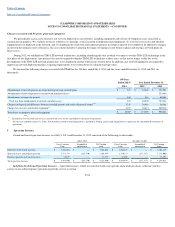

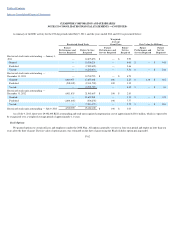

Interest Expense —

Interest expense included in our consolidated statements of operations for the 190 days ended

July 9, 2013

, and the years ended

December 31, 2012

and

2011

, consisted of the following (in thousands):

_______________________________________

F

-

74

190 Days Ended July

9,

Year Ended December 31,

2013

2012

2011

Interest coupon(1)

$

275,551

$

518,671

$

484,599

Accretion of debt discount and amortization of debt premium, net(2)

36,832

41,386

40,216

Capitalized interest

(6,751

)

(6,598

)

(18,823

)

Total interest expense

$

305,632

$

553,459

$

505,992

(1)

The year ended December 31, 2012 included

$2.5 million

of coupon interest relating to the Exchangeable Notes, which was settled in the non-

cash Exchange Transaction.

(2)

Includes non-cash amortization of deferred financing fees which are classified as Other assets on the consolidated balance sheets.