Starbucks 2009 Annual Report Download - page 54

Download and view the complete annual report

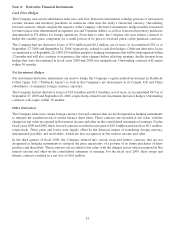

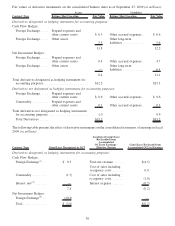

Please find page 54 of the 2009 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.subsequently reclassified into net earnings when the hedged exposure affects net earnings. For a net investment

hedge, the effective portion of the derivative’s gain or loss is reported as a component of OCI.

Cash flow hedges related to anticipated transactions are designated and documented at the inception of each hedge

by matching the terms of the contract to the underlying transaction. The Company classifies the cash flows from

hedging transactions in the same categories as the cash flows from the respective hedged items. Once established,

cash flow hedges are generally not removed until maturity unless an anticipated transaction is no longer likely to

occur. For discontinued or dedesignated cash flow hedges, the related accumulated derivative gains or losses are

recognized in Net interest income and other on the consolidated statements of earnings.

Forward contract effectiveness for cash flow hedges is calculated by comparing the fair value of the contract to the

change in value of the anticipated transaction using forward rates on a monthly basis. For net investment hedges, the

spot-to-spot method is used to calculate effectiveness. Under this method, the change in fair value of the forward

contract attributable to the changes in spot exchange rates (the effective portion) is reported as a component of OCI.

The remaining change in fair value of the forward contract (the ineffective portion) is reclassified into net earnings.

Any ineffectiveness is recognized immediately in Net interest income and other on the consolidated statements of

earnings.

The Company also enters into certain foreign currency forward contracts and commodity swap and futures contracts

that are not designated as hedging instruments for accounting purposes. These contracts are recorded at fair value,

with the changes in fair value recognized in Net interest income and other on the consolidated statements of

earnings.

See Note 5 for additional information on the Company’s fair value measurements related to derivative instruments.

Allowance for Doubtful Accounts

Allowance for doubtful accounts is calculated based on historical experience, customer credit risk and application

of the specific identification method. As of September 27, 2009 and September 28, 2008, the allowance for doubtful

accounts was $5.0 million and $4.5 million, respectively.

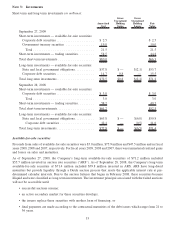

Inventories

Inventories are stated at the lower of cost (primarily moving average cost) or market. The Company records

inventory reserves for obsolete and slow-moving items and for estimated shrinkage between physical inventory

counts. Inventory reserves are based on inventory turnover trends, historical experience and application of the

specific identification method. As of September 27, 2009 and September 28, 2008, inventory reserves were

$21.1 million and $25.5 million, respectively.

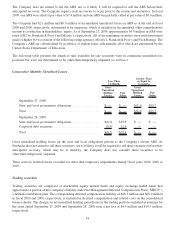

Property, Plant and Equipment

Property, plant and equipment are carried at cost less accumulated depreciation. Depreciation of property, plant and

equipment, which includes assets under capital leases, is provided on the straight-line method over estimated useful

lives, generally ranging from two to seven years for equipment and 30 to 40 years for buildings. Leasehold

improvements are amortized over the shorter of their estimated useful lives or the related lease life, generally

10 years. For leases with renewal periods at the Company’s option, Starbucks generally uses the original lease term,

excluding renewal option periods, to determine estimated useful lives. If failure to exercise a renewal option

imposes an economic penalty to Starbucks, management may determine at the inception of the lease that renewal is

reasonably assured and include the renewal option period in the determination of appropriate estimated useful lives.

The portion of depreciation expense related to production and distribution facilities is included in Cost of sales

including occupancy costs on the consolidated statements of earnings. The costs of repairs and maintenance are

expensed when incurred, while expenditures for refurbishments and improvements that significantly add to the

productive capacity or extend the useful life of an asset are capitalized. When assets are retired or sold, the asset cost

and related accumulated depreciation are eliminated with any remaining gain or loss reflected in net earnings.

46